Bitcoin fell below the $7,000 mark on Sunday for the first time since May.

Digital currencies were hammered this past week on fears of a China crackdown. For the first time in six month, Bitcoin slumps below the $7,000 mark.

The recent tumble is being attributed to China’s recent announcement that it will crack down on crypto trading. A statement by the People’s Bank of China on Friday warned it was increasing “supervision and control to combat virtual currency transactions.”

“Investors should be careful not to mix blockchain technology with virtual currency,” the central bank said, warning of the many risks of cryptocurrency trading.

There has also been speculation in recent months that China is preparing to launch a state-run digital currency, though the PBoC denied such a report earlier this year.

Warning Shot

This is precisely one of the things I have warned about on numerous occasions.

If and when central banks crack down on digital currencies it will be lights out.

People keep asking me what can central banks do. The question should not come up as the answer is obvious: ban transactions in Bitcoin.

If the US banned bitcoin transactions, people would still have their digital coins, but they would effectively be worthless. One could not buy anything with bitcoin other than barter transactions. There would be no way to get money in or out, at least in the US.

Look at the problems Iran is having with its oil.

Similar things would happen to Bitcoin.

We are not at that stage yet, and I hope we never get there. But China just fired a warning shot.

If Central Banks Feel Threatened

If central banks feel threatened, they will shut down cryptos.

I do not believe the Fed feels threatened yet.

By its statements and actions, China does feel threatened. What's the concern?

Capital Flight

People can get money out of China by converting to Bitcoin then going to Hong Kong, Japan, or the US and cashing out.

China wants to put an end to capital flight via Bitcoin.

Thus, people are playing with fire here.

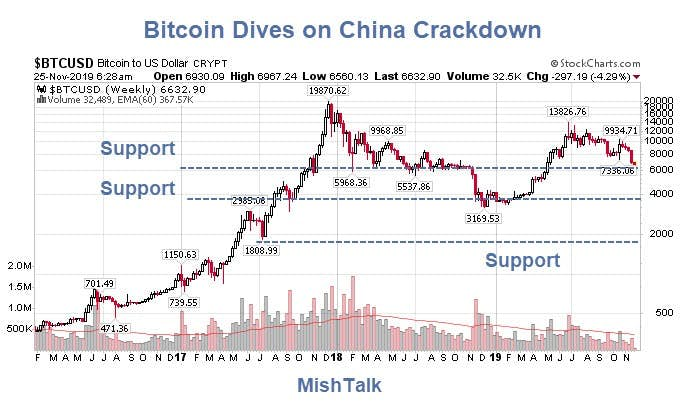

Technical Support Levels

Bitcoin is right at technical support. If this level breaks, and I believe it will, the next support is at or near the $3500 level or so.

If that level breaks, and ultimately I believe it will, look for a plunge to the $2000 level.

King Dollar

As a key aside, that China has to resort to capital flight controls is telling. Forget the Yuan: King Dollar is Here to Stay.

Wake me up when China floats the Yuan, gets rid of capital controls, has enforceable property rights, and has the world's largest bond market.

Those are all requirements of having the world's reserve currency.