Why? Because it is outside the norm. While most commodities measure against a fiat currency and, as such, are exposed to inflation, Bitcoin is not. Even if you are a hardcore critic, it can’t be denied any longer that Bitcoin is a store of value. Not only does it fit principle criteria like limited supply and divisibility, but it holds a trillion dollars right now.

Consequently, it is far more than a speculative object. Being decentralized and truly scarce, typically older generations find it hard to get their head around Bitcoin since it questions typical business procedures. Nevertheless, it has always been the case that the new gets attacked and finds its place only if it’s superior in its application. And Bitcoin has been proving unchallenged for more than twelve years just that.

In fact, Bitcoin is a decentralized global digital network which in essence is transforming analog assets into digital assets. It has been growing at 200% a year. Now after 12 years in existence Bitcoin is a digital trillion-dollar network.

What supports its long-term stability is that its decentralization and transparency are immune against policy. While we typically at the mercy of policymakers and as such a middleman that can manipulate the use of a payment method, with Bitcoin, the individual is genuinely safe. Looking at the world around us where it is hard to find any field not infiltrated by groups who seek to take advantage, manipulate, and flat out lie, it is a true need one can trust a store of value to benchmark against.

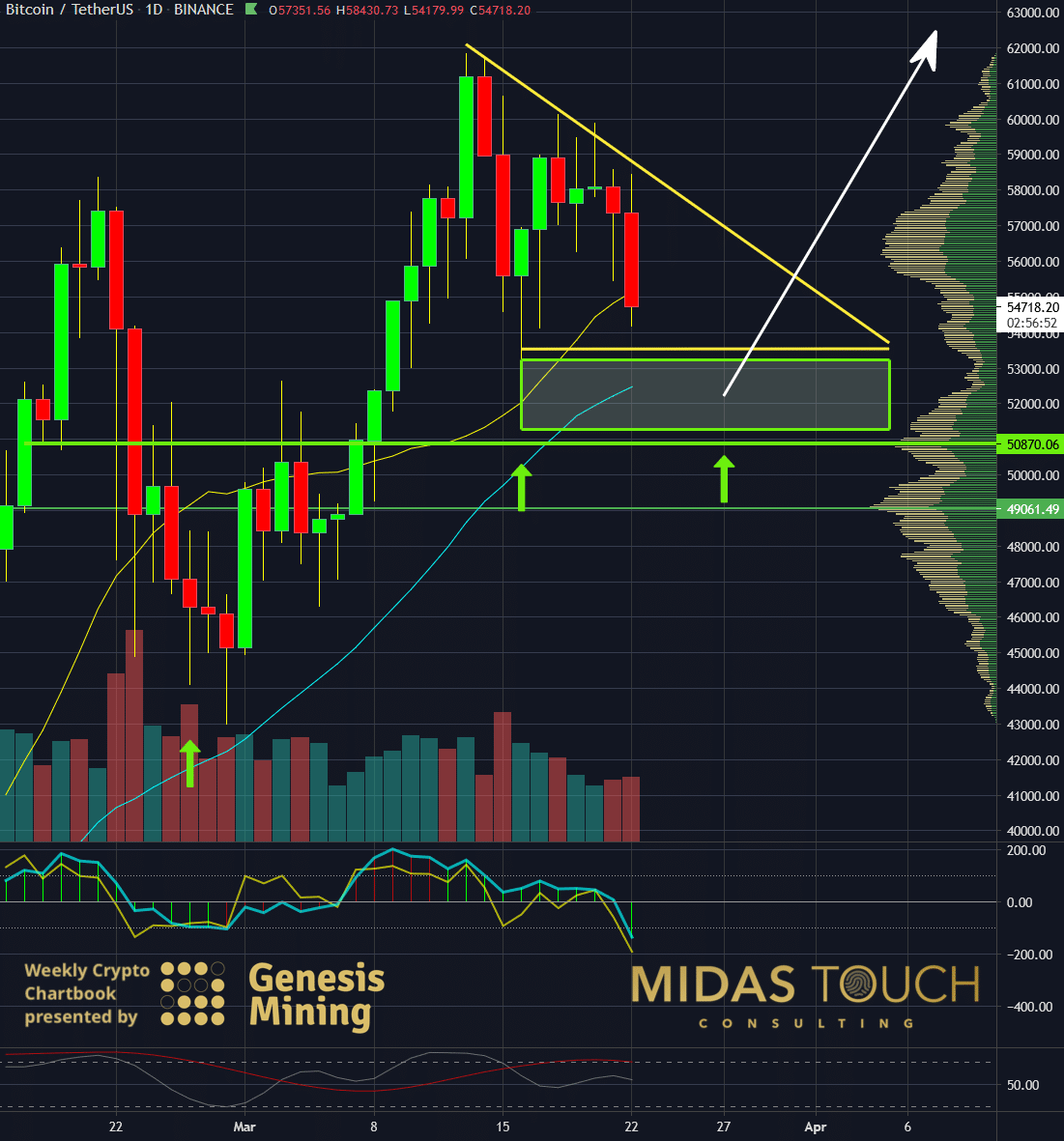

Our chart from last weeks chartbook:

We posted the above short to midterm chart prediction in our last week’s chartbook publication.

As anticipated-another leg up:

The market unfolded quite as planned.

Health and sustainability:

If we analyze Bitcoin prices advancing from last August’s lows, we can find an intact Elliot impulse wave pattern. The Health and sustainability of this trend are derived from the three propulsion proportions. While advancing strongly in the first wave with a 323 % advancement, the pace cooled down to a 99% second leg upward. These stunning advancements followed yet again by a more moderate increase of 44% to its recent all-time highs. This abstinence of a blow-off top or run-away train allows us to believe that prices could march higher.

Bitcoin is invaluable, Projections:

When examining projections, we like to stack odds by looking at both a time and a price component. The above chart shows this blend using a time cycle approach (vertical lines) and a Fibonacci extension probability measurement. Stacking these projection tools would lead us to a price target near ninety-seven thousand for the mid-next year. Our “conservative” projection is marked with the yellow circle on the top right of the chart.

Looking around, and you will find that the dollar is what around the world most value storage is bench-marked against. It seems frightening to us since the dollar has no gold standard or otherwise intrinsic value that we still give it this much power only based on a belief. With economic powers shifting towards the east and a lack of political and economic leadership, beliefs can change, and as such, currency stability is endangered. Hedging your store of value through an instrument that holds intrinsic value based on principles over beliefs seems more than logical.