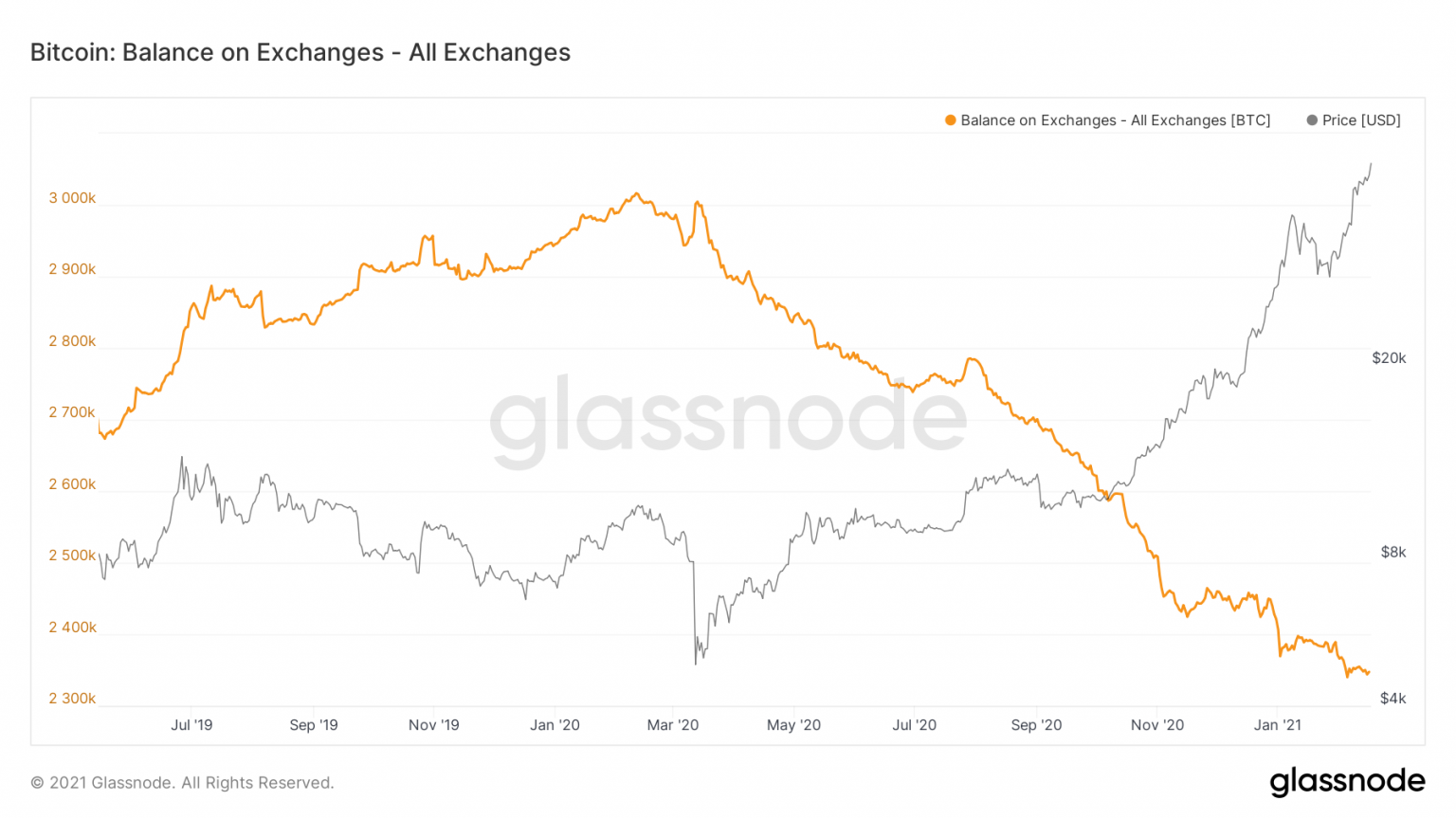

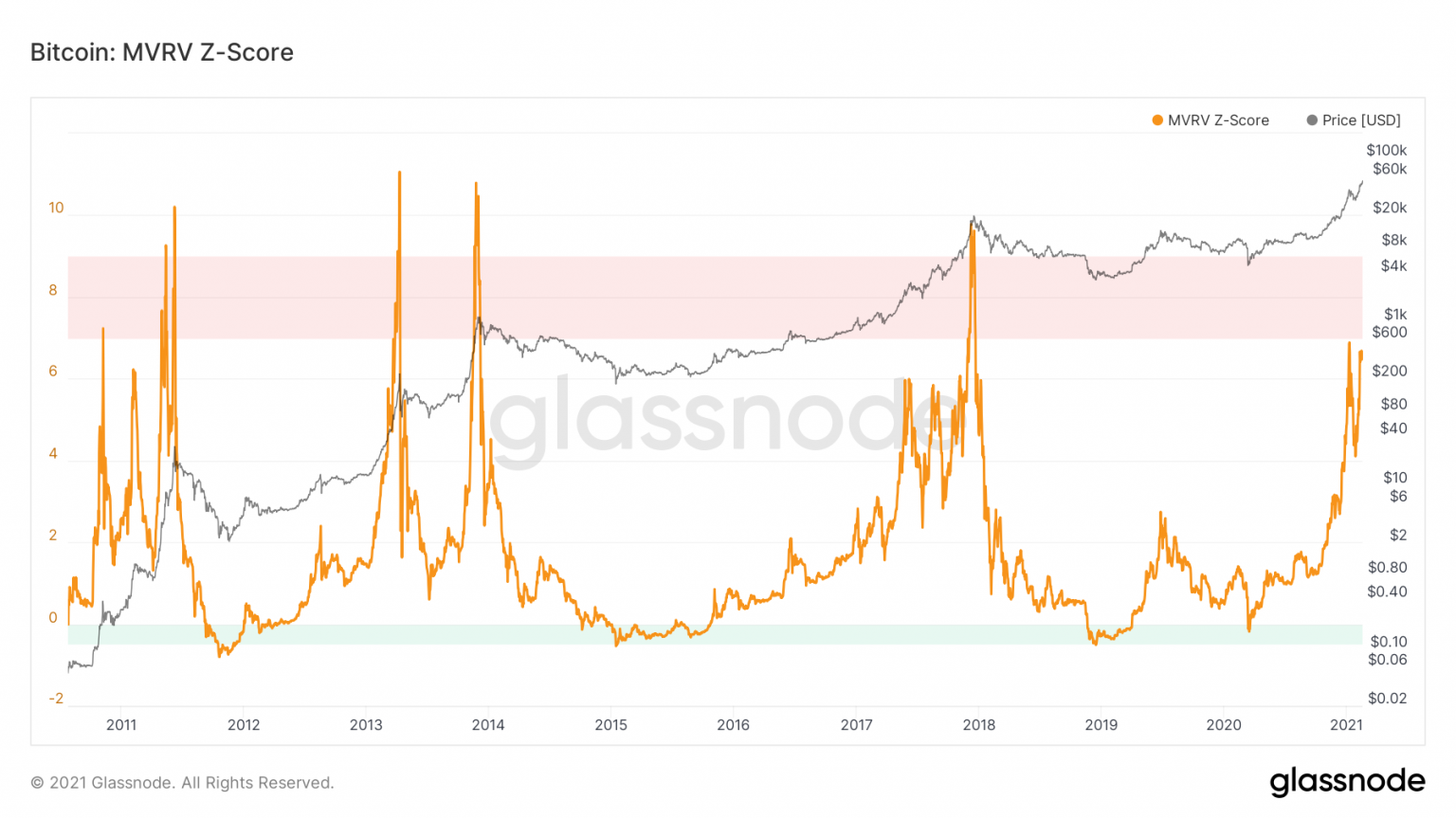

Bitcoin looks unstoppable as on-chain metrics suggest that a significant correction is nowhere near. After a year-to-date return of over 80%, some analysts warn that Bitcoin is approaching overbought territory. Still, a particular on-chain metric suggests that BTC is primed for another massive rise. Bitcoin’s market value has risen by nearly 60% since the beginning of the month. BTC was recently able to reach a new all-time high of $52,800 as a new wave of retail investors flocked to the coin. More than 20,000 new addresses have joined BTC’s network each day over the past five weeks, signaling a spike in user adoption. It appears that Tesla’s $1.5 billion Bitcoin investment put Bitcoin in the spotlight as trust in the global financial system erodes. Despite the massive gains that BTC has posted over the past month, some analysts believe that a major correction is underway. JP Morgan’s Global Market Strategist Nikolaos Panigirtzoglou has suggested that Bitcoin “looks unsustainable” at the current price levels. Panigirtzoglou maintains that an inelastic supply of Bitcoin led to a price premium for both “real money” and “speculative” investors, while retail interest dwarfing the institutional inflows. For this reason, the analyst expects that volatility would need to decrease to sustain the recent upswing. Despite the grim worst-case scenario, Bitcoin looks fundamentally strong. Whales have entered a buying spree, depleting the amount of Bitcoin available on exchanges and trading platforms. Market behavior of this type reduces the selling pressure behind the cryptocurrency, consequently capping its downside potential. Additionally, the MVRV Z-Score suggests that Bitcoin has plenty of room to go up before it reaches overbought territory. This fundamental metric represents the ratio between the difference of Bitcoin’s market capitalization and realized capitalization and the standard deviation of market capitalization. Each time this on-chain index rose above a value of 9 over the past ten years, it served as a sell signal leading to a steep correction. For instance, the MVRV Z-Score rose to a high of 9.80 in mid-December 2017 when Bitcoin peaked at nearly $20,000. Following this milestone, Bitcoin prices suffered an 84% correction while the MVRV Z-Score was able to reset. Now that Bitcoin is trading at a record high, the MVRV Z-Score is hovering at a value of 6.60. If this indicator proves to be as accurate as it was in previous instances, BTC could climb another $10,000 to $20,000 before the market becomes overheated. Technical analyst Philip Swift believes that the ongoing bullish cycle may look similar to the one in 2013, when Bitcoin hit the MVRV Z-Score’s red zone twice before a significant retracement occurred. Swift maintains that BTC could even reach three local tops during this cycle before it enters a meaningful corrective period. Key Takeaways

Market Value Up By 60%

Bitcoin Looks “Unsustainable”

Plenty of Room to Go Up

Next Cycle May Look Like 2013

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Could Rise $20,000 Prior To Overbought Territory

Published 02/18/2021, 01:20 AM

Bitcoin Could Rise $20,000 Prior To Overbought Territory

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.