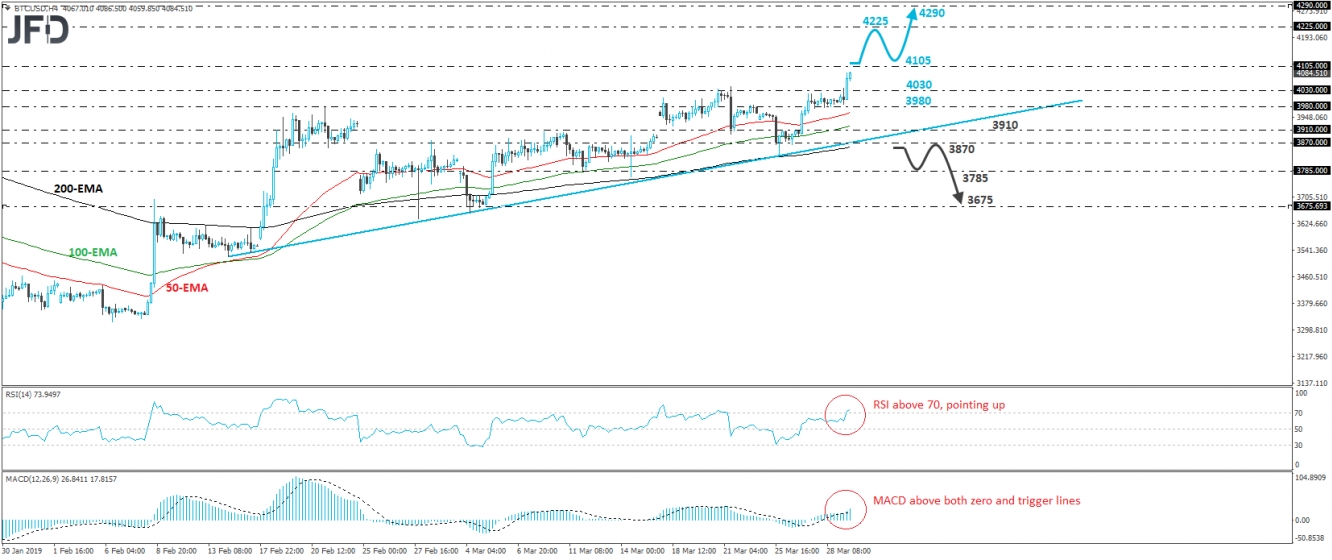

BTC/USD edged north during the European morning Monday, breaking above the resistance (now turned into support) hurdle of 4030. The move confirmed a forthcoming higher high on both the 4-hour and daily charts, which combined with the fact that the crypto is trading above the upside support line drawn from the low of February 14th, paints a positive near-term picture.

Now, bitcoin looks to be headed towards January’s peak of 4105, the break of which may open the door to larger bullish extensions, perhaps towards the 4225 zone, marked by the peak of December 24th. If that hurdle fails to stop buyers from driving the price higher, then we may see a test at around 4290, which is the high of November 30th.

Looking at our short-term oscillators, we see that the RSI emerged above its 70 line and continues to point up, while the MACD lies above both its zero and trigger lines, pointing north as well. These indicators detect strong upside speed and support the case for further near-term advances.

On the downside, even if the crypto slides back below 4030 and 3980, we would treat such a retreat as a corrective phase. The outlook would still be somewhat positive in our view. We would like to see a decisive dip below 3870 before we start examining the case of a bearish reversal. Such a move would confirm the break below the aforementioned upside support line and may initially pave the way towards the 3785 zone, defined by the low of March 12th, and slightly above the low of March 14th. Another break, below 3785, may allow the bears to put the 3675 zone on their radars.