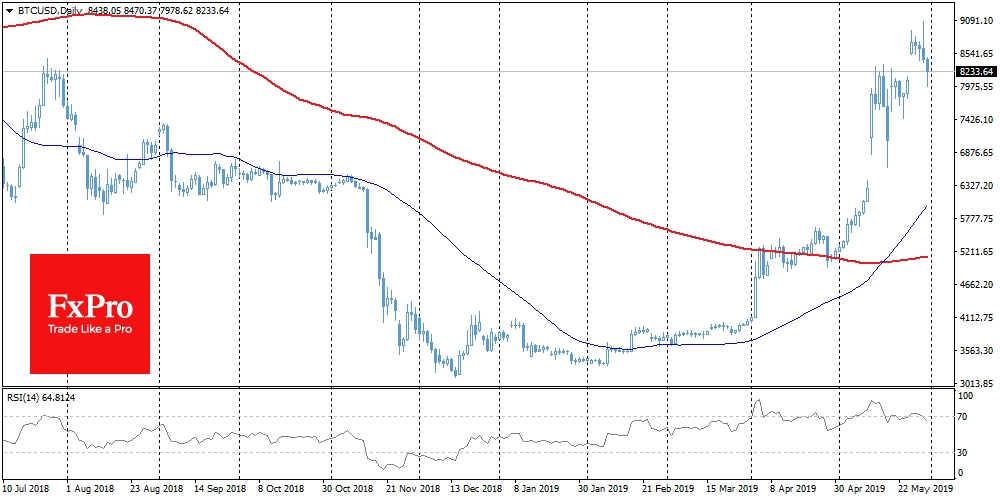

Crypto market, as expected, experienced some correction after explosive growth. Over the past 24 hours, Bitcoin loses almost 5% and trades around $8,300, being under increased pressure after an unsuccessful attempt to consolidate above $9,000. Since the beginning of the day, the BTC/USD pair has received support on downturns to $8,100, which can be perceived as another short-term correction during the rally that has been going on since April. Recently, at the weekend, we are much more likely to see new growth waves than corrections, so another attempt to consolidate above $9,000 in the next two days cannot be ruled out.

Altcoin market has suffered much stronger than the first cryptocurrency. Almost all coins from TOP-10 lose approximately 10% in the last 24 hours. The exception is the infamous Bitcoin SV (BSV), which declines by 17%. The coin showed an incredible growth on the fake news from China about relisting on Binance, now, apparently, this cryptocurrency is waiting for a tough correction.

While experts noted a record increase in demand from institutional investors, Diar analysts calculated that during the Crypto-Winter, “whales” increased their BTC-balances by 26%. Grayscale Investments assets already exceed $2 billion, while 98% of them are investments in Bitcoin. Bitcoin Trust, which was one of the first publicly traded BTC products on the market, attracted 11,236 bitcoins in April alone. Each month, 54,000 BTC are mined, and Grayscale claims that demand growth doesn't fade away.

As is often the case in financial markets, the most profitable deals take place in moments of total pessimism around the prospects of an asset. The prevailing sentiment among market participants during Bitcoin at a price of about $3K opened up huge investment opportunities. Now the only question is at what level the investors "at the bottom" will choose to take profits.

The FxPro Analyst Team