- Bitcoin’s price has been range-bound between $58,500 and $61,600, influenced by market caution and various risks.

- The US government’s sale of $594 million worth of Bitcoin, part of confiscated Silk Road funds, adds to market uncertainty.

- A shift towards Bitcoin accumulation, especially among large wallets and long-term holders, suggests renewed market confidence.

- Double Bottom pattern hints at a potential bullish rally. Will the range be broken?

Bitcoin prices have been confined to a narrow range over the past week as traders exercise caution. While concerns about a recession have eased during this period, numerous risks still capture the attention of market participants.

The range between 58500 and 61600 has remained solid, with yesterday exemplifying this stability. The leading cryptocurrency by market cap tested both the upper and lower bounds of this range, highlighting its current trading pattern and indecisive nature.

US Government Sells Bitcoin Worth $594 Million

The US Government has created a buzz as it moved 10,000 bitcoin valued at almost $594 million, it prompts questions regarding Washington’s approach to cryptocurrency and its possible effects on the market.

The funds, confiscated during the shutdown of Silk Road, are in addition to a prior transfer of 29,800 BTC in July 2024, which was valued at nearly $2 billion at that time.

With an estimated holding of 203,000 BTC, approximately worth $12 billion, the United States establishes itself as the unrivaled leader among bitcoin-holding countries.

The excess supply entering the market could hamper Bitcoin and put a halt on any attempt at a bullish breakout.

Holding Makes a Comeback

Another reason that could in part explain the rangebound nature of Bitcoin lies with the return to popularity of holding and accumulating rather than buying and selling.

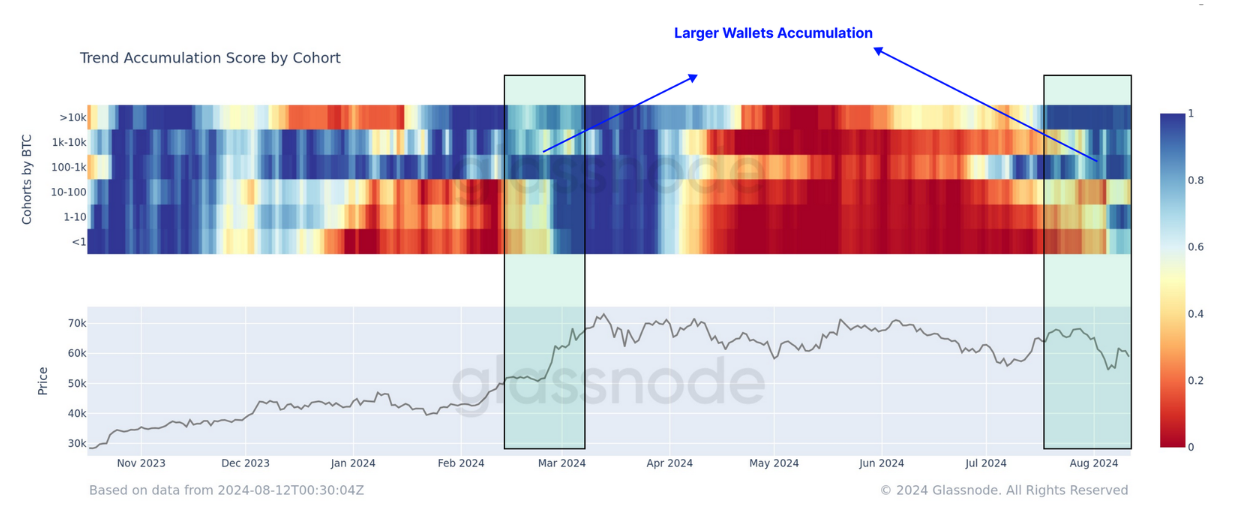

According to Glassnode, Since Bitcoin reached its all-time high in March, the market has experienced a prolonged phase of supply distribution, involving wallets of various sizes.

In recent weeks, however, this trend has begun to show initial signs of reversing, especially among the largest wallets, which are frequently linked to ETFs. These substantial wallets seem to be shifting back to an accumulation phase.

*The Accumulation Trend Score (ATS) metric assesses a weighted balance change across the market. This metric also suggests there is a shift back towards accumulation dominant behavior.

The aforementioned shift towards accumulation has contributed to the ATS recording its highest possible value of 1.0, suggesting significant accumulation throughout the last month.

Source: Glassnode

This trend is also seen among Long-Term Holders (LTH), who sold a lot of Bitcoin before it hit its all-time high. Now, they are holding onto their coins again, with over 374,000 BTC becoming long-term holdings in the past three months.

This suggests that market participants are more inclined to keep their coins rather than spend them.

It would appear that market participants remain optimistic following the most recent selloff.

This ties in with recent reports by both Bybit and Blackscholes, both of whom stated that based on Bitcoin’s ratios during the previous cycles, the bull run will extend into the third quarter of 2025. Given that rate cuts from the Fed look almost a certainty in September and beyond bodes well for hodlers and crypto enthusiasts alike.

According to Bybit, Bitcoin is in the second phase of its bull cycle with some notable crypto analysts stating that the bull cycle is around 42.5% complete meaning there is a lot more room to the upside. Institutional adoption and the launch of the ETH ETF have also been cited as reasons for the bullish rally and the hopes that it is not over yet.

Technical Analysis of BTC/USD

From a technical standpoint, Bitcoin has been trading within a range of about $3100. After failing to gather enough buying momentum for a bullish breakout yesterday, it rebounded strongly off the 58500 support level this morning, reaching 59583 at the time of writing.

Today’s low of 57717 has formed a double-bottom pattern, suggesting a potential upward rally. However, there are several obstacles that need to be overcome for the bulls to regain control fully.

The immediate resistance lies at the 60000 mark, followed by the range high and the 50-day moving average at 61600. The 200-day moving average is slightly higher at 62442, with further resistance around the 100-day moving average and the 63800 area.

If the daily candle closes below 58500, it could lead to a retest of 56561 and possibly the psychological level of 50000.

Support

- 60000

- 61664

- 63800

Resistance

- 58500

- 56561

- 50000 (psychological level)

Bitcoin (BTC/USD) Daily Chart, August 15, 2024

Source: TradingView.com