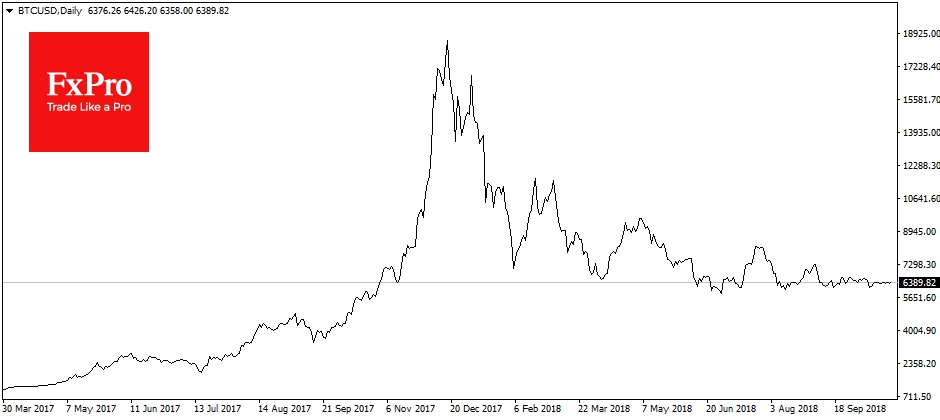

The cryptocurrency market and Bitcoin in particular did not respond to the stocks indexes negative dynamics. At the moment it turns out that cryptocurrencies demonstrate greater stability than some of the world's largest companies, that's why BTC could attract some of the safe-haven demand.

About a year ago stock markets correction spurred cryptocurrency rates growth. It is also worth noting that cryptocurrency related articles has almost completely disappeared from the mainstream financial publications. Anyway all that’s happening creates favourable background for a more neutral fundamental dynamics.

On Friday morning, all the top 10 cryptocurrencies show almost zero movement. It is likely that market stability will have a positive impact on the US Securities and Exchange Commission (SEC) decision to approve the Bitcoin ETF launch at the end of 2018 - 2019. Earlier SEC rejected requests because of extreme volatility, BTC reference rate that was linked to crypto exchanges, low liquidity and weak regulation but now the situation is rapidly changes.

While the SEC still can't make decision on Bitcoin ETF the largest cryptocurrency companies are seeking to obtain licenses to offer custodial services. For example, Coinbase, the largest crypto exchange, received a New York State license to provide such services to institutional clients. Until the end of the year major players will get a number of licenses and positive regulators decisions but we still face an issue: is there enough institutional money for such opportunities to invest?

The largest crypto holders are trying to “warm up” market interest. After an event with a huge Bitcoin transaction that costed only 10 cents, it was Ethereum’s turn with $181 million transaction that costed 6 cents. Judging by the absence of any market reaction to these news a significant part of participants from euphoria and depression turned to indifference. Sad but true: it will be hard enough to provoke even a part of the hype that prevailed in the market a year ago.

Alexander Kuptsikevich, the FxPro analyst