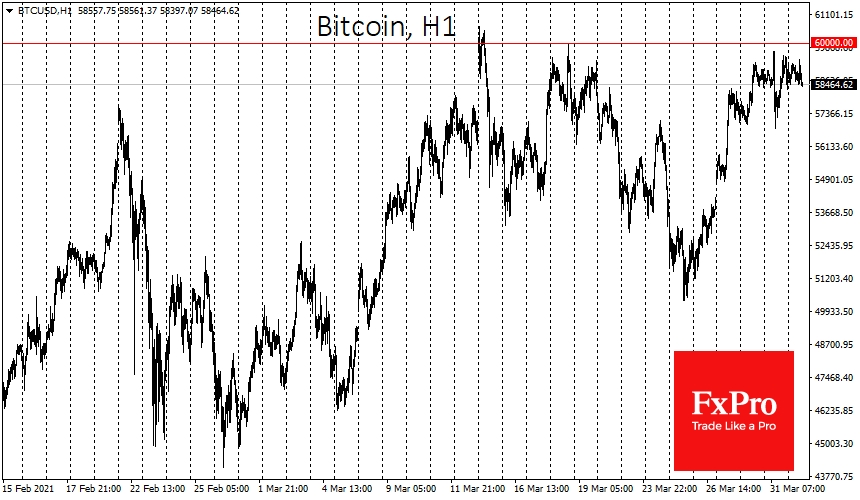

On the last day of March, Bitcoin approached the $60K threshold again, but a wave of sales almost immediately pushed the benchmark cryptocurrency to $57K. For the third consecutive day, BTC/USD seems to be hitting an invisible ceiling on the approach to $60K. Simultaneously, relatively small pullbacks allow us to talk about the consolidation of buying forces before a further round of growth, rather than about any fundamental difficulties with the rally.

Guided by Fibonacci levels, the next main ones for Bitcoin may be the $73,000 and $92,000 price levels. However, they will only be possible if resistance at $61K is confidently overcome.

Glassnode analysts found that about three-quarters of bitcoins in circulation last moved after reaching a price of about $11K. This isn't the first study proving that investors are prone to long-term strategies for Bitcoin, suggesting that we may indeed see historical highs in the future, which at this stage may seem like unrealistic targets. The company has also found that bitcoins are not only being put off for the long term, but the number of proponents of this approach is generally growing.

It is likely that a combination of the propensity for long-term investments, active accumulation of coins, clear interest from institutional investors, and a wide range of news about Bitcoin's acceptance into the traditional settlement system made it possible to maintain the current price levels. At this stage, correction is a great opportunity to buy the asset on a pullback.

First, Tesla (NASDAQ:TSLA) launched the ability to buy cars with bitcoins, promising not to convert them into fiat. Then the processing giant Visa (NYSE:V) came on the scene, announcing the integration of USDC stablecoin into payments. While this news has no direct impact on Bitcoin, such decisions improve the reputation of cryptocurrencies in general.

Visa’s announcement was followed by news from PayPal (NASDAQ:PYPL), which allows its U.S. users to pay with leading cryptocurrencies. It then became known that the investment bank Goldman Sachs (NYSE:GS) in the second quarter of 2021 will add investment instruments based on the benchmark cryptocurrency, including instruments with physical delivery.

Building the infrastructure for investing in Bitcoin during the crypto winter was the right direction. At this point, we are witnessing the major players in the traditional market having a warmer attitude towards the major cryptocurrencies. The result will be more and more integration of the asset into the traditional market, but there is still a very troubling question about the attitude of the U.S. regulator about what is happening.

Apparently, Bitcoin's increasing dependence on institutional money suits American authorities and, in a sense, calms them down. In addition, as long as bitcoin and its leading alternatives act as assets rather than a means of payment in the crypto market, the regulator's attitude remains neutral. Facebook (NASDAQ:FB)'s Libra was supposed to be an international means of payment, but was quickly brought to a standstill.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Polski

- Português (Portugal)

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Gathers Strength Before Storming To New Highs

Published 04/01/2021, 09:13 AM

Bitcoin Gathers Strength Before Storming To New Highs

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.