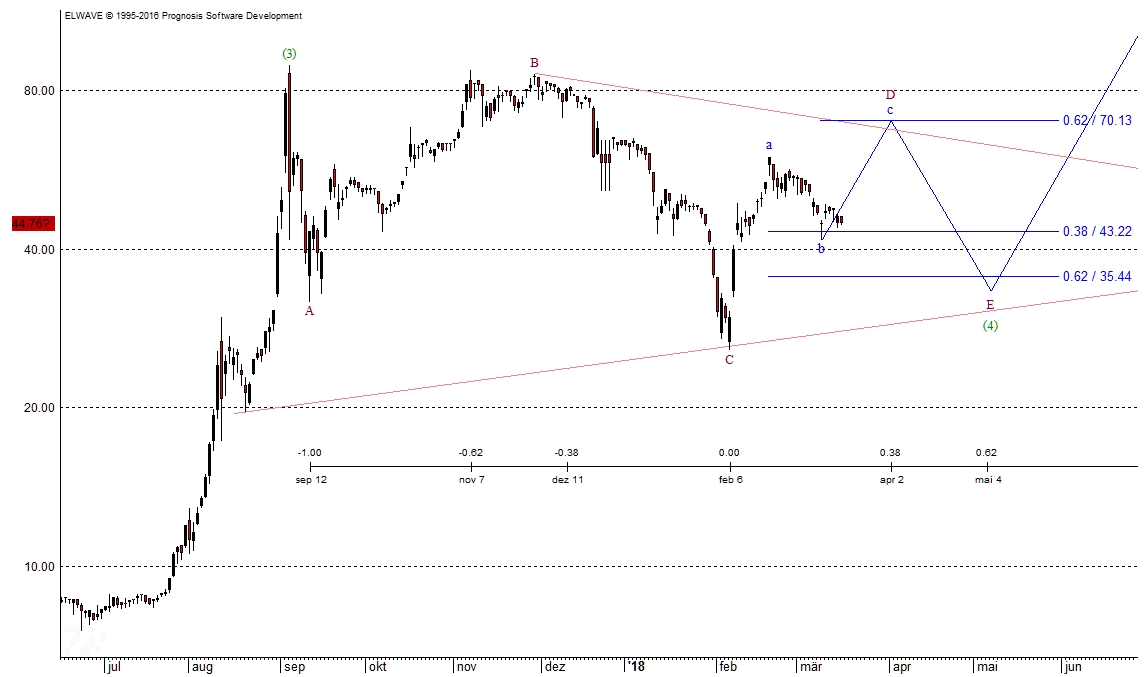

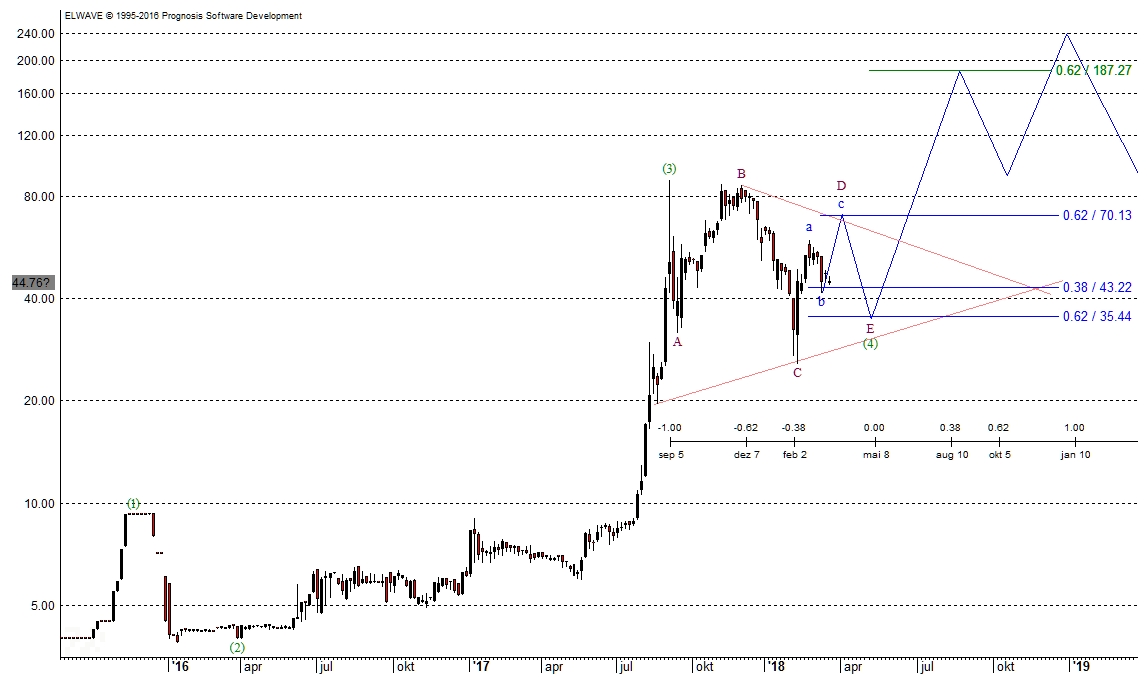

With the share of Bitcoin Group SE (DE:ADE) I am today for the first time attempting to examine a provider of a crypto currency. The chart also shows the reason for my restraint so far, because exploitable data have only been available for about a year. Bitcoin is currently training a correction that has been underway since September as part of the overall upward trend. The middle chart illustrates this aspect very impressively. Unfortunately, due to the lack of data, I cannot give you the long-term outlook that you have come to expect from me, but time does not stand still for Bitcoin either.

Outlook:

Currently, wave (4) forms as a triangle (A-B-C-D-E), as it is not unusual for a "4". The three-part (a-b-c) wave (D) currently under training will carry the crypto currency provider into the range of the 0.62 retracement at 70.13 €. Nothing more can be expected from this wave. At present, the internal small wave (b) is developing, even if not much negative is to be feared from this movement any more.

As shown in the chart, (b) can drop to a maximum of 0.62 support at 35.44 €. However, this step is not very realistic. The lack of a closing price below the important 0.38 retracement (€ 43.22) has a very positive effect in this respect. This fact alone nourishes the hope for an immediate formation of wave (c) and with it a small upward trend, up to 0.62 resistance at 70 €.

After completion of (D), the last triangle wave (E) will drop the share back into the range around 35 €. Only after completion of (4) it goes again steeply upward, only then the quotations up to 200 € the doors are open. At the moment I cannot see any dangers for the positive scenario described.

Conclusion:

Bitcoin's stock is currently undergoing a major correction and is expected to close in the first half of the year (time ruler). A buy-signal is unrealistic at the present time. Secure your positions on the 0.62 retracement at 35.44 €.