- Bitcoin (BTC/USD) is holding above $95k but facing significant resistance.

- While spot Bitcoin ETFs have attracted substantial investments, there have been recent net outflows, and on-chain data suggests a cooling down in speculative appetite.

- Strategy’s potential Bitcoin purchase, following a $2 billion fundraising, could be a catalyst for a future bull run.

Bitcoin has regained momentum after finding support at the key $95k level this week before rising to trade at 98357 at the time of writing. The recent consolidation suggests that Bitcoin could be ready for its next big rally, with a move higher looking appealing once more.

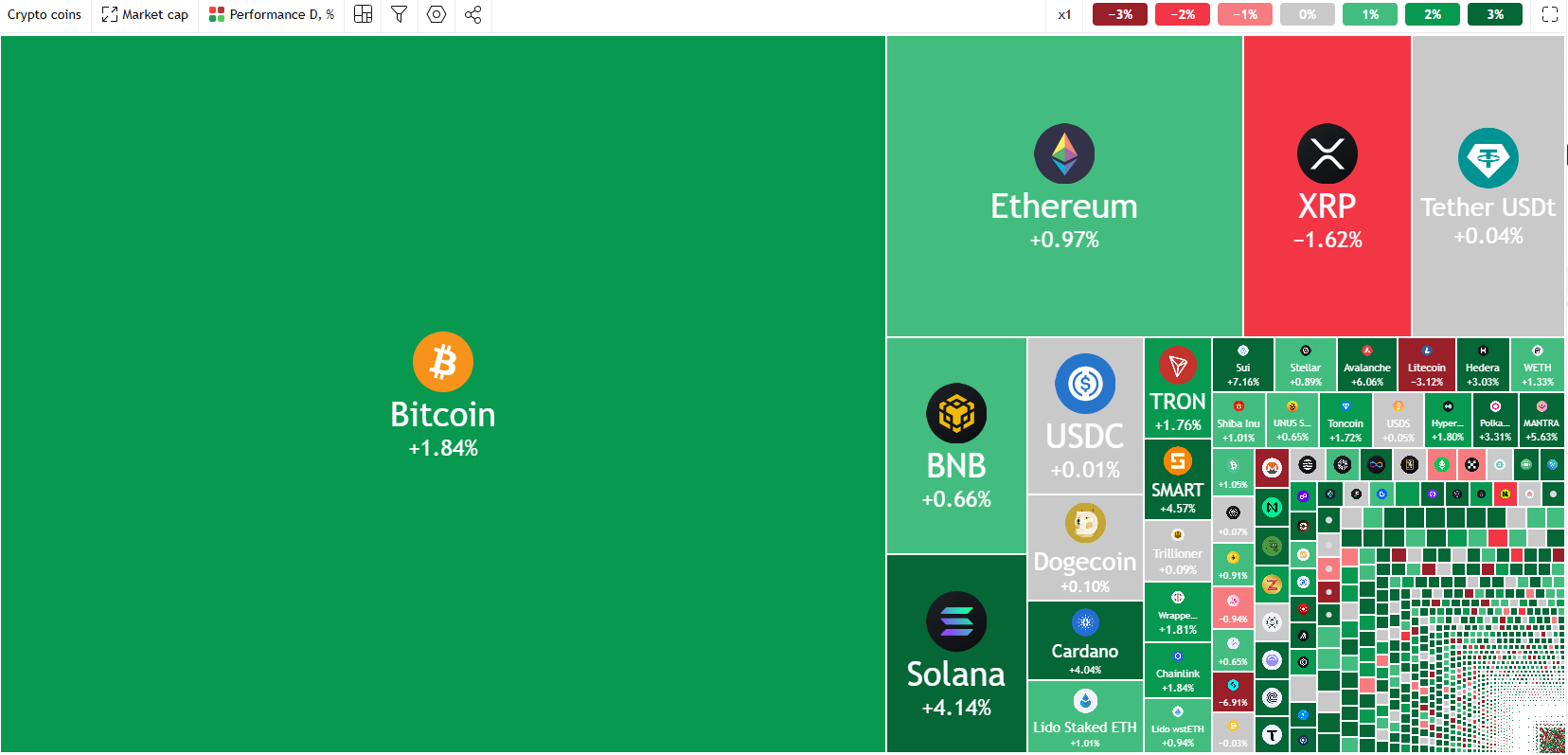

Crypto Heatmap, February 20, 2025

Source: TradingView (click to enlarge)

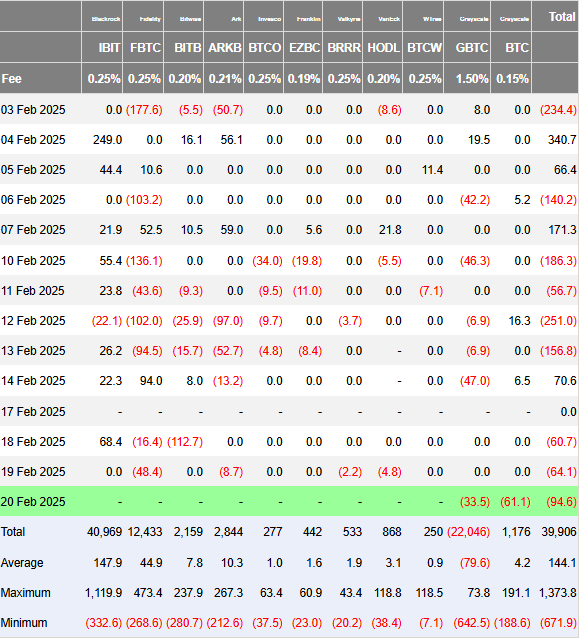

ETF Flows

Even though Bitcoin’s price fell from its all-time high on January 20, data from CoinShares shows that spot ETFs tied to Bitcoin have still attracted a huge $5.6 billion in new investments.

However, over the last few days we have seen a consistent amount of net outflows with figures of 60.7, 64.1 and 94.6 million USD in net outflows since Tuesday.

Source: Farside Investors

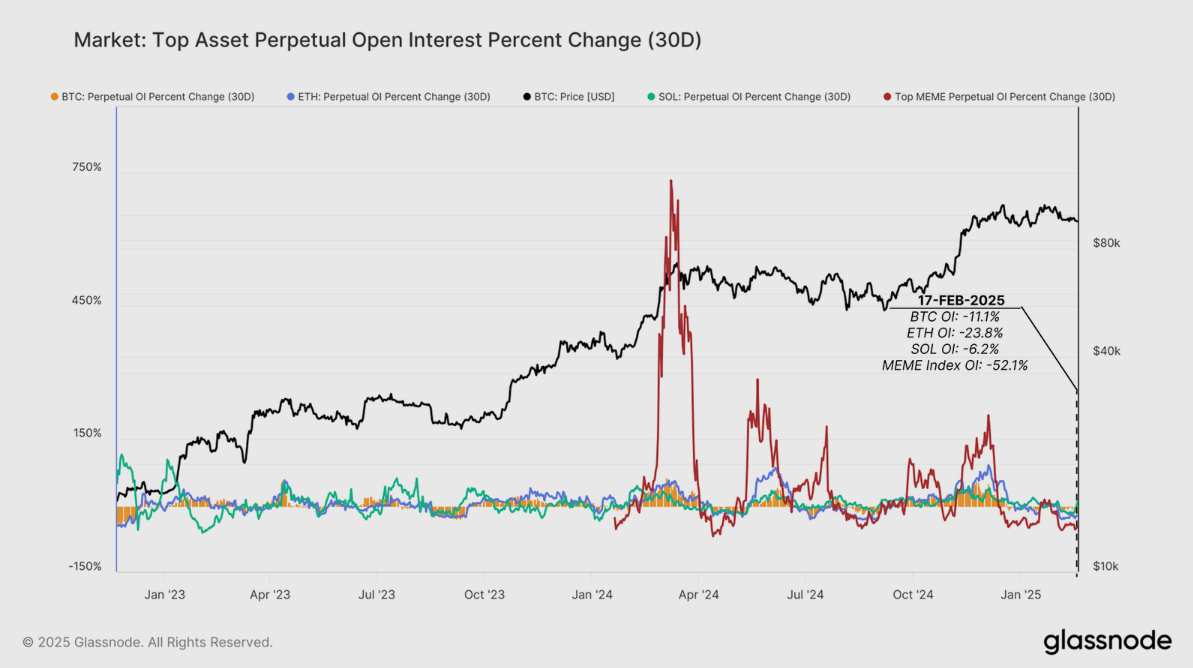

The Week on Chain – Glassnode Data Reveals Downside Risks

Money flowing into the market is slowing down, and trading in derivatives is dropping. The way short-term investors are buying now looks similar to May 2021, which was a tough time for the market.

Overall, in recent weeks markets are seeing the momentum of capital inflows has declined for all digital assets. This signals a meaningful cooling down in speculative appetite and alludes to a potential for capital rotation out of riskier assets on the road ahead.

This is in line with the overall market sentiment at the moment. Although US stock markets continue to hold near highs, the rise of Gold is a clear sign that markets remain nervous as haven demand continues to propel the precious metal to fresh highs.

Momentum in spot markets is slowing down, and less money is going into perpetual futures. This drop in demand has caused a big decline in open interest across major assets, showing less speculative trading and lower profits from cash-and-carry strategies.

The drop in open interest shows that traders are cutting back on risky leveraged bets, likely because the market feels weaker and less certain.

The biggest decline is in Memecoins, which usually attract short-term traders but quickly lose popularity when confidence fades.

Source: Glassnode

Microstrategy (NASDAQ:MSTR) or ‘Strategy’ Gearing Up for Fresh Buys?

MicroStrategy or as we should get used to calling them, Strategy didn’t buy any Bitcoin last week, keeping its total at 478,740 BTC for the second time.

However, MicroStrategy has hinted at a new Bitcoin purchase with its recent fundraising effort. On February 20, the company announced it had successfully priced a $2 billion offering of 0% convertible notes due in 2030. The deal, set to close on February 21, also gives buyers the option to purchase an extra $300 million in notes.

Will such a purchase prove to be the catalyst for another bull run?

Technical Analysis BTC/USD

Bitcoin (BTC/USD) from a technical standpoint on the daily timeframe sees price eyeing a breakout following a period of consolidation.

The consolidation between 94000 and 100000 has lasted for the last two weeks with Tuesday seeing price dip to a low of 93340 before reclaiming the 95000 handle.

Thursday’s daily candle did close back above the 100-day MA resting at 97899 but there are significant hurdles ahead. The 50-day MA rests at 99059, just shy of the psychological 100000 level.

Bitcoin (BTC/USD) Daily Chart, February 20, 2024

Source: TradingView.com (click to enlarge)

Dropping down to a two-hour chart and there may be scope for a short-term pullback. Significant support rests below the current price as we have the 50,100 and 200-day MA converging between the 96000-97000 handles.

This makes this a key area of confluence which could serve as a base for a move toward the 100000 psychological level and beyond.

Immediate support rests at 97000 before the key 95000 handle comes back into focus.

Resistance rests at 99059 and 100000 before markets will turn their attention toward the 102157 resistance handle.

Bitcoin (BTC/USD) Two-Hour (H2) Chart, February 20, 2024

Source: TradingView.com

Support

- 97000

- 95000

- 93200

Resistance

- 99059

- 100000

- 102157

Most Read: Brent Oil Price Forecast: Supply Concerns and Technical Analysis