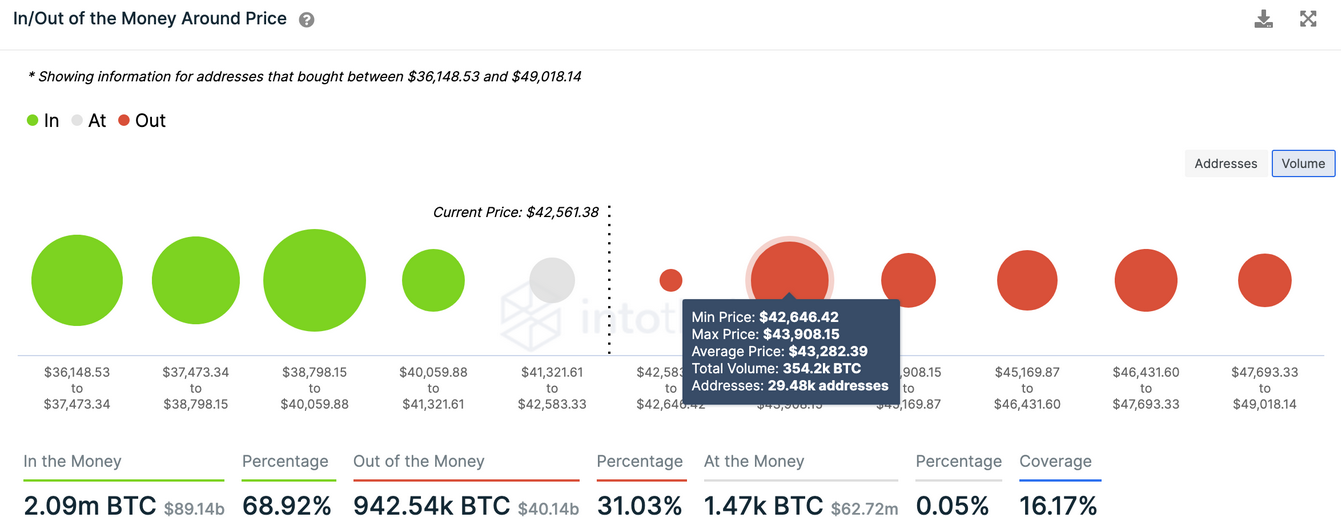

Bitcoin is back in the green, facing little to no resistance ahead. Bitcoin has sliced through a crucial resistance level that was preventing it from achieving its upside potential. Bitcoin looks ready to rally. Doubters have been trying to short the asset in recent weeks, but prices continue to rise. At time of writing, data from Bybt showed that more than $180 million worth of short positions were liquidated over the last few hours. It seems like the break of the $41,000 level led to a short squeeze, pushing BTC further up. Although there are a few technical reasons to be leaning bearish in the mid-term, the short-term future looks bright. Bitcoin has claimed the 100-day moving average as support once again and made a higher high. These developments suggest that BTC now has the buying pressure it needs to tap the 200-day moving average at $45,000 and advance further. The descending triangle where Bitcoin broke out on July 26 forecasts that the recent run-up will extend toward $47,600. This outcome would depend on the leading cryptocurrency’s ability to move past the 200-day moving average. Although the technicals suggest the 200-day moving average could act as significant resistance on the way up, the transaction history shows there aren’t any significant supply barriers ahead. The only interest area that may absorb some of the buying pressure seen recently sits between $42,650 and $43,900. At this level, nearly 30,000 addresses have previously purchased over 350,000 BTC. It’s possible that investors within this price range will try to break even in their underwatered positions, thereby slowing down Bitcoin’s uptrend. Nonetheless, another increase in buy orders around the current price levels that allows BTC to slice through this barrier may be the only thing needed to achieve its upside potential. It is worth noting that now that the $40,000 level has been turned into support, it will likely play a vital role in Bitcoin’s uptrend. A sudden spike in profit-taking that pushes BTC below this demand wall could lead to a steep correction. The most significant support levels below $40,000 sit at $35,000 and $29,500. Key Takeaways

Bitcoin Is Breaking Out

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Looks Primed To Run To $47,000

Published 08/08/2021, 01:32 AM

Bitcoin Looks Primed To Run To $47,000

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.