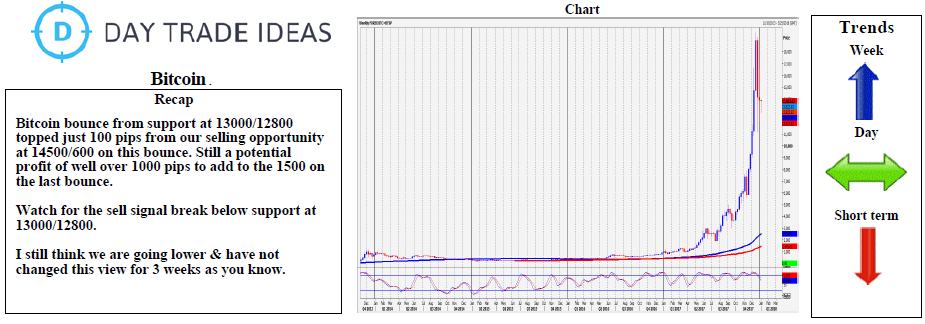

Bitcoin lower as expected from our selling opportunity at 14500/600, to hit support at 13000/12800. A break below 12800 is another negative signal and looks increasingly imminent – sell into shorts and look for 12600/500, 12300 and 2 week lows at 12050 before the 3 week low at 11160. Do not be surprised if we break this level on the next test.

Holding support at 13000/12800 allows a recovery to 13400, perhaps as far as 13800/900. Gains are likely to be limited but above here look for a selling opportunity at 14500/600. Stop above 15000 but only above strong resistance at 15400/500 is less negative. Bulls require a break above 16400/500 for the bull trend to resume. It would be encouraging above the recovery high of 17300 of course and allows a further recovery towards the all time high at 19550/666. However we still have double top risk here. Longs could panic out on the way to this resistance, seeing this as their last chance before a collapse. Bulls need a clean break above 20,000.