In the year-to-date period, cryptocurrencies value has suffered in sharp contrast to their impressive performance in 2017. In this year-to-date period, the market capitalization of the cryptocurrency industry has declined more than 42% from $598B to around $345B. As expected, many of the cryptocurrencies in the market has recorded high double-digit losses as a result.

Now, traders and analysts suspect that cryptocurrencies have suffered long enough, and the market might be on the eve of a breakout. This piece provides trading insights on bitcoin (BTC) as it starts to build momentum to head back to its bullish ways.

Is BTC About To Breakout?

The chart below from Trading View shows the support and resistance levels of the BTC/USD pair over the last three months. The support lines are shown in green while the resistance lines are shown in red. The thickness of the lines shows the depth of the support or resistance. The strong support suggests that the price of the cryptocurrency is not likely to fall lower –however, if the support is breached, the coin will suffer a bigger downturn.

In the last couple of days, BTC/USD has been testing support around the $7,625 to $7652 range as seen in the chart above. The bulls and bears are locked in a fierce battle for the soul of the cryptocurrency but the strong support relative to resistance suggests that Bitcoin might be about to breakout towards its previous highs.

What Does The Market Think?

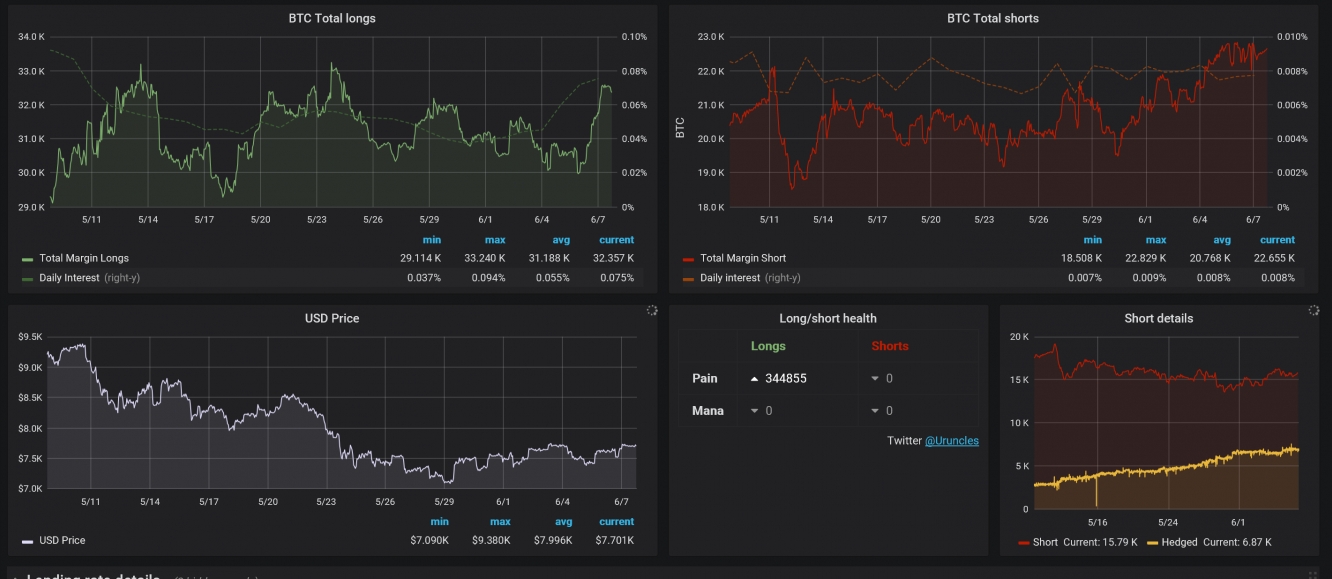

It would be myopic and practically irresponsible to base the answer to where a cryptocurrency is headed on ordinary support and resistance lines. Hence, I tried to measure market sentiment based on margin positions from Datamish. Over the last two months, the volume of BTC Total Longs has outpaced the volume of BTC Total Shorts as seen in the chart below.

In the last two months, BTC margin longs average in total around 32.25K while the margin shorts trading on BTC were 22.65K. A situation in which margin long trades are more than margin short trades suggests that the market sentiment is leaning towards a bullish takeoff rather than a bearish downturn.

Market sentiment is a good indicator of where the market is headed because the market doesn’t operate in a vacuum. The performance of Bitcoin is often based on market sentiment because the cryptocurrency is still considered a speculative asset.

Setting Up The Trade

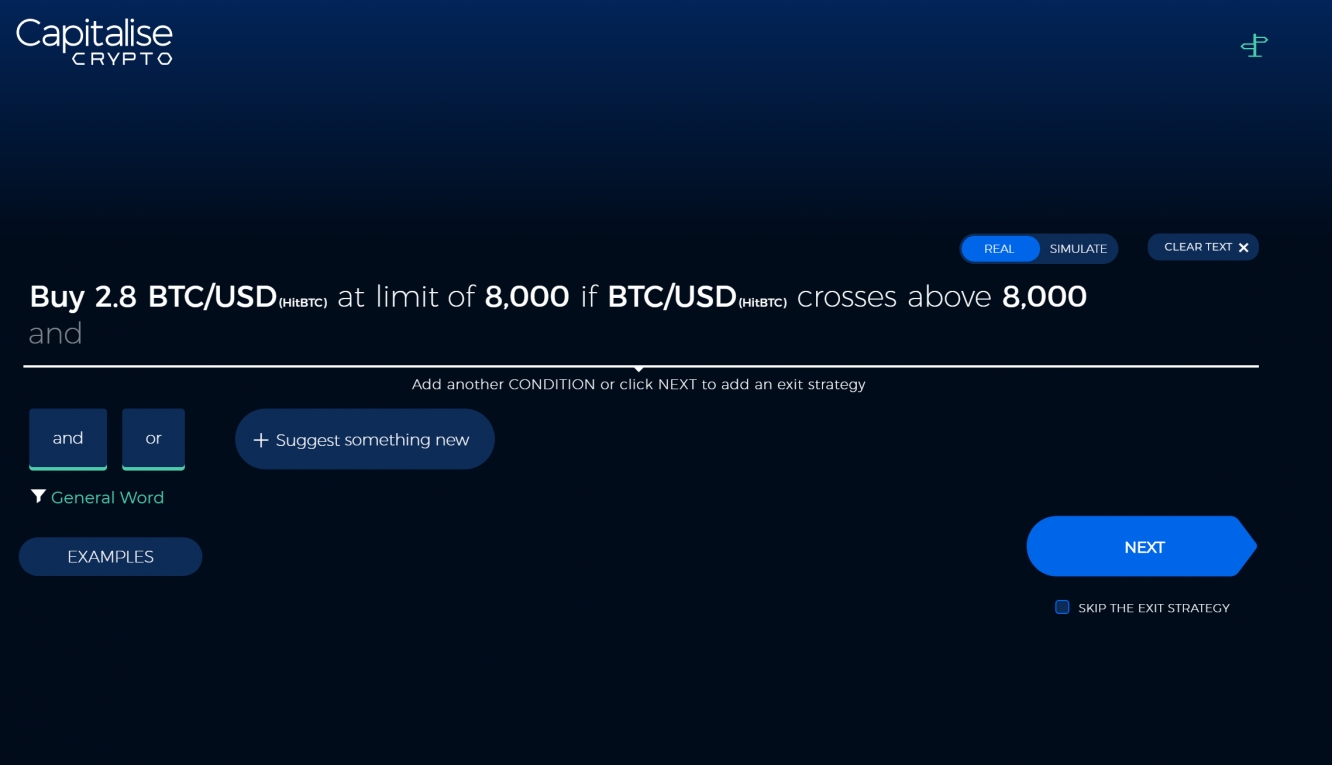

Bitcoin has had a series of breakout attempts, which died out in the last couple of months. However, I am convinced that the bullish momentum being gathered by bitcoin has the potential to lead to a breakout. To set up this trade, I am using a DIY automated trading platform from Capitalize (see image below).

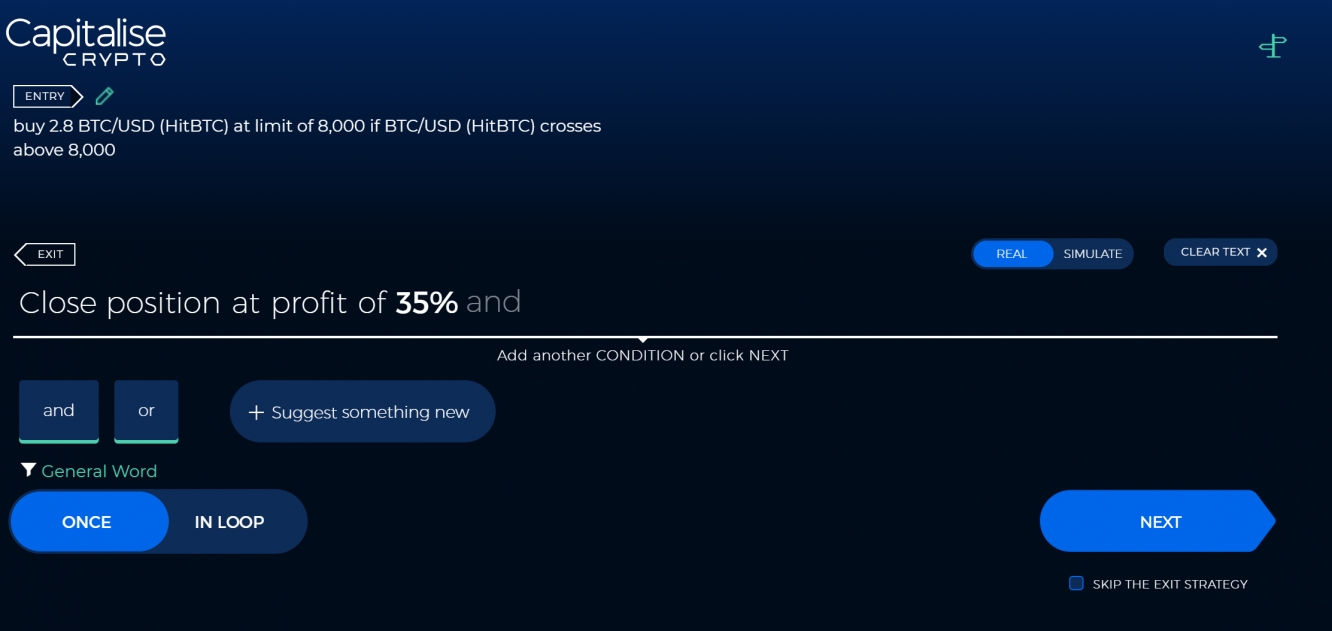

I set up an automated trade that will buy me 2.8BTC at $8,000 at the very moment the cryptocurrency breaks out above its $8000 resistance. I also automated the trade to close the sale as soon my trade setup scores a 35% profit.

It is still somewhat early to know if the parameters for this trade will be met and whether the strategy will be activated. Nonetheless, the volatile nature of cryptocurrencies suggests that the trigger could be activated in a matter of minutes; hence, the reason for automating the trade.

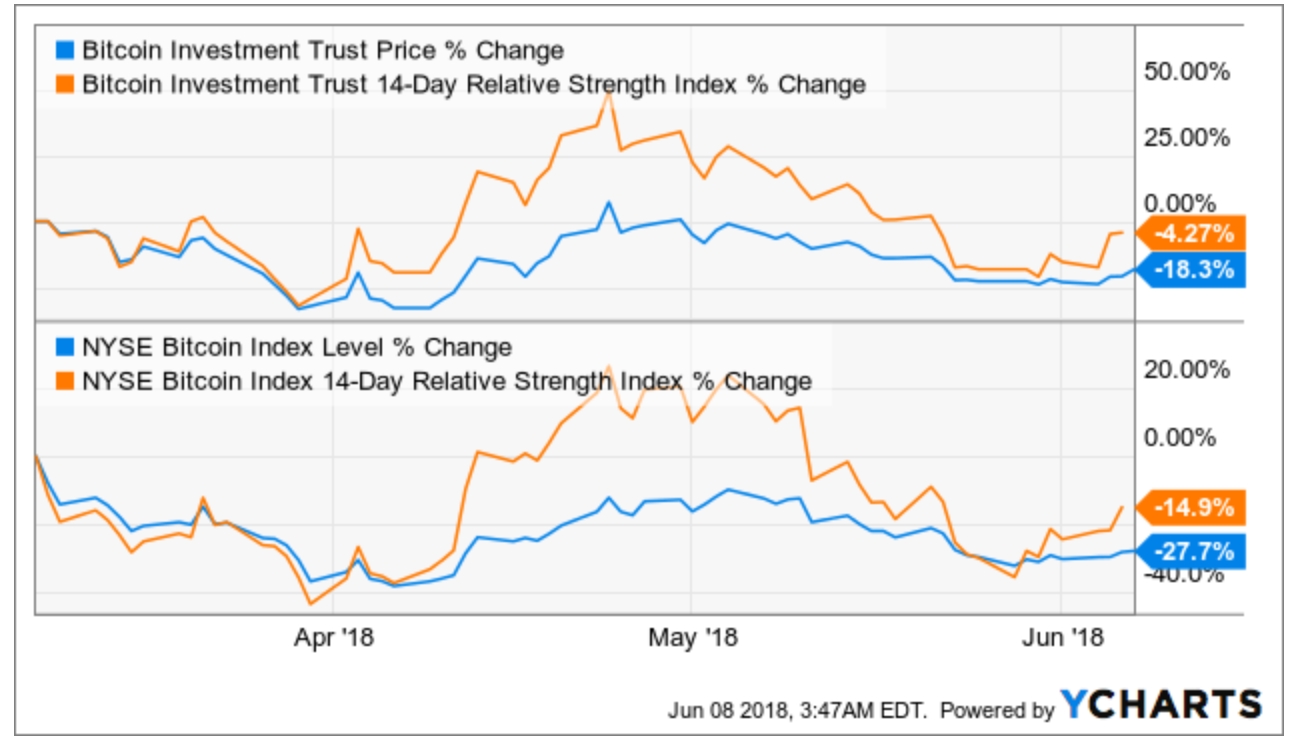

Where Wall-Street Thinks Bitcoin Is Headed

The chart above shows the performance of Bitcoin Investment Trust and the NYSE Bitcoin Index over the last three months. Bitcoin Investment Trust is down a massive 18.3% and the NYSE Bitcoin Index is down 27.7% in the same period. Interestingly, 14-day Relative Strength Index (RSI) of Bitcoin reads a negative 4.27% while the RSI for the Bitcoin Index reads a negative 14.9%. From the foregoing, the cryptocurrency appears to be particularly oversold and it is about time it returned to winning ways.