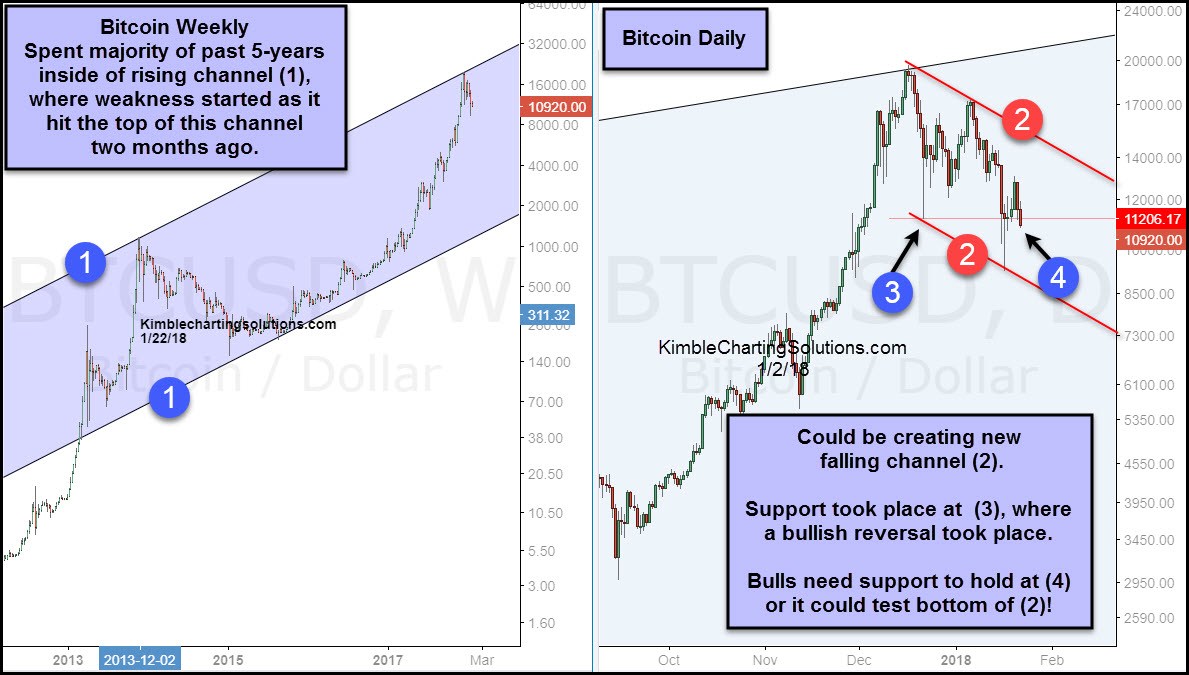

Below looks at bitcoin from two different time frames. The chart on the left looks at bitcoin on a weekly basis over the past few years and the chart on the right looks at it on a daily basis over the past 5 months.

The left chart highlights that bitcoin has spent the majority of the past 5 years inside of rising channel (1). Bitcoin hit the top of this channel last month, where selling pressure has started taking place.

Once bitcoin hit the top of the channel last month, it could be forming new falling channel (2), where lower highs and lower lows are taking place.

The bottom of falling channel (2) looks to have started on a bullish reversal pattern at (3), which took place at the 11,200 level. Last week this level was tested, where bullish reversals took place.

Key support is being tested again today at (4), where bitcoin bulls have their fingers crossed that support holds. If support does not hold at (4), bitcoin could end up testing the bottom of falling channel (2) again.