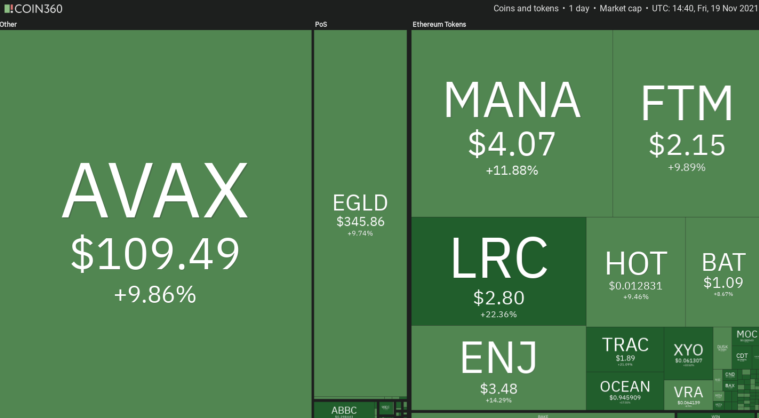

Bitcoin and Ethereum look primed to rebound after reaching crucial support levels. Bitcoin and Ethereum have faced substantial price drops over the last nine days. While investors are showing signs of fear, one indicator suggests that a significant rebound is underway. Volatility has struck back the cryptocurrency market, sending many investors into a state of “fear” for the first time since September. Bitcoin crashed below $60,000 Wednesday, helping cause more than $600 million worth of long position liquidations over the past four days. The downswing spilled across the entire cryptocurrency market and generated significant losses. Still, many lower cap assets shrugged off the uncertainty. Several Metaverse tokens, including Decentraland’s MANA, Enjin Coin’s ENJ, and The Sandbox’s SAND, have fully recovered from the recent pullback and are showing bullish momentum. Meanwhile, Elrond’s EGLD and Avalanche’s AVAX recently reached new all-time highs. While Bitcoin and Ethereum have been in recline this week, lower cap assets are in the spotlight. Nonetheless, a technical indicator flashing a buy signal for the two leading crypto assets suggests that they could soon catch up with the rest of the market. The bullish formation anticipates a swift rebound that could put the bears under pressure. The Tom Demark (TD) Sequential indicator has presented a buy signal on both Bitcoin’s and Ethereum’s 12-hour charts. The bullish pattern came after both cryptocurrencies saw their market valuation drop by more than 18% since Nov. 10. Now, the TD forecasts that BTC and ETH could enter a one to four 12-hour candlestick upswing before the downtrend resumes. A spike in buying pressure that pushes Bitcoin above $58,500 could send prices to the 100-twelve-hour moving average at $60,000. A sustained 12-hour candlestick close above resistance level could extend the rebound toward the 50-twelve-hour moving average at $62,300. Likewise, Ethereum needs to overcome the $4,300 resistance level to advance toward the 50-twelve-hour moving average at $4,500. If it overcomes this hurdle, ETH could advance to $4,653. It is worth noting that Bitcoin and Ethereum must hold above their respective swing lows to avoid further losses. If BTC breaks below $55,600 and ETH loses $3,960 as support, the downtrend could be primed to resume. Bitcoin could fall to $52,000, while Ethereum could drop to $3,700. Key Takeaways

Lower Caps Bounce Back

Bitcoin, Ethereum Present Buy Signal

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin, Ethereum Trail While Market Picks Up

Published 11/21/2021, 01:56 AM

Bitcoin, Ethereum Trail While Market Picks Up

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.