Cryptocurrencies are following a sideways trend. On the one hand, we’ve seen some crypto-investor relief after SEC and CFTC representatives at the U.S. Senate hearing unequivocally decided not to impose any limitations on cryptocurrency trading on a national level, though the IRS plans to put together a control group to monitor operations on the cryptocurrency market. On the other, the Japanese National Tax Agency has started classifying profits from cryptocurrency trading as ‘miscellaneous income,’ meaning that investors will incur between 15-55% tax, depending on income level.

Governments find it difficult to monitor or control decentralized cryptocurrencies, yet they are indeed in position to monitor fund withdrawal to traditional currencies (fiat money), stock exchange activities, retail investors and mining companies.

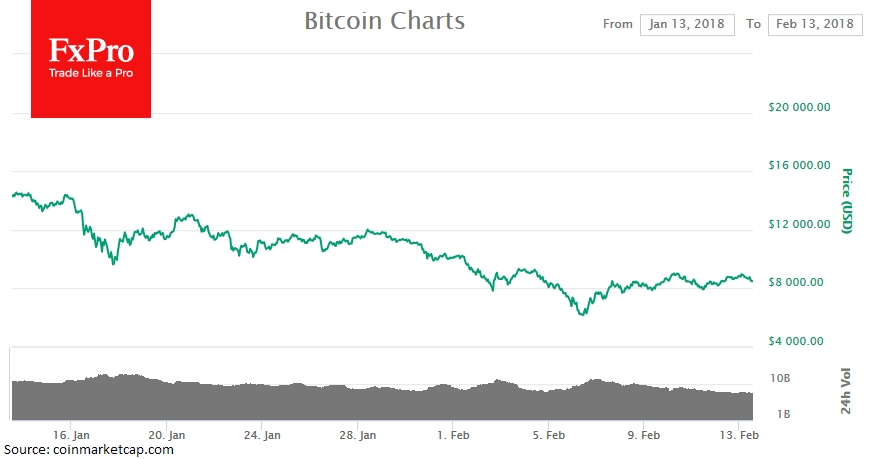

Bitcoin seems to be facing difficulties in moving beyond $9,000. The increase in mining complexity and the peak output of new capacities to the market at the end of 2017 have led to miners facing several issues after price correction. The overall situation reminds of the oil market situation at the end of 2014, and it seems that only this low-price environment can bring balance to the complexity of networks and amount of equipment, with NVIDIA and AMD shares likely to be affected.