When Bitcoin was trading at around $19,000 about two weeks ago, I wrote waiting for a pullback ideally “to $15,675-$16,500 target zone to complete an (irregular) flat 4th wave.” All we got was around $17,600, as the instrument is already back to making new all-time highs.

As said:

“Upside surprises and downside disappointments are the hallmarks of a bull market.”

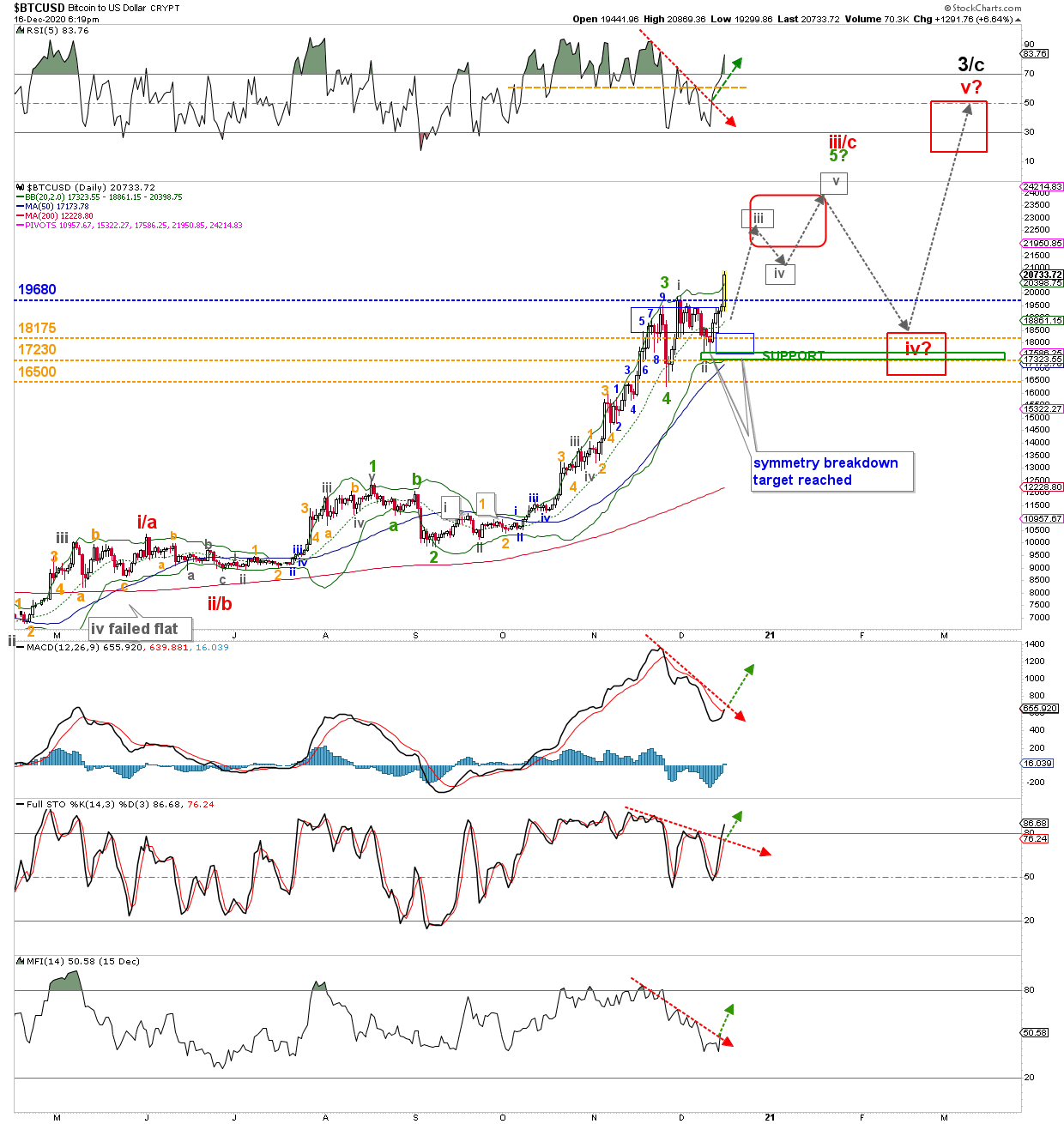

This means the recent dip to the $17,600s was, most likely, already (grey) minute wave-i of (green) minor wave-5. See Figure 1 below.

In my last article, I mentioned we could expect a “rally to the $21,700-23,700 target zone on a close above $19,680.” This rally is now under way.

Figure 1. Daily Bitcoin candlestick chart, with detailed EWP count

If the above-mentioned short-term Elliott Wave Principle (EWP) count is correct, then minute wave-v of minor-5 of (red) intermediate-iii/c should ideally reach almost exactly the upper end of the red target zone. Due to the recent price action, I had to adjust that zone slightly upwards to $23,900. The grey boxes are the 138.20-161.80% (iii), 100.00-76.40% (iv) and 176.40-200.00% (v) Fibonacci-extension of (grey) minute wave-i, measured from (grey) minute wave-ii. The grey arrows show the preferred path going forward in price for the next few days, weeks, and months.

Thus, albeit BTC did not get as low as I anticipated; I was off by 6.7%, which is not good enough by my standards, the recent “dip” in BTC was nonetheless a great buying opportunity. It should now be on its way to $23,700+.

For those who have followed me since I first became an author for Investing.com, you know I have been bullish on bitcoin and the Bitcoin Investment Trust (OTC:GBTC) since late-September. Back then, BTC was trading in the mid-$10,000s and GBTC in the $11,000s. Fast forward, and both have seen over 100% in appreciation since then. Thus, although I did not get every twist and turn correct, nobody can be right all the time; my bullish perspective was proper and is my view until proven otherwise. In combination with classic technical analyses, the EWP has been beneficial and profitable for my premium members, hedge fund clients, and my own portfolio. We have not had a losing trade in GBTC since. I hope for you too.

And like I said in my previous update, “Longer term, the rally in BTC has still a long way to go if downside/support levels hold.” In this case, support is now at $19,680.