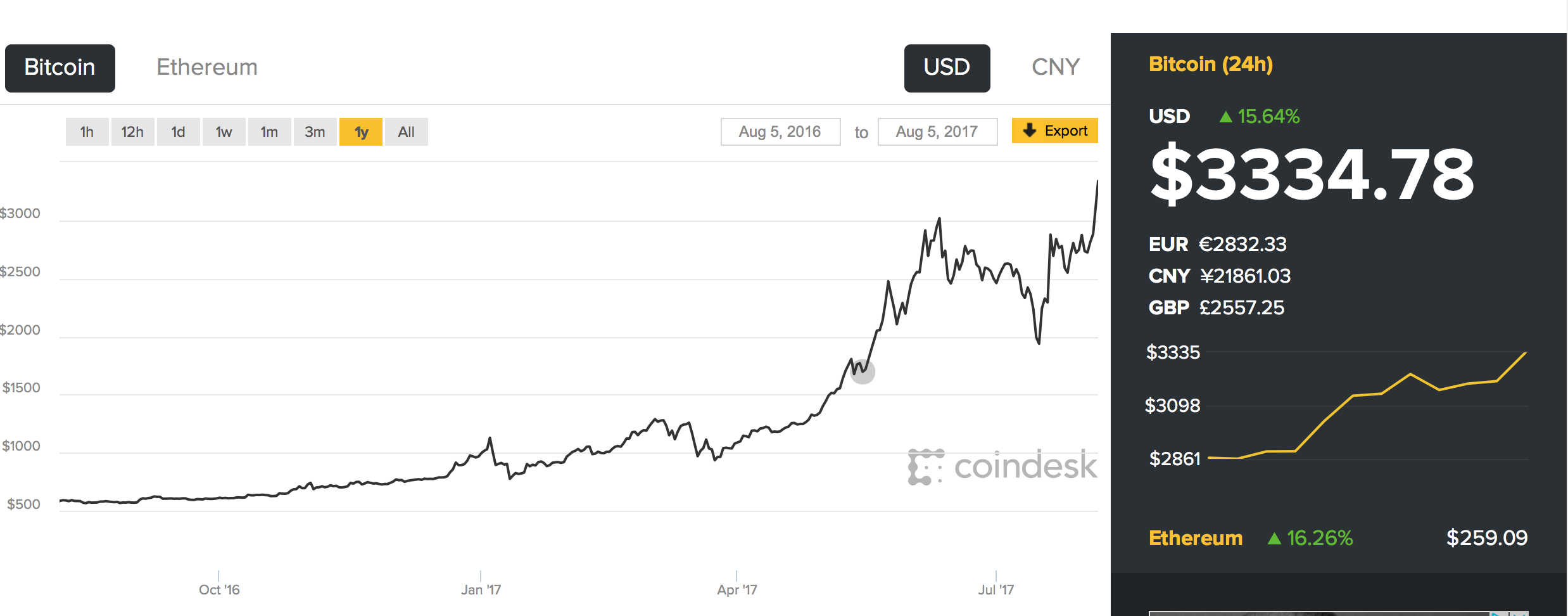

Bitcoin trades 24/7 and is surging this weekend into an ATH as shown on my first chart, below. GBTC made a new Trading Cycle high on day 14 Friday and may well gap up on Monday morning on day 15 if BitCoin is able to sustain its trend into next week.

Note that my GBTC trade was up $1,718 at the close on Friday. Sure wish I had bought more but I do feel good at my entry point after closer analysis spotted the recent low as a 5-6 month Intermediate Cycle Low (ICL).

So if Monday will be day 15, when will this Trading Cycle Top? My previous analysis on GBTC’s shorter Trading cycle shows GBTC has a TCL/DCL timing band of 17-24 days with Highs as late as day 18 (one high on day 16 and another on day 18). This analysis on Previous GBTC Trading/Daily Cycle counts can be found here.

My last chart is a 2-year Weekly that shows you the 5-6 moth Intermediate Cycle counts in weeks along with the Weekly counts into the Intermediate Highs. Note that we are just in week 2 or perhaps week 3 of the current Intermediate Cycle.

So is this a blow off top into an early Intermediate Top? I am not an Elliot Wave expert so anyone having this skill please chime in. Looking at the weekly chart I see two EW possibilities and they are very different.

Scenario #1, which is my current thinking, has the previous weekly top in June as a Wave 3 Top followed by a Wave 4 low in late July. That would put us moving into a Wave 5 top in this current move. Scenario #2 has the June top as just Wave 1 and the recent July low as Wave 2 which would make this just the start of an Elliott Wave 3 Pattern. I must say that I sure like Scenario #2 much better.

Stay tuned as a large gap up on Monday will likely have me taking profits on day 15. I don’t like gaps especially near a Time count that is close to where we have seen previous cycle highs. We saw this recently with Sugar late in the count and I should have stuck to my previous practices and taken profits rather than getting stopped out at a loss after the Trading Cycle topped on that gap up day…

We are tracking the Bitcoin phenomena and it turns out, like all financial instruments, it to has a repeatable cycle.