Bitcoin and Ethereum were holding on a pivotal point on their trends that could lead to rebound or capitulation.

Key Takeaways

- Bitcoin and Ethereum have lost more than 50% in market value since late November.

- Multiple on-chain metrics showed that both assets have reached a strong foothold.

- Still, buy orders must increase rapidly to allow BTC and ETH to rebound.

Bitcoin and Ethereum appeared to have reached a critical support level following a major market correction. Although the downtrend may not be over, there were reasons to believe that a relief rally was underway.

Bitcoin Readies To Rebound

Bitcoin looked primed to bounce off support after incurring significant losses.

The flagship cryptocurrency has been in a downtrend for the last three months, shedding more than 35,000 points in market value. The sell-off has pushed prices below the psychological $40,000 barrier. The asset took a plunge along with the rest of the market from Thursday through Saturday, before dipping further to hit a six-month low of $32,850 on Monday.

Although many demand walls have been broken on the way down, BTC appeared to have found stable support.

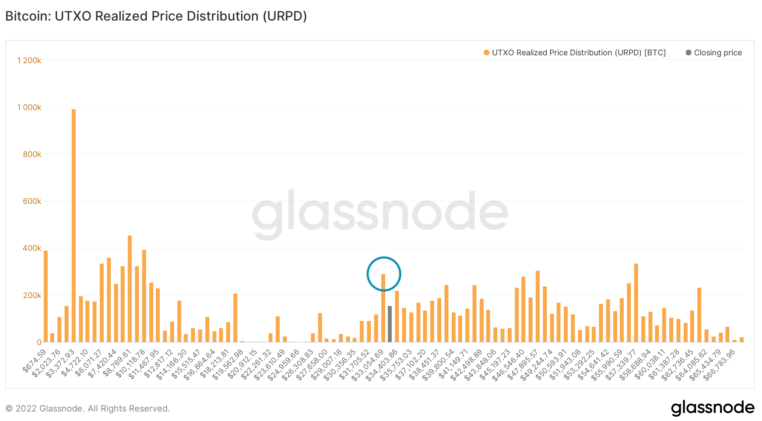

Glassnode’s UTXO Realized Price Distribution (URPD) model showed that a large concentration of BTC tokens was last moved around $33,000. Such market behavior made this price point one of the most significant support zones underneath the number one crypto.

If it were to continue to hold, Bitcoin could have a chance of rebounding.

The Tom DeMark (TD) Sequential indicator added credence to the optimistic outlook. At time of writing, it presented a buy signal on Bitcoin’s daily chart. The bullish formation developed as a red nine candlestick, which was indicative of a one to four daily candlesticks upswing.

A spike in buying pressure could help push BTC toward $40,000 or even $43,000.

It is worth noting that the URPD model also showed little to no support below $33,000. Breaching the critical area of demand could create a capitulation event that would result in further losses. Under such circumstances, Bitcoin could crash to $19,500—a key historical level not seen since December 2020.

Ethereum Finds Stable Support

Ethereum appeared to be forming a local bottom while the Crypto Fear & Greed Index showed that market participants are displaying signs of fear.

More than $640 million worth of long ETH positions have been liquidated across the board over the past week. As ETH plummeted 32%, overleveraged traders were among the hardest hit. Now, ETH appears to have found a strong foothold.

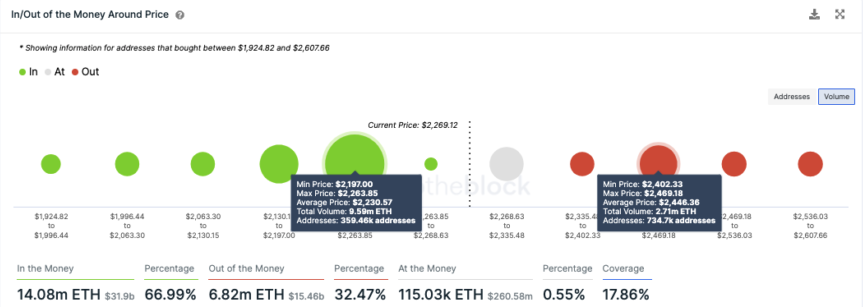

IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that nearly 360,000 addresses have purchased 9.6 million ETH around $2,200. This has created a significant demand wall that could prevent prices from dipping further and serve as a rebound zone.

The TD Sequential supported the bullish thesis as it was presenting a buy signal on Ethereum’s daily chart. The formation of a red nine candlestick was indicative of a one to four daily candlesticks upswing or the beginning of a new upwards countdown.

To validate the optimistic outlook, ETH would have to overcome the $2,500 resistance level to approach $3,000.

The $2,200 support level was a major one for ETH. Any signs of weakness could discourage investors from re-entering the market. In turn, this could result in a downswing to the next key level at $1,700—a level that ETH last saw as a local bottom in July 2021.