Buy the crash. Sell the all-time high. Rinse. Repeat. This has been a time-honored trading strategy for Bitcoin that, in hindsight, has offered a very low-risk way of profiting form the manic rise of Bitcoin.

Today, the famed cryptocurrency was down as much as 30% before bouncing back with a furious rally. The trading strategy was in full display as Bitcoin rallied to close out the day with a “mere” 5.2%.

Trading volume apparently surged as Bitcoin (BTC) hit its low of the day. BTC was down as much as 30% on the day before bouncing.

At the lows of the day, Bitcoin (BTC) hit a 3-week low. The tremendous rally from there did not end the overall orderly decline from the last all-time high hit a week ago just under 20,000.

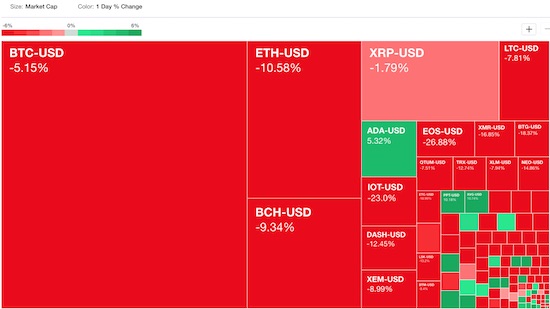

Bitcoin was the biggest story, but its troubles were shared by most of the over 100 cryptocurrencies now in existence. Coinbase crashed (again) alongside Bitcoin due to the massive traffic on its site as traders rushed to buy, sell, deposit, withdraw, and/or just watch the charts spin.

It was a rough day across the board for almost all 100+ cryptocurrencies.

I can only guess at what caused the massive panic, but I am duly noting that today was the last trading day before Christmas. Perhaps too many people had plans to try to secure their crypto funds into paper money ahead of the holiday. Whatever the reason, the end result after the dust settled was the on-going orderly decline from the all-time high set a week ago on December 15th.

As Bitcoin crashed, the headlines and articles churned out furiously. I particularly liked a piece from finance and CNBC veteran Ron Insana titled “The last person into a speculative frenzy such as bitcoin never gets out before it’s too late.” Insana told his own personal tale of flirting with jumping into the cryptocurrency frenzy and just barely missing getting in near the latest top. An over-eager friend was not so lucky. Full of hindsight, Insana of course regrets not getting in Bitcoin for $300 when he had a chance, but he also looks back with relief at how he avoided flushing his career into the dot-com bubble and bust at the turn of the 21st century.

As the frenzy continues it still seems too easy to find skeptics and bubble prophets. Here is my favorite quote dripping with skepticism from Agnico Eagle Mines (AEM) Vice Chairman and CEO Sean Boyd on Jim Cramer’s Mad Money: “One of the things about bitcoin and the cryptocurrencies is, is there really an unlimited supply?…We’re gold miners. We mine deposits. I think, over time, the question will be: are these cryptocurrencies and the developers of these cryptocurrencies just mining the public?”

The psychology and history of bubbles suggests that the bursting does not happen in earnest until such negativity is nearly impossible to find…or when the biggest players finally try to sell en masse to a shrinking pool of poorly capitalized buyers. Moreover, cryptocurrencies are global in nature; perhaps the first truly speculative frenzy synchronized on a global basis with the ability for anyone and anywhere to participate. Such a collective represents an unprecedented amount of (potential) purchasing/trading power. People in different countries and cultures have very different needs and attitudes toward crypto, so simply looking at a chart and observing the relentless rise to infinity is not enough (for me) to prognosticate on a bursting.

While I marvel from the sidelines, I have enjoyed the comic relief that the frenzy produces. Two of my favorites so far…

How Bitcoin works…

Spiritual financial advice on Bitcoin…

https://www.facebook.com/awakenwithjp/videos/1968519879830531/

Be very, very careful out there!

Full disclosure: no positions