- Bitcoin prices are currently range-bound, the range between 56,561 and 61,750 is keeping both buyers and sellers cautious.

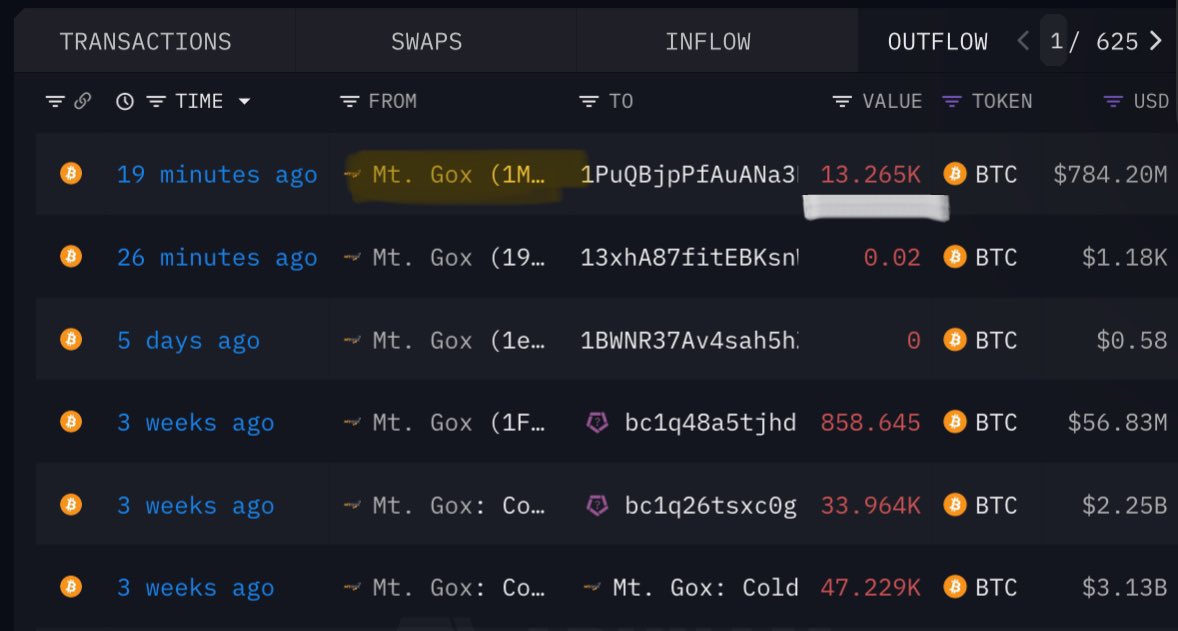

- Mt. Gox moved 13,265 Bitcoins totaling an estimated $780 million. The first major move by the bankrupt exchange since July 30.

- According to research by investment firm River, 60% of the largest hedge funds in the U.S. have exposure to Bitcoin ETFs.

Despite the recent bounce, Bitcoin prices continue to trade sideways in the longer-term view as the range high held yesterday before prices slid. The $61,600 range high is holding firm but yesterday saw Bitcoin fail at the 50-day MA, languishing around $61,400.

Yesterday, news broke that Mt.Gox had made its first major move in 3 weeks. The bankrupt former exchange moved a total of 13265 Bitcoins, with an estimated value of around $780 million.

Source: x.com/HODL15Capital/ , On Chain Data

The move could be a precursor to Mt.Gox continuing its repayments to creditors. Mt.Gox had already moved 47229 Bitcoin on July 30th.In a move that has surprised some, Mt. Gox creditors have held onto their Bitcoin instead of selling it.

Bitpanda’s deputy CEO, Lukas Enzersdorfer-Konrad, told Cointelegraph earlier this August that it’s important to remember Mt. Gox was one of the first exchanges. This means its users were among the early adopters of Bitcoin and thus believe in the technology. This could in part explain why they are refusing to sell the world’s largest cryptocurrency.

Bitcoin is trading up around 0.6% on the day but these developments are likely to keep downward pressure on the price of BTC/USD.

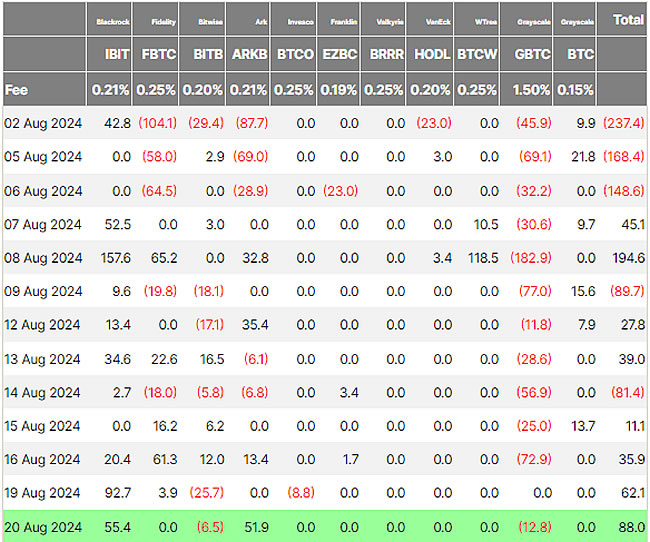

Spot Bitcoin ETF Flows

U.S. spot Bitcoin ETFs have had more money coming in than going out for eight of the last ten trading days.

On August 20, these ETFs received $88 million, which is the most they’ve gotten in two weeks, according to early data from Farside Investors.

Source: Farside Investors

According to a recent report by Sam Baker, Researcher at Investment Firm River, 60% of the largest hedge funds in the United States have exposure to Bitcoin ETFs. This is big for Bitcoin and could explain why despite the massive selloff early in August prices have recovered some sense of stability.

There is a theory that with more institutional adoption Bitcoin may lose some of its volatility, however, the drop in early August suggests this may be somewhat misguided. I guess time will tell where this one is concerned.

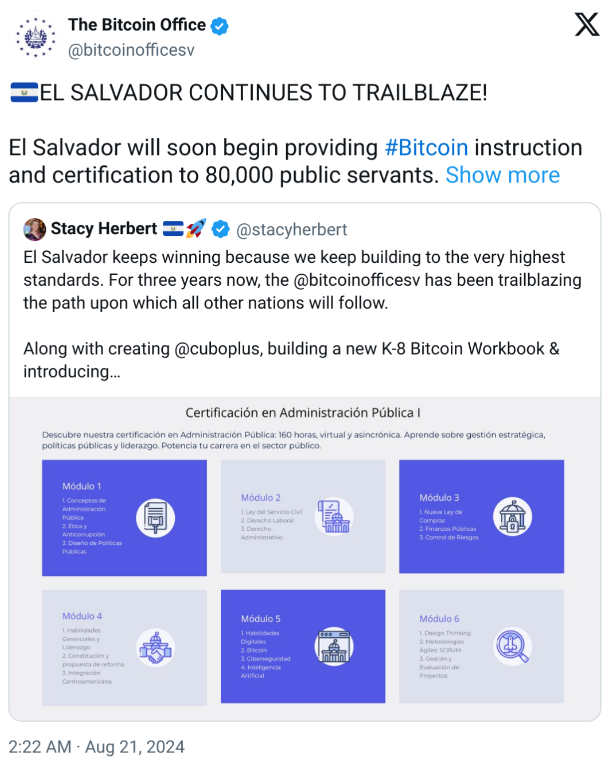

El Salvador Continues to Innovate

El Salvador’s National Bitcoin Office (ONBTC) is offering Bitcoin training and certifications to 80,000 government workers. The country has started this program to teach public employees about managing and creating policies for Bitcoin.

The training, called Certification in Public Administration 1, lasts 160 hours and is done online. It’s divided into seven parts, each covering different concepts, laws, skills, and management for using Bitcoin as legal money.

Source: X/Bitcoin Office

This follows El Salvador giving transparency a new meaning earlier this year. The Country launched its own proof-of-reserves website which provides real-time data of the countries Bitcoin reserves.

As the week progresses, we do have the FOMC minutes this evening which could provide markets with a shot in the arm and stir up some volatility. Markets are a bit calm at the moment as Jackson Hole beckons with all eyes on Federal Reserve Chair Jerome Powell.

Market participants will be looking for more cues regarding the rate path of the Federal Reserve moving forward and this could have an impact on riskier assets such as Bitcoin

Technical Analysis BTC/USD

From a technical perspective, Bitcoin is currently stuck in a price range, with a recent dip almost breaking out but not succeeding. The range between 56,561 and 61,750 is keeping both buyers and sellers cautious.

The longer Bitcoin stays in this range, the more likely a strong breakout will happen, although it’s uncertain which direction it will take.

Some crypto enthusiasts are predicting a bullish breakout, with some even suggesting a rise to 100,000, though that seems unlikely at this point.

In the short term, resistance is at 60,000, with more challenges at the 50-day moving average and range high around 61,750. Beyond that, there are additional hurdles at the 200 and 100-day moving averages at 62,917 and 63,870 before buyers can take full control.

Support

- 58500

- 56561

- 54000

Resistance

- 60000

- 61750

- 62917

Bitcoin Technical View

Source: TradingView.com