Key Takeaways

- Bitcoin's recent price surge is primarily driven by institutional investors, not retail.

- In spite of geopolitical tensions and market uncertainty, Bitcoin recorded a 7% gain in September.

Despite Bitcoin’s rally near $66,000, key indicators suggest it’s not ready for a new all-time high. China-focused stablecoin data and low retail participation point to a slowdown, while broader global interest remains muted.

Although institutional investors have fueled Bitcoin’s recent price surge, the situation in China paints a different picture. Stablecoins like USDT have been trading at a discount in China, which typically indicates bearish sentiment. This lack of demand contrasts with US spot ETFs’ inflows, suggesting that broader global investor interest in crypto may still be muted.

Interestingly, China has been a focal point for global markets, with the Chinese government’s recent economic stimulus leading to a historic buying spree in stocks.

According to a tweet by Kobeissi Letter, Chinese ETF call volume hit 3.4 million contracts last week, the highest since 2020. ETFs like $FXI and $KWEB surged 18.5% and 26.8%, while China’s CSI 300 index posted its best week since 2008 with a 15.7% spike. Despite this boost in Chinese equities, Bitcoin’s price still faces challenges in aligning with broader market optimism.

Retail investor participation, a key indicator of market euphoria, remains subdued. In past bull markets, retail activity surged, with Coinbase (NASDAQ:COIN) ranking as the number one downloaded app. Currently, the Coinbase app ranks 417th, far below its peak positions during previous rallies.

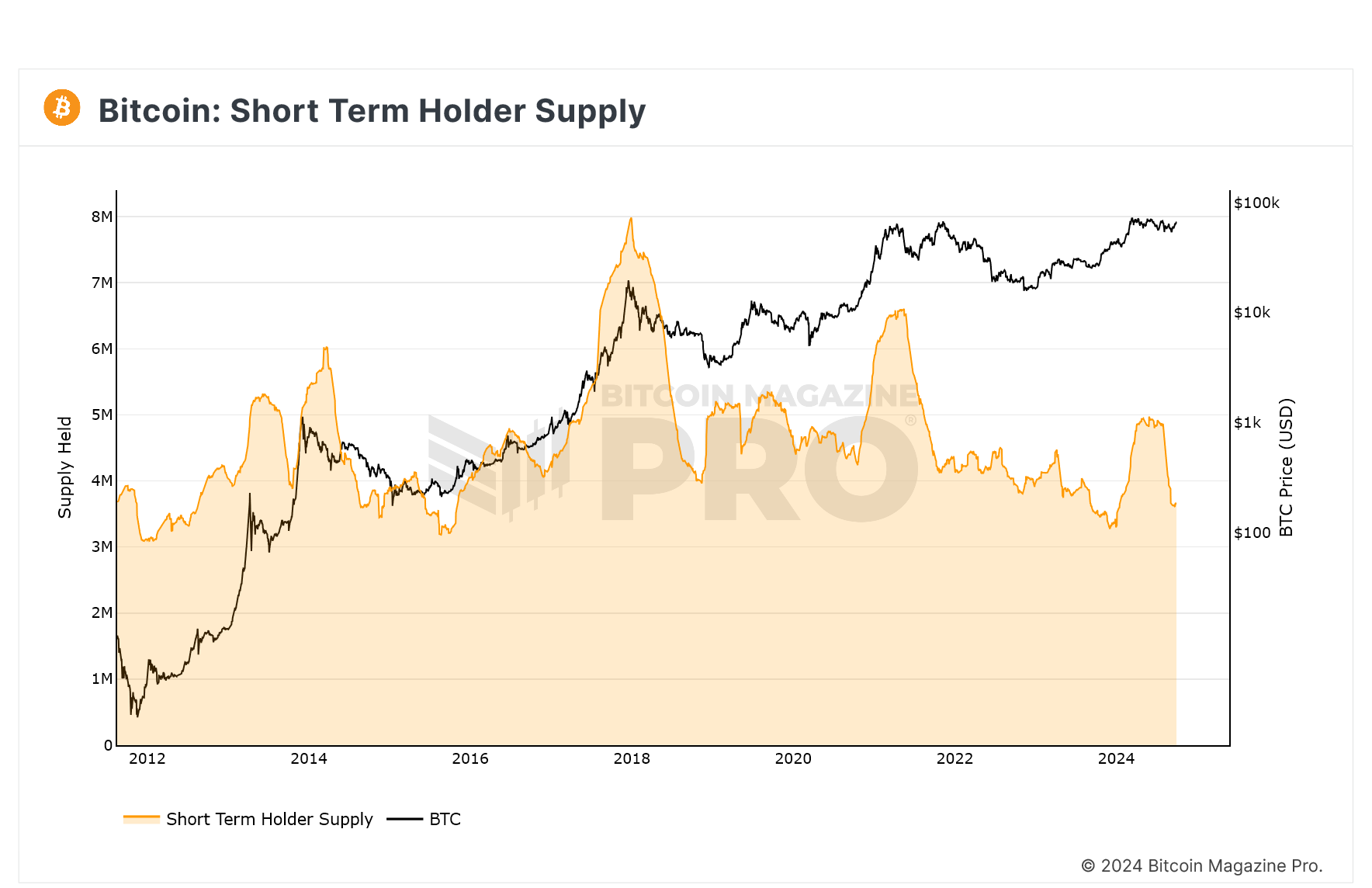

On-chain data shows short-term holder supply is also declining, indicating that retail investors are not yet piling in. Lower retail activity could indicate that Bitcoin’s rally may still have room to grow before hitting the top.

BTC: Short Term Holder Supply (Bitcoin Magazine)

Bitcoin’s price dropped by nearly 3% today as escalating tensions in the Middle East, particularly Israel’s airstrike on Beirut, sent shockwaves through global markets. In times of heightened geopolitical uncertainty, investors tend to seek safer assets like gold and government bonds, avoiding risky investments like crypto.

Additionally, US traders are preparing for key economic updates, including jobs data and Fed Chair Jerome Powell’s guidance on interest rates, delivered earlier today. Powell stressed that the Fed is not on a fixed path and will assess conditions as they evolve, with potential rate cuts depending on incoming data. With traders expecting a potential 25-basis-point rate cut, this cautious approach has left the market in limbo, contributing to the ongoing uncertainty.

Regardless of Bitcoin’s recent dip, the token is still set to close September with a 7% gain, its best performance since 2013, according to CoinGlass metrics. Historically, October has been a strong month for Bitcoin, earning the nickname “Uptober” due to its consistent positive returns.