- Bitcoin prices rebounded due to increased ETF inflows, ending an 8-day outflow streak.

- BlackRock warns of continued market volatility, citing recession concerns, US election anxiety, and investor sell-offs.

- On-chain data indicates decreased investor engagement and trading volumes in Bitcoin and Ethereum.

Bitcoin prices have recovered last week’s losses as ETF flows snap an 8-day streak of outflows.

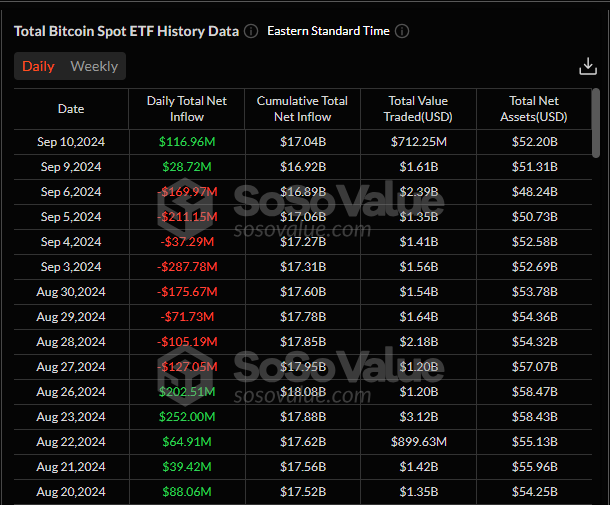

On September 10, there was a substantial increase in inflows, reaching $116.96 million, which is more than four times the $37.29 million recorded the day before.

Source: SoSo Value

Bitcoin tapped a high of 58000 yesterday before a pullback today pushed prices toward the psychological 55000 level. A bit of whipsaw price action today as markets digest US inflation data which has all but confirmed a 25 bps rate cut at next week’s meeting.

BlackRock (NYSE:BLK), the world’s largest asset manager, has issued a warning that they see more volatility flare-ups ahead and do not see the Fed cutting rates as fast as markets are predicting.

According to the note released by BlackRock Investment Institute, including Jean Boivin, several elements are contributing to market volatility: renewed recession concerns due to weaker economic data, anxiety surrounding the upcoming U.S. elections, and investors selling off to accommodate new stock offerings.

On-Chain Data Analysis

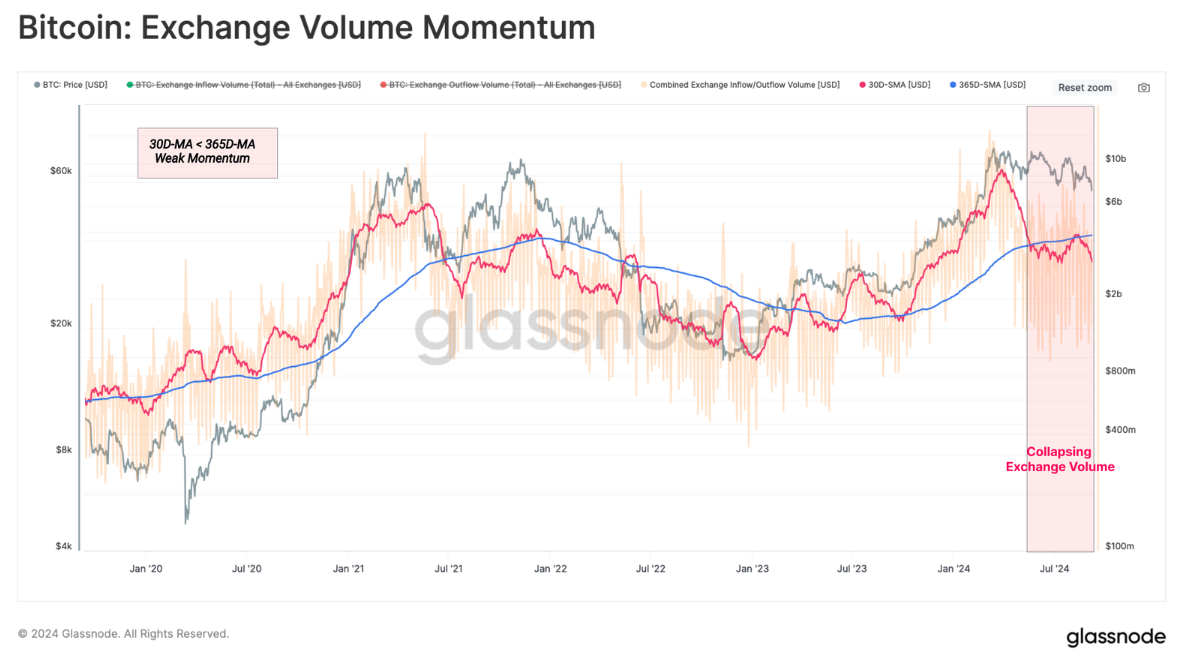

Looking at on-chain data analysis from Glassnode, investor engagement with exchanges is decreasing, as shrinking trading volumes indicate a reduced interest in both investing and trading activities.

Running a similar 30d/365d momentum cross-over for exchange-related inflows and outflows, we can see that the monthly average volume has fallen well below the yearly. This underscores a decline in investor demand and less trading by speculators within the current price range which is no surprise given the lack of conviction we are seeing.

Source: Glassnode

While both Bitcoin and Ethereum ETFs are experiencing outflows, the level of investor interest in Bitcoin ETFs is considerably greater. Despite the recent outflows the Bitcoin ETF was a historic event for crypto markets and recent analysis by Chainalysis’ concurs.

According to Chainalysis, the spot Bitcoin ETF increased crypto transactions globally to unprecedented levels. The launch of the Bitcoin ETF in the US triggered an increase in the total value of Bitcoin activity across all regions and thus meant a significant milestone reached during the 2021 bull run has been surpassed.

As always and more so when it comes to crypto, perspective is important.

US Presidential Race and Debate Reaction

The US Presidential debate took place yesterday and delivered very little. There was a notable omission of anything related to Bitcoin despite the crypto lobby having spent $119 million on the election so far.

Donald Trump is still broadly seen as the pro-crypto candidate putting him at odds with Harris who is expected to continue the Biden administration’s hostile approach to crypto. For now, it would appear that markets are calm regarding the US election. However the closer the date gets the more chance there is that crypto will return as a talking point and that could stoke volatility.

Technical Analysis BTC/USD

Bitcoin fell today towards the psychological 55000 level before rebounding aggressively to trade above the support level at 56500.

The daily candle close today will be crucial and could provide some insight into what to expect tomorrow. A bullish close will see the daily candle close as a hammer candlestick which hints at further upside tomorrow. A bearish close would be a hanging man, which in theory points to some form of pullback.

If one thing has become clear lately, range trading remains very much in play as market participants bide their time. The on-chain data confirms this with trading volume also suffering of late.

Support

- 56515

- 55000

- 53900

Resistance

- 58500

- 60000

- 61555

Bitcoin (BTC/USD) Daily Chart, September 11, 2024

Source: TradingView.com

Most Read: Gold Flirts with All-Time Highs. Will US CPI Prove the Catalyst for a Breakout?