A new report from crypto research firm K33 Research suggests that Bitcoin could hit the $45,000 mark by May. The report argues that BTC’s current drawdown and recovery cycle is very similar to the one seen during the 2018 bear market in terms of length and trajectory.

Are We Living Through a Repeat of the 2018 BTC Cycle?

Historically, Bitcoin market cycles, which include the periodic rise and fall in the flagship cryptocurrency’s price, have repeated themselves to varying degrees. This has convinced some analysts to study previous cycles and compare them to the current price of Bitcoin to get an approximate idea of how the cryptocurrency might perform.

For this reason, researchers at K33 have recently compared the current BTC price cycle to the 2018 cycle. While there is no 1:1 correlation between the two cycles, the similarities are striking, K33 said in a research report last week.

The bottoms lasted for around 370 days in both cases, and the peak-to-trough drawdown returned around 60% after 510 days. The only significant difference was that the peak-to-trough drawdown was more severe in 2018 than last year.

The price of Bitcoin dropped 84% in 2018, bottoming near $3,100 in December of that year. The trend changed in the subsequent months, with prices climbing to $3,700 by the start of 2019 and rising as high as $13,800 by the end of June.

“While history is far from likely to repeat in a similar fashion if the fractal were to continue – BTC would peak around May 20 at $45,000.”

Long-Term Bitcoin Holders Refuse to Sell

The report noted that committed long-term holders are driving the current accumulation phase of BTC. These holders are unwilling to sell despite the recent fluctuations and market downturn, using these times to accumulate more BTC.

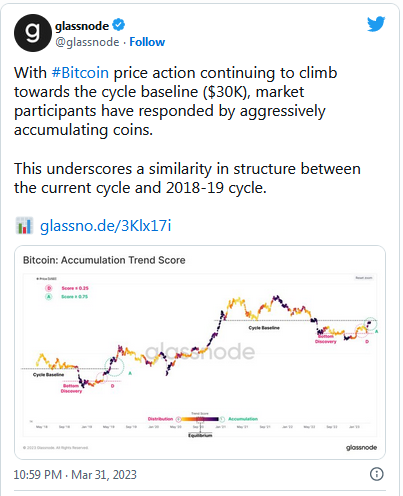

Earlier this month, on-chain analytics firm Glassnode also revealed that investors have shifted towards aggressively accumulating BTC as the flagship cryptocurrency climbs toward $30,000. The company argued that the BTC accumulation might help sustain the rally longer.

Last week, Bitcoin finally surged past the $30,000 level for the first time since June 10, 2022. The rally came as investors have become more optimistic about US central bank monetary policy and expectations of more accessible monetary policies gather momentum.

When writing, the flagship cryptocurrency is trading at around $30,000, almost flat over the past day. The coin is up by more than 7% over the 14 days and 10% over the past month, data by CoinGecko shows. However, it is still down by 56% compared to its all-time high of $69,000 registered in November 2021.

The K33 research report argued that the early 2023 rally has all the hallmarks of a “hated rally,” where investors feel underexposed after a highly traumatic year of de-risking in anticipation of further downside. “The hated rally of 2019 ended with a significant blow-off top before BTC resumed trading at a 40-60% drawdown from its 2017 ATH.”

The report concluded that if the pattern continues, BTC could hit $45,000 by May 20. While this is an estimated target, the current landscape bodes well for those who have accumulated BTC during the recent market downturn.

***

Neither the author, Ruholamin Haqshanas, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

Disclaimer: This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.