Key Takeaways

- Bitcoin fell below $62K due to escalating Middle East tensions.

- Market volatility continues as geopolitical and economic uncertainties persist.

Bitcoin’s value plummeted below $62K on Tuesday afternoon following news that Iran had launched a missile attack on Israel. At the time of reporting, BTC was trading around $62,200, down 1.4% in the last 24 hours as the conflict intensified, creating uncertainty in the global markets.

Traders who had been anticipating a bullish start to “Uptober” saw their hopes dashed as both crypto and stock markets plunged at market open.

Following Iran’s large-scale missile attack on Israel today, Bitcoin experienced a sharp selloff, pushing the token down to just below $61K. Although the price has since recovered to around $62K, the ongoing conflict between Israel and Iran continues to fuel uncertainty.

Analysts warn that Bitcoin may face further downward pressure and could retest the key support level of $60,000 if the situation escalates.

The selloff in Bitcoin and other crypto assets was driven largely by reports of escalating violence in the Middle East. Iran launched a barrage of missiles targeting major Israeli cities, including Tel Aviv, following threats of retaliation for recent Israeli strikes on Hezbollah forces. The Israel Defense Forces confirmed that all Israeli civilians had been ordered into bomb shelters as the attacks unfolded.

Adding to the tension, US President Joe Biden and Vice President Kamala Harris were reported to be in the White House Situation Room, ordering US Military forces across the Middle East to aid in the defense of Israel.

Bitcoin’s price quickly tumbled as investors fled from speculative assets. At press time, Bitcoin had recovered slightly but remained down roughly 2% over the past 24 hours. This volatility reflects the broader market uncertainty caused by the conflict, as investors seek safer assets like gold, which surged 1.2% to near-record highs.

In addition to geopolitical concerns, traders were booking profits ahead of the upcoming FOMC. Data from CoinGlass shows significant outflows from major tokens like Bitcoin, Ethereum, and Solana, with more sellers than buyers in the market.

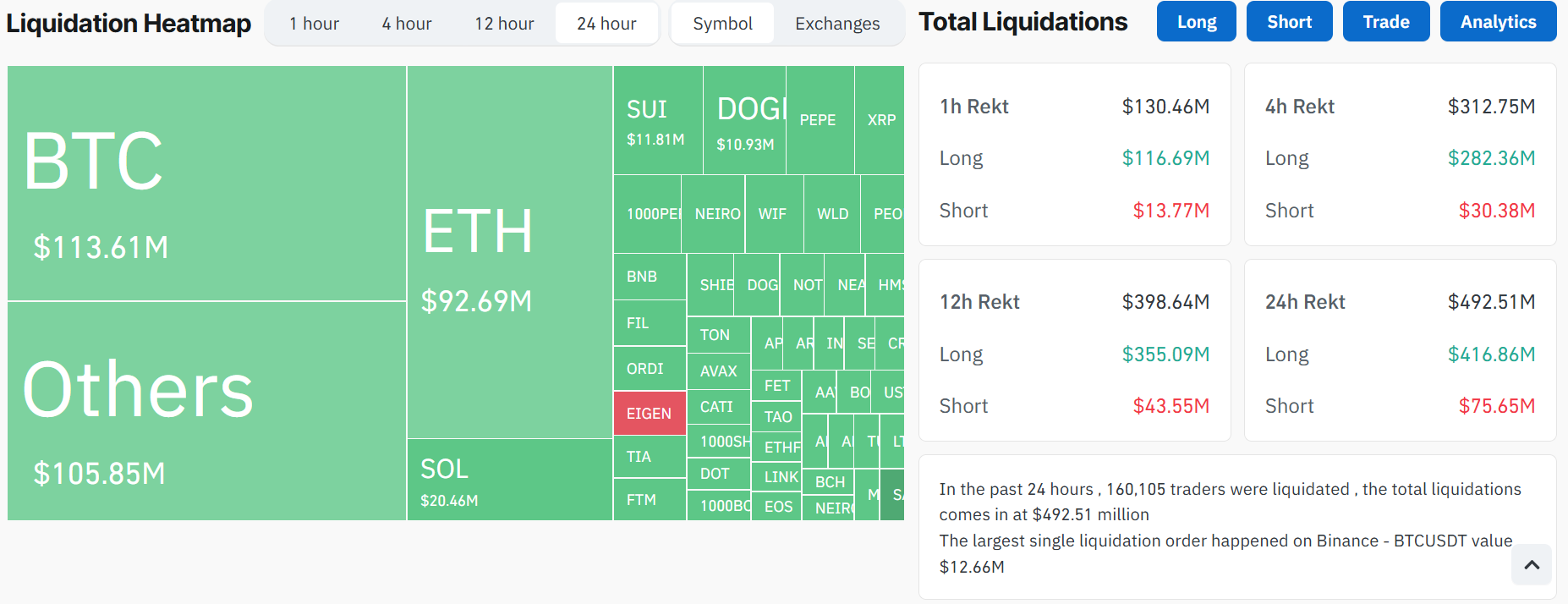

Over $481 million in liquidations were recorded, adding to the selling pressure. Ethereum saw over $92 million in liquidations, while Bitcoin positions worth $113 million were wiped out, marking the largest liquidation event since early September.

Crypto liquidation heatmap chart (Coinglass)

Bitcoin’s recent selloff mirrors similar declines seen in April and July when tensions in the Middle East caused crypto assets to fall. With the conflict ongoing and market volatility persisting, the likelihood of Bitcoin testing lower support levels, such as $60,000, remains high.

October is traditionally a strong month for Bitcoin, earning it the nickname “Uptober” for its consistent positive returns. However, with geopolitical tensions and key macroeconomic events like the FOMC meeting looming, market volatility is likely to continue.