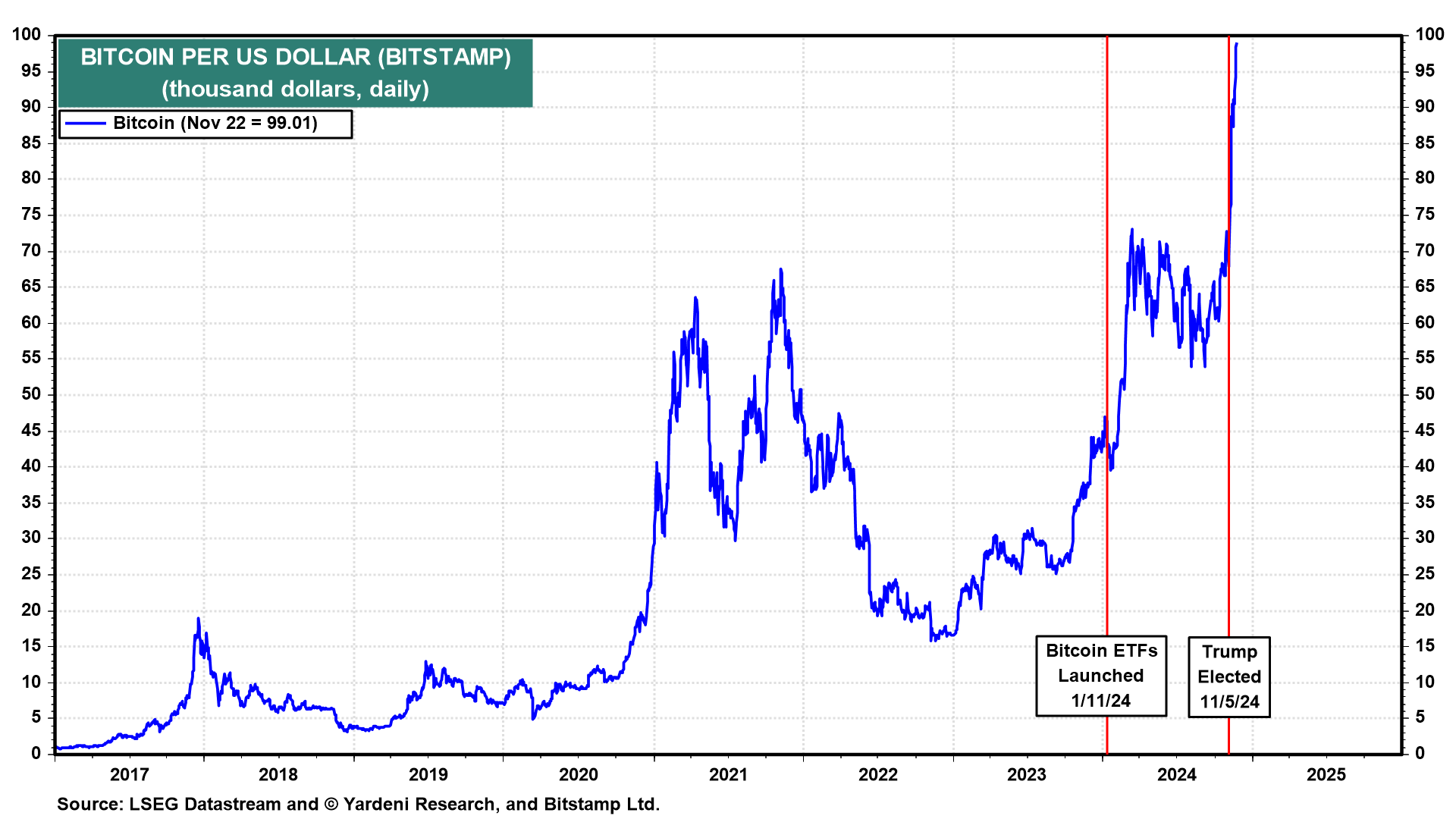

We are increasingly asked about the outlook for Bitcoin. We don't have a clue because it doesn't provide investors with any way to value it. We know that the supply of cryptocurrency is limited, which is why the supply of alternative cryptocurrencies seems to be expanding as fast as the price of Bitcoin is soaring. However, the increased supply of alternatives doesn't seem to be a problem so far.

Can Bitcoin soar from $100,000 to $1 million? Sure, why not? It already increased almost 7-fold just since early 2023, 10-fold since mid-2020, and 100-fold since early 2017 (chart).

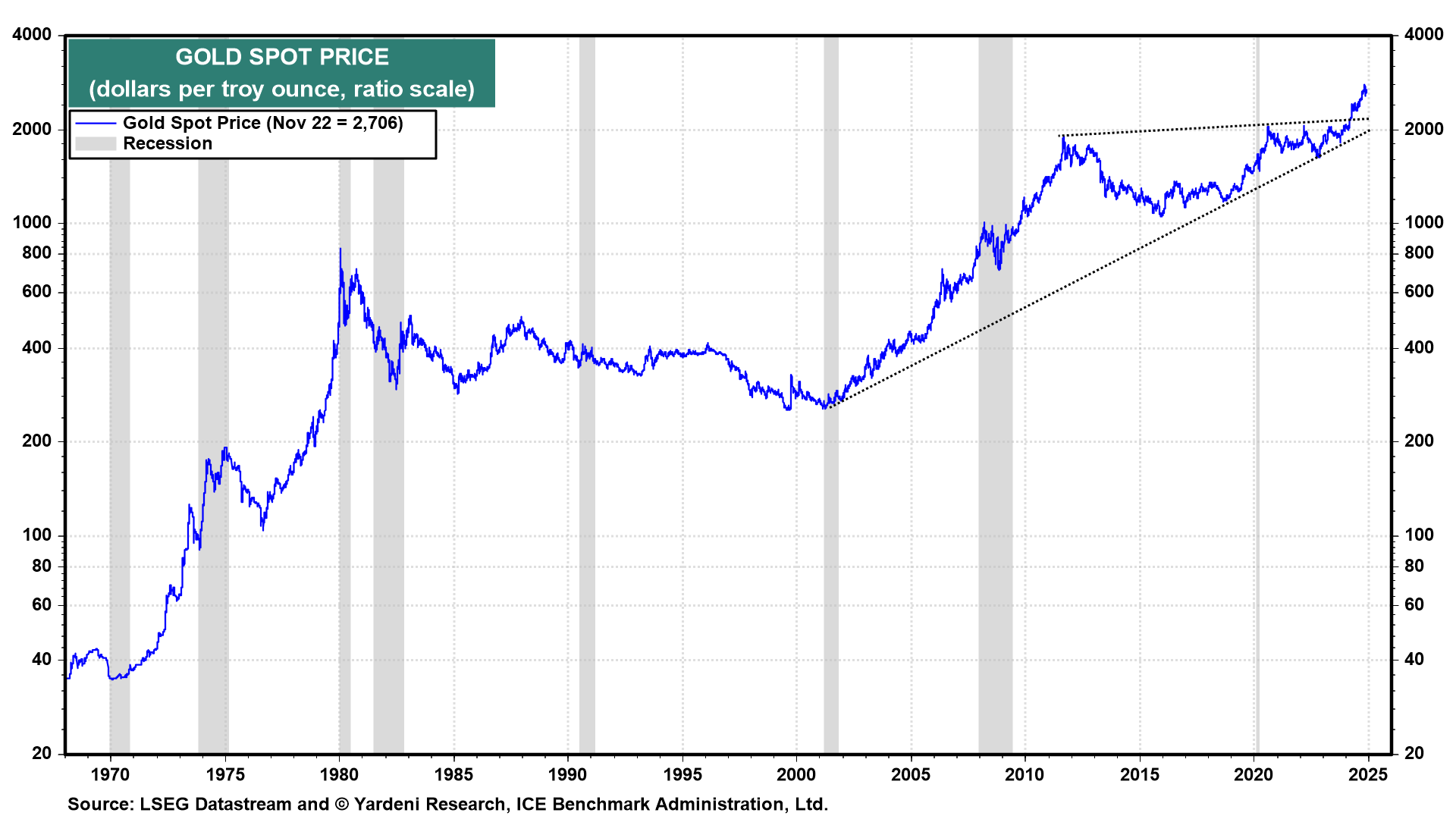

By comparison, the price of gold rose only 20-fold during the 1970s after President Richard Nixon closed the Gold Window on August 15, 1971 (chart).

That effectively devalued the dollar, boosted inflation, and created a surge in demand for gold. During the current bull market in gold that started in 2002, the price of the precious metal has risen almost 10-fold.

However, the supply of gold isn't limited as is the supply of Bitcoin at 21 million coins, with 19.9 million in existence and 1.1 million left to be mined. Furthermore, storing physical gold is an expense that isn't relevant to Bitcoin.

We've previously described Bitcoin as "digital tulips," implying that it is a speculative bubble. What we meant is that unlike the Amsterdam tulip bubble (1634-37), the demand for Bitcoin is global and the market is open 24x7. So it is a global bubble rather than a local or national one. That implies that the price, which has already gone to the Moon, can go to Mars, and to infinity and beyond!

After all, President Donald Trump, who called Bitcoin a "scam" in 2019, embraced it during his 2024 presidential campaign and accepted campaign donations in it and other cryptocurrencies. He also spoke at the Bitcoin 2024 Conference, expressing support for making the US a leader in cryptocurrency and for a national strategic Bitcoin reserve.

What could possibly go wrong?

What if MicroStrategy's (NASDAQ:MSTR) strategy blows up? The company is selling both equity and debt to buy Bitcoin. Barron's ace reporter Andrew Bary posted an article today on this subject: "The company, which is the largest corporate holder of bitcoin with 331,200 coins as of Nov. 17, has been on a bitcoin buying spree during November.

It purchased about $6.6 billion of bitcoin from Oct. 31 to Nov. 17 using proceeds from at-the-market equity offerings sold through a group of nine Wall Street firms." In effect, it is a perpetual prosperity rocket ship on course to infinity and beyond. The price of Bitcoin goes up. The company raises more money to buy more Bitcoin, which continues to go up in price as does the stock price of MicroStrategy...and so on to infinity and beyond.

What could possibly go wrong? We aren't sure, but we are thinking about it.

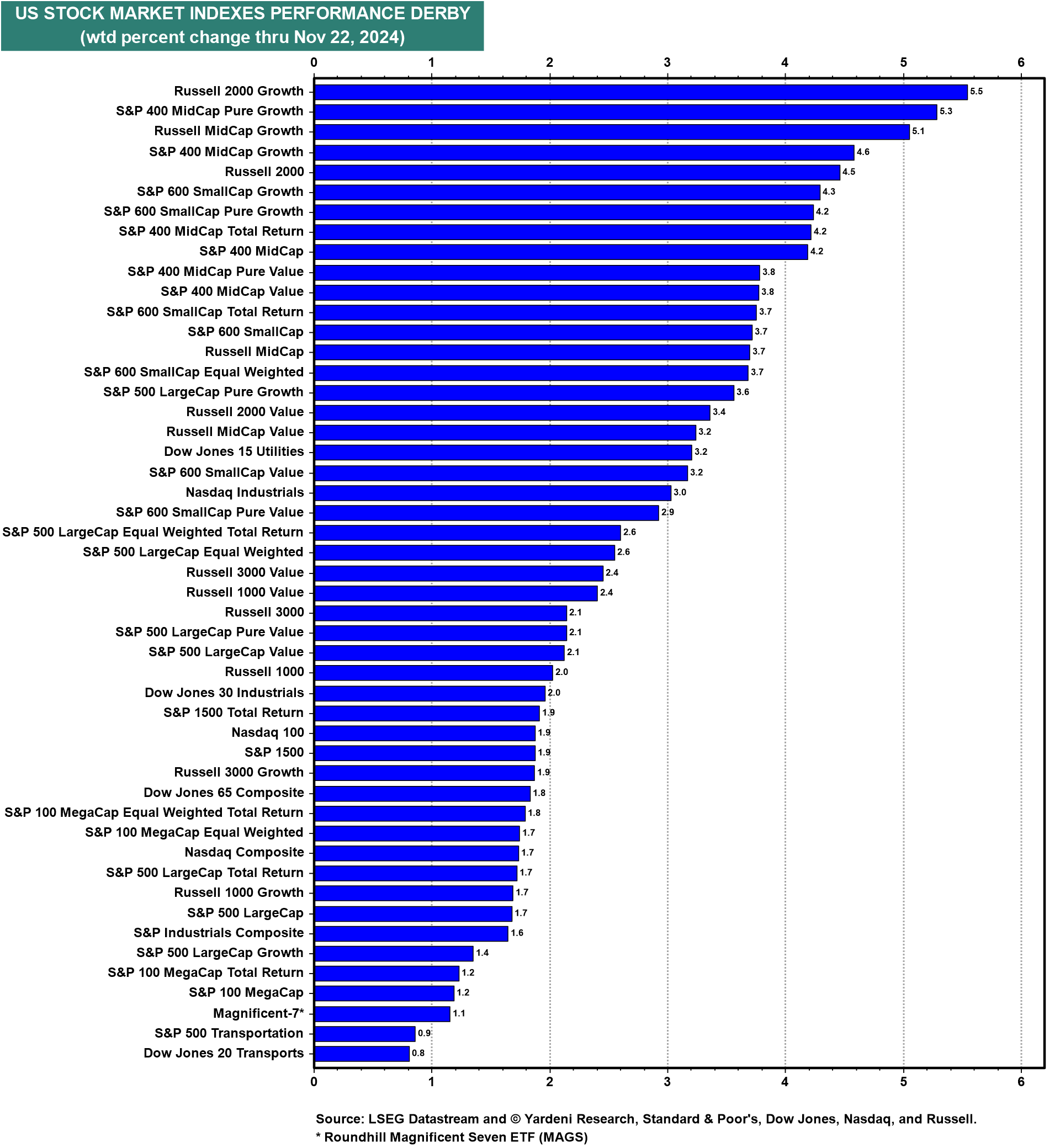

By comparison, the US stock market's returns seem like chump change. Nevertheless, last week was another good one for stocks as the market continued to broaden to smaller-cap stocks (table).