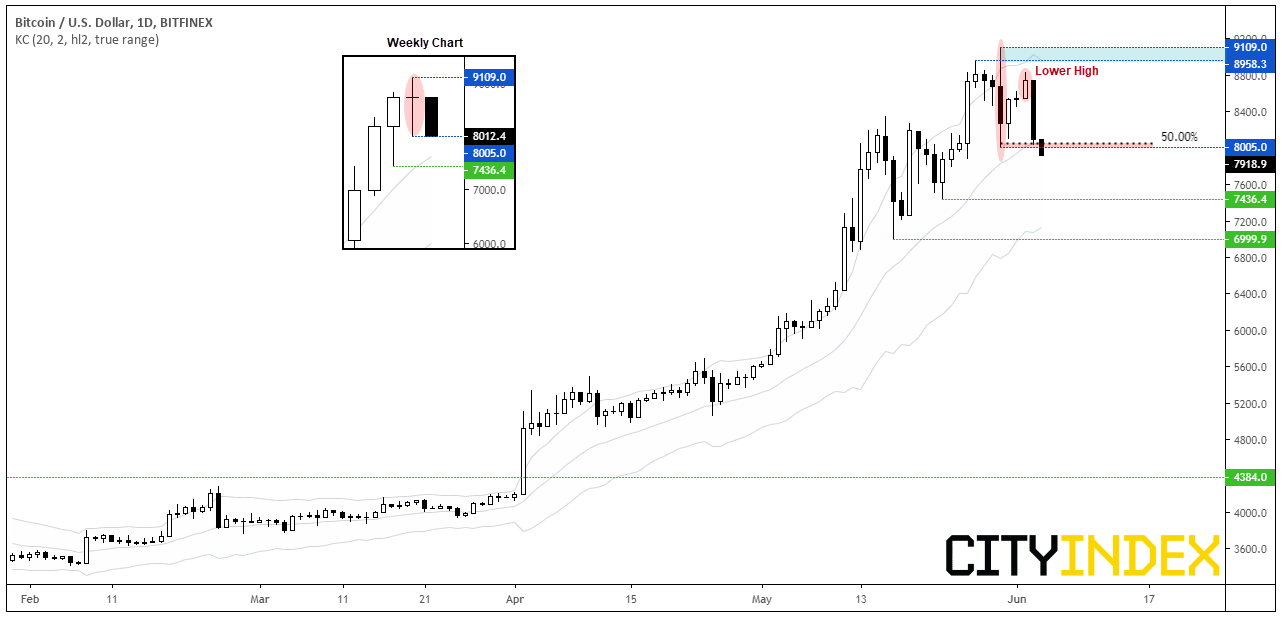

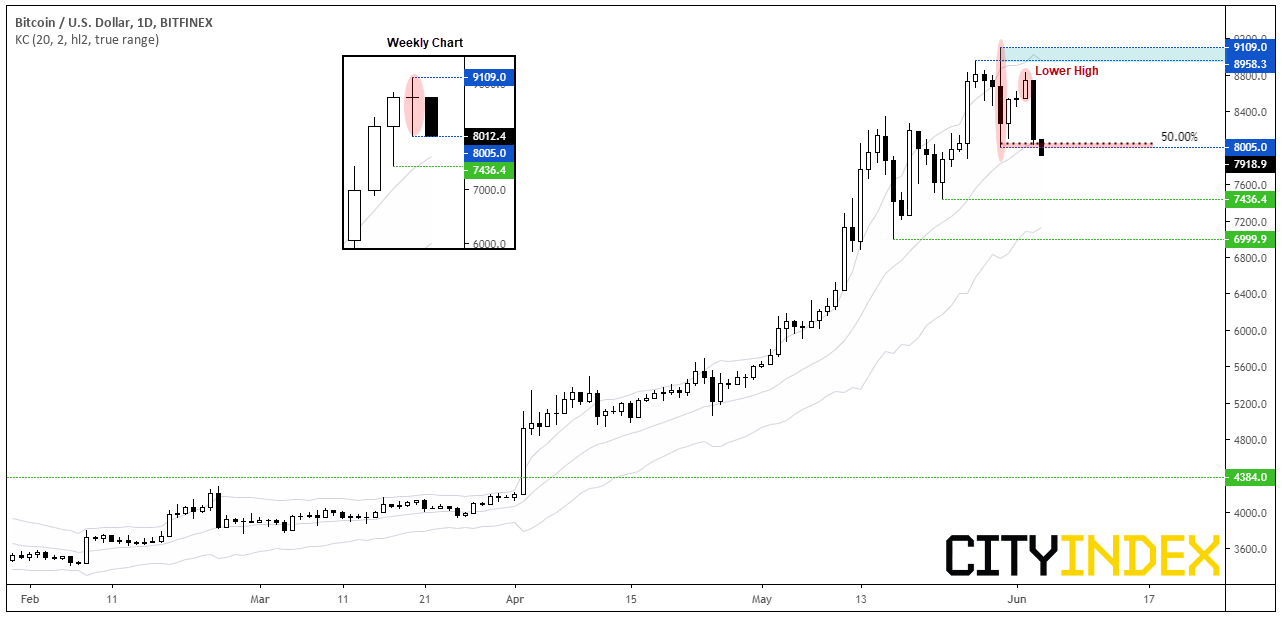

Bitcoin’s shakeout at the highs continues after tumbling over 8% in early Asia. Over 5% of which was shed within 30 minutes.

Thursday’s bearish engulfing candle served as a warning all was not well at the highs, and it invalidated earlier analysis for $8.5K to remain supported ahead of another next leg higher. Furthermore, today’s plunge places a lower high at $8,825 to suggest we’re on for a deeper correction against the dominant trend.

$8K is a key level to monitor and we’ve just seen an intraday break beneath it. The area houses several technical levels, including the 20-day EMA, 50% retracement level and bearish engulfing low. Moreover, last week’s Rikshaw Man Doji outside of the upper Keltner band is a sign of exhaustion, and a clear break beneath $8K confirms a near-term reversal to pave the way for mean reversion.

The break of the four-hour trendline ahead of the break below $8K is a positive sign for bears. However, we’d expect some noise around this key level, so bears could wait to see if $8K turns into resistance or fade into rally towards the broken trendline. Downside targets include the $7,436 and $7,000 lows, although we’d also look for signs of bearish exhaustion around these key levels to signal a potential base. Until then, momentum points lower.