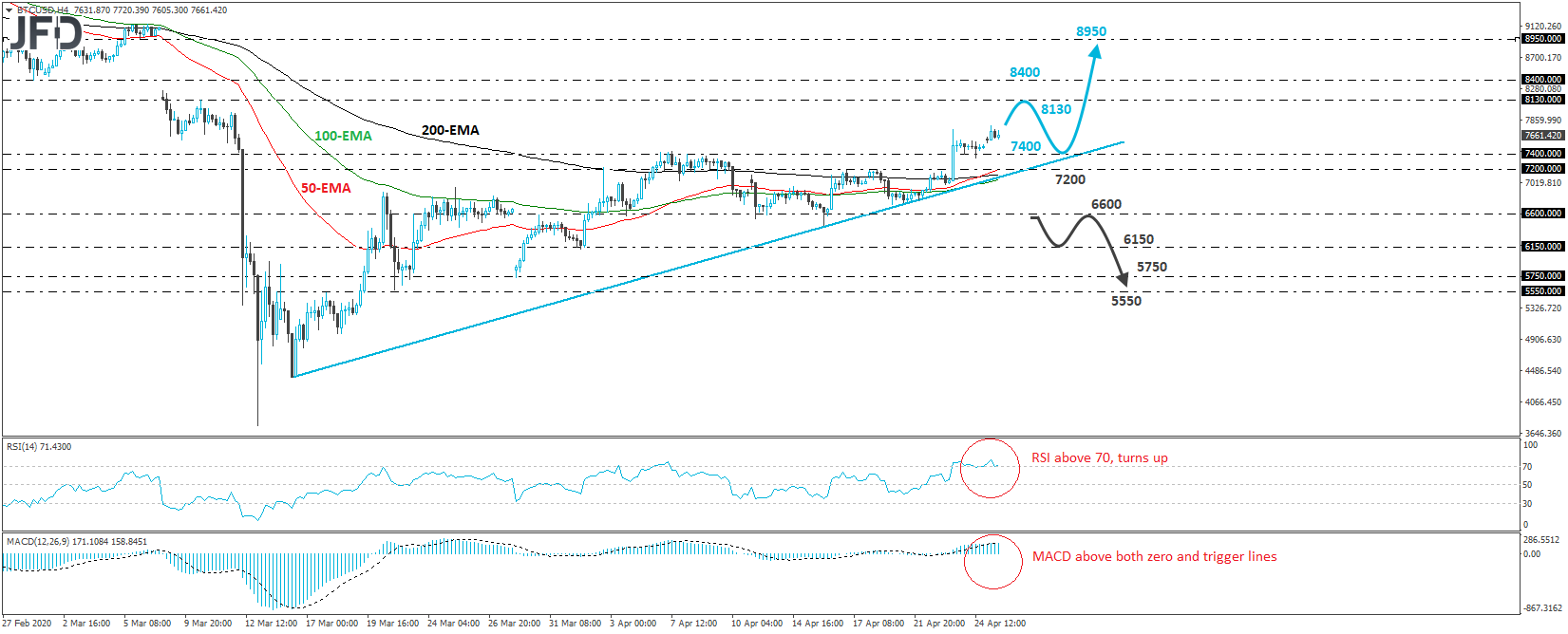

BTC/USD rallied on Thursday, breaking above the 7400 barrier, thereby confirming a forthcoming higher high. Overall, the crypto is trading above an upside support line drawn from the low of March 16th, and as long as this is the case, we will hold a positive stance.

If the bulls are willing to stay in the driver’s seat, we may see them challenging the 8130 territory soon, defined as a resistance by the peak of March 10th. That said, in order to get confident on larger advances, we would like to see a break above the 8400 zone, marked by the low of February 28th. Such a move may set the stage for upside extensions towards the 8950 obstacle, marked by the low of March 6th and the high of March 2nd.

Taking a look at our short-term oscillators, we see that the RSI, already within the above-70 zone, hit support near 70 and turned up again, while the MACD stands positive and has just turned up as well, crossing back above its trigger line. Both indicators detect strong upside speed and support the notion for some further near-term advances.

On the downside, a break below 7200 may also bring the price below the aforementioned upside line. However, we prefer to wait for a dip below 6600 before we start examining the case of a negative reversal. This would confirm a forthcoming lower low on the daily chart and may initially aim for the low of April 1st, at around 6150. Another dip, below 6150, may encourage the bears to dive towards the 5750 zone, marked by the low of March 29th, or the 5550 area, defined by the low of March 20th.