- Bitcoin’s price is flirting with a break above the 200-day moving average and the 65k handle.

- However, downside risks persist, including profit-taking potential and concerns about Mt. Gox repayments impacting Bitcoin’s supply.

- Technically, a daily candle close above the 200-day MA and 65k handle could trigger a bullish breakout, while a rejection might lead to a correction.

Bitcoin prices have held the high ground over the past 7 days flirting with a break of the 200-day MA and the psychological 65k handle. Acceptance above the 200-day MA could be a catalyst for further gains as ETF flows remain positive.

According to SoSoValue, the total daily net inflow for BTC ETFs surpassed $100 million for the second consecutive day, marking a five-day streak of positive net inflows for these funds.

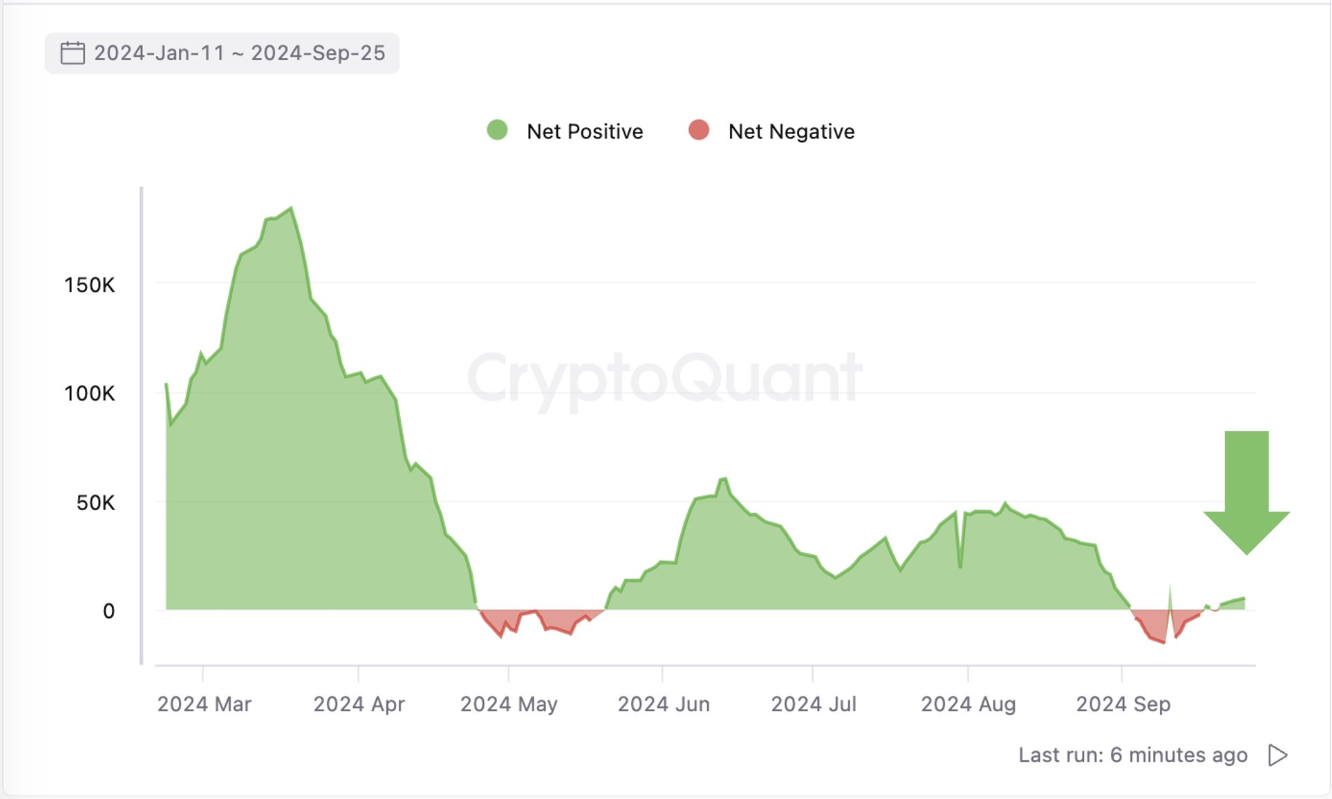

Data from CryptoQuant reveals that this has turned the 30-day net holdings indicator for ETFs positive for the first time in September, indicating a growing trend of accumulation rather than sales.

Source: CryptoQuant

Optimism continues to grow that the world’s largest cryptocurrency is ready for a bullish breakout as global Central Banks step up policy easing. Will a break above the 65k handle improve market sentiment and propel Bitcoin back above the 70k threshold?

Downside Risks – Profit Taking and Mt. Gox Still in Focus

As much as optimism has risen, this would not be the first attempt to break above crucial resistance areas in the last few weeks. Previous attempts have been futile, will this attempt be any different?

My main concern is profit taking with Bitcoin’s Unspent Transaction Outputs (UTXOs) showing 84% profitability if price languishes above the $63800 handle. An increase in UTXO is usually seen as a sign of improving investor confidence.

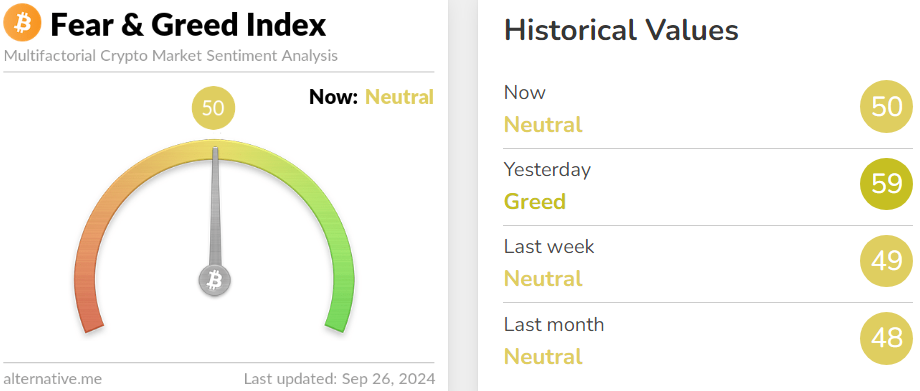

Looking at the crypto fear and greed index, however, the story is a bit different. The index dropped around 10 points from yesterday to languish in neutral territory.

Source: FinancialJuice

Failure to push on and break above the 65k handle may see some short-term speculators cash in and look to enter on a pullback which could lead to a correction and scupper attempts at a run toward the 70k handle.

Mt Gox Repayments Back in Focus

Mt Gox repayments are back in focus this week as the wallet appears to have shown signs of movement. On Wednesday the bust crypto exchange emptied four of their wallets after receiving funds from the Kraken exchange.

Arkham Intelligence asking the correct question, does this mean more repayments are on their way soon? The Mt Gox wallets hold 44,899 BTC worth $2.85 billion with any significant repayments likely to stoke concern of an oversupply as creditors look to sell their Bitcoin. Such a move could exert downward pressure on Bitcoin prices and are definitely worth monitoring.

Technical Analysis BTC/USD

Bitcoin is currently trading around 3.5% up on the day and above the psychological 65k handle. A daily candle close above the 200-day MA and 65k handle may embolden bulls and be the catalyst for a push higher.

A close above the 65350 handle may open up a clear run toward resistance at 68350 before the 70000 handle comes into focus. There is a descending trendline around the 70000 mark which could prove a stubborn hurdle but beyond that a clear run to the all-time high is a real possibility.

Given the downside risks present, let’s take a look at the alternative. A rejection of the 200-day MA and a return of selling pressure could lead Bitcoin back toward support at the 100-day MA languishing at 61000. The area between the 100 and 50-day MA at 59900 is a key area of confluence and support and could keep any attempted push lower at bay. This area could form the base for a move beyond the all-time highs if it is able to hold firm.

Bitcoin (BTC/USD) Daily Chart, September 26, 2024

Source: TradingView.com

Support

- 61000

- 59900

- 58000

Resistance

- 65350

- 68350

- 70000