The BTC-e debacle continues with the U.S. government seizing the exchange’s website. Now, BTC-e has its data center seized by the FBI. On CoinDesk, we read:

(…) in a statement on the Bitcoin Talk forum (that was tweeted out via its official account), representatives for the exchange issued new comments, including a pledge to return users' funds.

The statement read:

"For all those who buried us, I will remind you that the service has always worked on trust and we are ready to answer for it. The funds will be returned to everyone!"

The message also confirmed that BTC-e's data center had been raided by the U.S. Federal Bureau of Investigation on July 25, during which time the agency "seized all equipment, the servers contained databases and purses of our service."

Notably, the statement pushed back on claims that Vinnik was an employee of BTC-e, with the operators stating: "officially declare – Alexander was never the head or employee of our service." In announcing the charges against Vinnik, the US Department of Justice had asserted that he was the "operator" of BTC-e.

The BTC-e statement went on to say that more information would be released in the next two weeks, including an account of "how much money fell into the hands of the FBI and what amount of funds is available for return."

It is unclear at this time what will actually happen with the funds locked into BTC-e accounts. BTC-e has already been fined $110 million and we don’t yet know whether the funds will be used as collateral or if any part of them will be released to customers. The way things look now, it seems unlikely for BTC-e to spring back from this. We wouldn’t expect to see any definitive statements on the issue of funds from the U.S. government any time soon. Bitcoin’s reaction to the BTC-e news has been quite interesting.

For now, let’s focus on the charts.

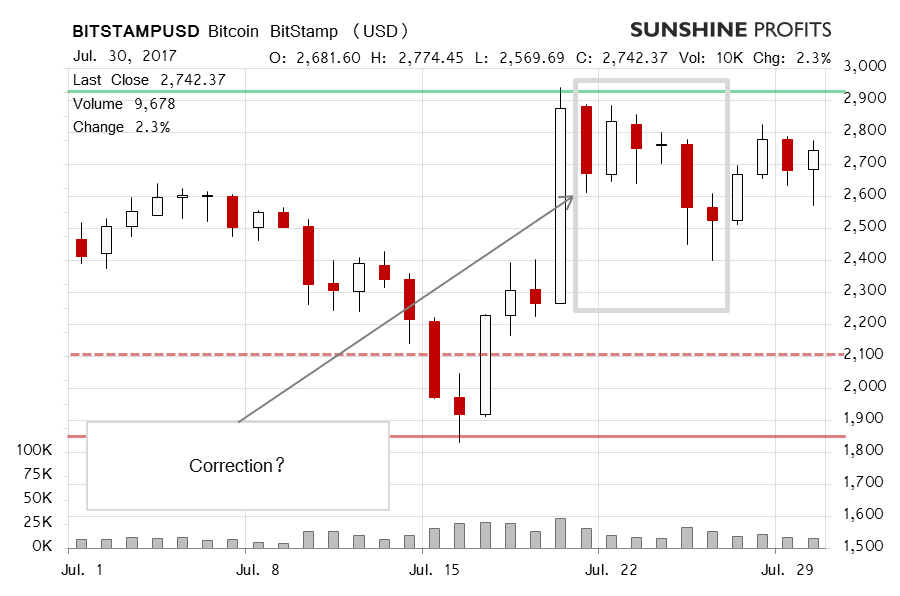

On BitStamp, we see that the move down from the $2,900 level was followed by some appreciation and this makes the situation look more bullish. Recall our recent comments:

The rebound has continued so far (...) and our stop-loss was taken out earlier today. At the moment of writing these words, Bitcoin is not only above the 38.2% retracement ($2,182) but also above the 23.6% one ($2,487). This is a bullish development, at least at first sight, and the volume has been relatively strong so far. Not explosive, perhaps, but strong enough to make this move a plausible beginning of yet another move up.

What we wrote previously remains up to date. Bitcoin is still above the 23.6% retracement level. So far, the recent surge has bullish indications as Bitcoin tested the 50% retracement and very quickly shot up to the upside. We’re now quite close to the all-time high and the way Bitcoin is traded at this level (if it is reached) might be very important for the currency.

Even though BTC-e is a bad story for Bitcoin, the currency hasn’t really budged and we still see Bitcoin just above the 23.6% retracement level. This shows that the currency has been holding up and there has been no change in the short-term outlook based on the price/volume action only.

The current action comes in the wake of the recent test of the 23.6% retracement level ($2,487). The fact that we saw such a test and a move below this level was denied, and we haven’t seen a retest so far, suggests that the current situation is tilting to bullish.

On the long-term BTC-e chart we still don’t see a quote from the exchange, which reflects its recent troubles. Our recent comments:

Now, we see that the situation is very much the same as far as the price is concerned. It is, however, very different when we take into the BTC-e disaster. The idea that a well-known exchange most likely goes underwater should have resulted in a visible downswing. At least this is what we saw following the Mt. Gox debacle. Granted, BTC-e is nowhere near as systemically important as Mt. Gox was but we should have seen at least some reaction. We have seen no visible slide. Actually, at the moment of writing, Bitcoin is up for the day. This might mean that there is more buying power in the market and it is a bullish indication. We would prefer to wait an additional day for the effects of the news to transpire but right now, we view the situation as a lot more bullish than only a couple of days ago.

Even though we don’t see quotes from BTC-e, quotes from other exchanges show that Bitcoin is still above the 23.6% retracement and it has actually gone up recently. At the moment of writing these words (before 12:00p.m. ET), we see Bitcoin in the middle of the range between the 23.6% retracement from the downside and the all-time high from the upside. The situation still has a bullish to it but, in our opinion, it is not enough to go long just now as not much movement might flip the situation around completely.