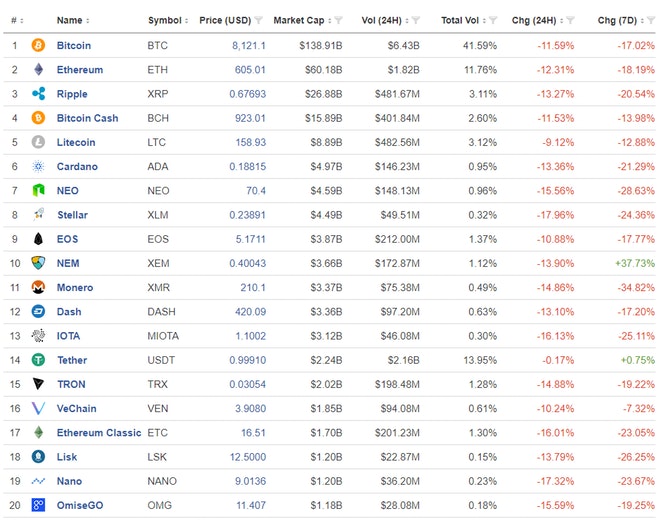

Bitcoin failed its latest breakout attempt. Heck, it did not even come close. Down again we go. For how long?

Bloomberg writes "The Bitcoin Fad Is Fading—For Now":

It might be hard to believe. But after the 1,400 percent rally of 2017, with wild swings along the way, the great crypto craze has cooled, at least for now. For the past month, Bitcoin’s price has stalled between $8,500 and $11,300 -- a minuscule range by its standards. And internet searches for “Bitcoin” have plunged, suggesting public interest has, too.

“The general public is now realizing that this is not a risk-free, get-rich-quick, investment opportunity and general interest has since diminished,” said Lucas Nuzzi, a senior analyst at Digital Asset Research.

Online searches for “bitcoin” fell 82 percent from December highs, according to Google Trends. Tweets that mention the coin peaked Dec. 7, at 155,600, and are now down to about 63,000, BitInfoCharts says. And the number of bitcoin transactions is off 60 percent from its record on Dec. 13, according to Blockchain.info.

December brought “Bitcoin Craze Propels Coinbase App to No. 1 in Apple’s Store.” Now there’s “Bitcoin’s Wildest Days Are Over as Regulators Circle.” Indeed, Bitcoin’s been in the news for all the wrong reasons lately.

For Now or for Good?

That's the million dollar question as well as a the price many true believers think is in the cards.

$4,000,000?

Why not? As long as you are making idiotic predictions, why not $100,000,000? Why not a billion?

For someone who got in at at $1,000 with a $10,000 purchase would have $10,000,000 if it gets to a million. Someone who got in at $100 would have $100 million.

Someone how got it at a penny with a $10,000 purchase would have 10 billion dollars.

Cashing Out

At some point the early investors will want to cash out. It might be at a $1 million, at $10 million, at $100,000, or something far less.

I suspect it is happening now.

Suppy alone, from those cashing out will prevent these nonsensical targets from ever coming close whether or not governments shut down the exchanges or tax the hell out of them.

Latecomer Psychology

What about those who paid over $12,000? Unless they have become true believers, they are now praying to get out whole.

What about those getting in at $6,000 and HODLing?

They had a 300% gain and are now approaching break even for the second time?

Will they keep HODLing at $6,000? $5,000? $4,000?

More supply is coming if Bitcoin makes a new low.

When's the Panic?

At some point, even the true believer HODLers will panic.

When? I do not know. But I confidently predict a massacre when it happens.

Meanwhile, $28,000 is still in play. So is $4,000 and $500.

Feelin' lucky? For now or for good?