The emerging role of Bitcoin as a financial safe haven came into the spotlight over the past week, as tensions spiraled between the US and Iran. On Friday, January 3rd, Bitcoin rallied sharply along with gold and crude oil, in the wake of news that Iranian general Qassem Soleimani was killed by missiles shot from American drones targeting his convoy near Baghdad International Airport.

After Iran launched attacks on Iraqi bases housing US forces in retaliation in the early hours of January 8th, Bitcoin rallied to its highest levels since November and gold reached highs last seen in March 2013. Like gold, Bitcoin is an asset with a limited supply and the move sparked discussion of Bitcoin becoming established as a digital alternative to gold.

Bitcoin yielded substantial gains on Wednesday, after President Donald Trump announced a de-escalation in the conflict between the US and Iran in his televised address to the nation. Speaking from the White House, President Trump stated: “Iran appears to be standing down, which is a good thing for all parties concerned and a very good thing for the world.” He added; “The United States is ready to embrace peace with all who seek it.”

Bitcoin bulls now look forward to the ‘halving’ event expected to take place in May of 2020. Only 21 million Bitcoins can be mined and the rate at which they are created is reduced by half every four years. A debate is raging over whether the halving expected in May will trigger another bull run, or if the event is already priced in. Additionally, Bitcoin’s hash rate recently reached an all-time high. The hash rate is viewed as a good indicator of the Bitcoin network’s health and has shown a positive correlation with the price of Bitcoin.

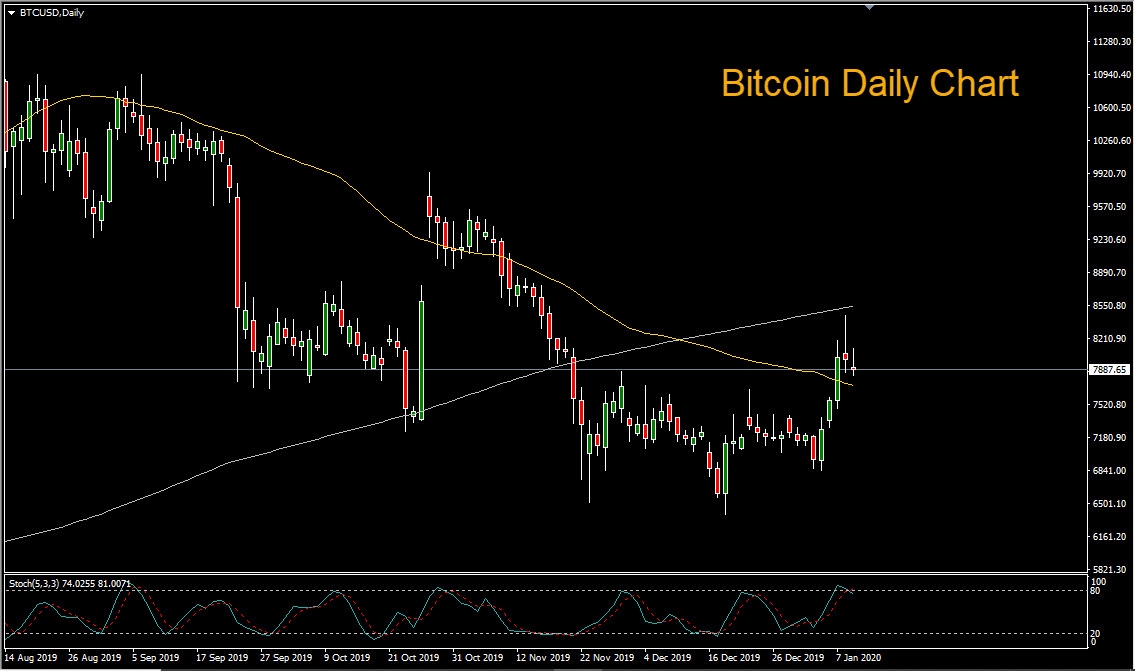

Looking at the Bitcoin daily chart we can see that price was unable to breach the 200 period simple moving average and the pin bar pattern that formed on Wednesday, reflecting indecision. Investors turn their attention to tomorrow’s US Jobs report, with analysts expecting the December unemployment rate to hold at 3.5% and nonfarm payrolls to fall to 164K.