Coronavirus has receded a little, clearing the room for other news events, among which is halving in the Bitcoin network. There are only 12 days left until the world’s most important crypto event. Halving-FOMO finally got the space to amplify its strength, and the digital currency market showed a rather impressive rally. The whole crypto market was comfortably in the green zone.

In the last 24 hours, the bitcoin grew by 16% or $1,300 and is trading around $9,200. The capitalization of the first cryptocurrency has increased by 16% or $24 billion with almost doubles the trade volumes over the last 24 hours. According to CoinMarketCap, this indicator reached a historical high at $71 billion compared to $20 billion on the price peak in 2017. In terms of investment opportunities, the market has grown dramatically.

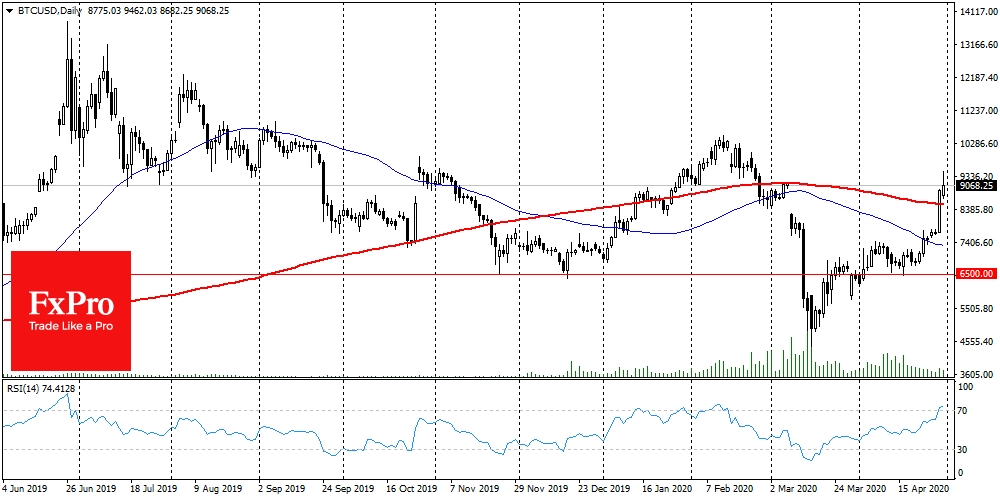

Technical analysis is also on the bull’s side. From this point of view, the growth accelerated after reaching a level above the 50-day average. And the day before, the price crossed the 200-day average and fixed above it on Wednesday. The bulls may further target the February highs area at $10,400.

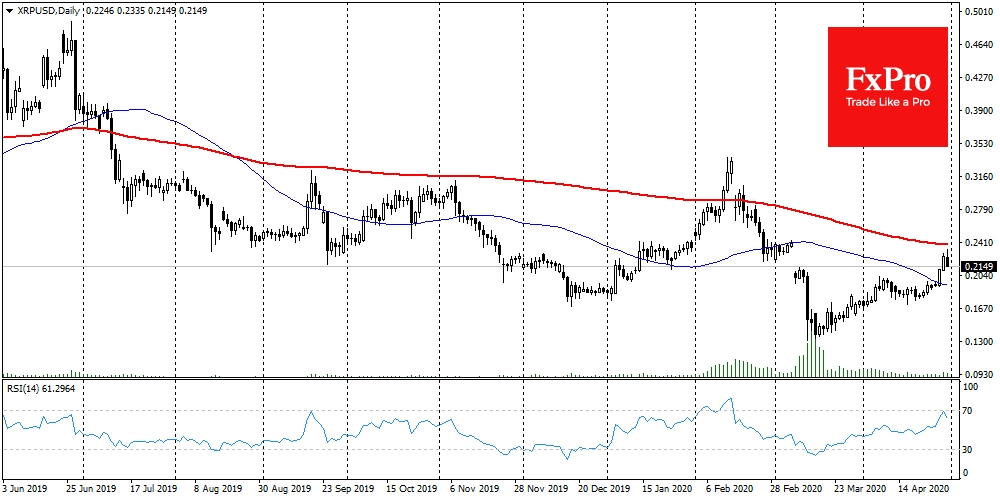

In a week, the first cryptocurrency shows a 30% growth. Ethereum (ETH), XRP, Bitcoin Cash (BCH) and Litecoin (LTC) rose by 21%, 22%, 16% and 19% in 7 days, respectively. Altcoins always follow the first coin, but this time it is worth noting XRP, which began to grow before the Bitcoin rally. The cryptocurrency has been under severe pressure over the last few years and started to get a boost from buyers because of its deficient historical price level. Although this does not mean that XRP won’t face increased pressure from short-term speculators, as the fundamental basis for growth remains weak.

The approaching halving is mainly causing positive vibrations in the crypto market, but as always, there are supporters and opponents. During the last 24 hours, we have seen the support of the buyers. However, some believe that halving is already in the price. From this point of view, halving is a reason for current buyers to take profit from the rally. At the moment, the cryptocurrency may face selling pressure from short-term speculators who bought it in March after the market crash, as well as from miners to cover operational risks.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Knocking Down Obstacles One By One

Published 04/30/2020, 09:44 AM

Updated 03/21/2024, 07:45 AM

Bitcoin Knocking Down Obstacles One By One

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.