Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

Smart money took profits (rang the cash register) on short positions as Bitcoin's composite BuST pushed towards 1; bitcoin daily and monthly downside alignment are currently 1.16 and 2.30. The later increases the probability of a material retracement from 2018 high.

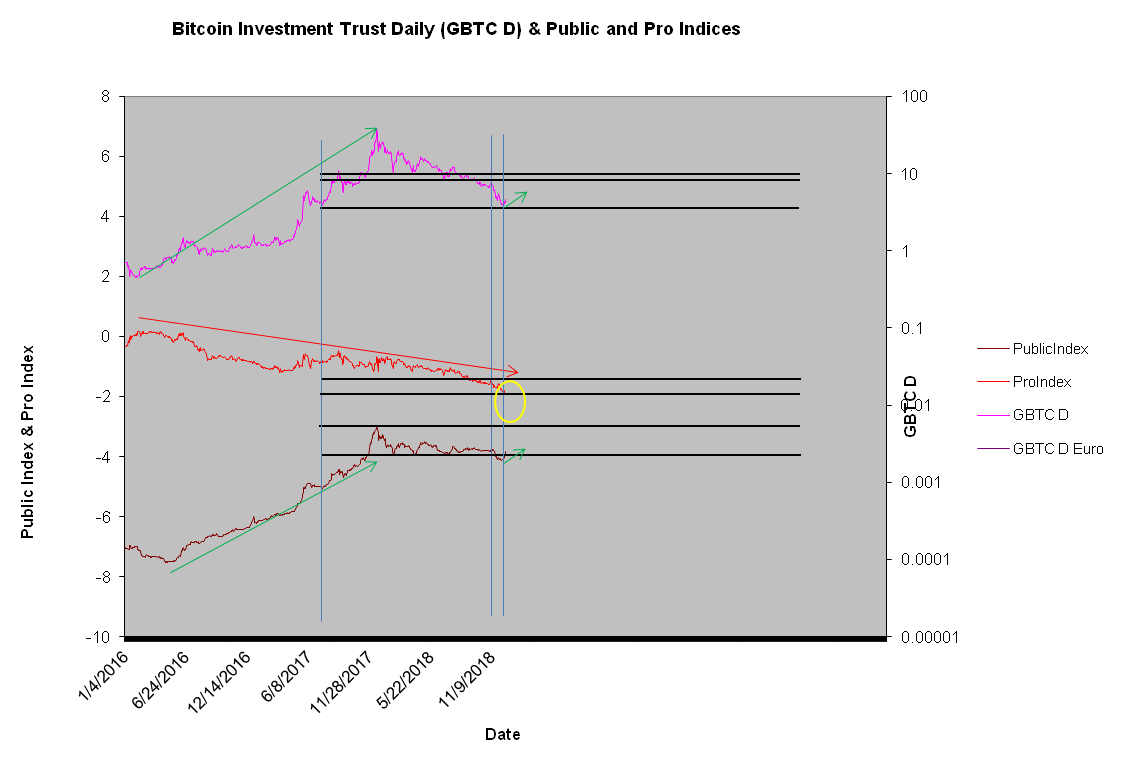

Although bulls are likely paying attention now, I must warn them that the rally from the reaction low is weak. Knowing the difference between a weak and strong rally is important. Few TA tools properly characterize trends. The rally is weak, because its public rather professional driven. Professional traders, the group you want driving moves, is distributing. Fresh lows in the pro index as Bitcoin Investment (OTC:GBTC) rallies is a warning to the bulls. Please pay attention as few people understand how to properly track this. The longer this divergence lasts, the greater the warning and likelihood of an unexpected reversal.

Chart