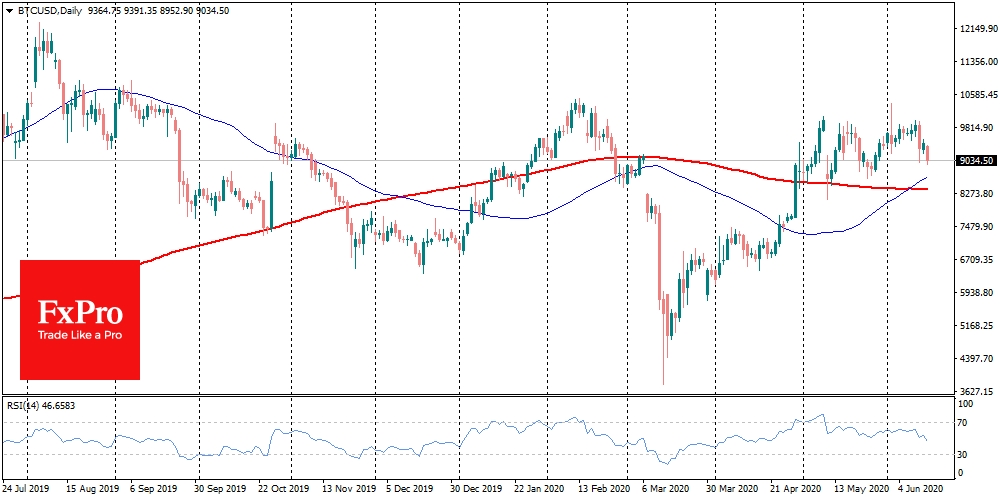

Bitcoin broke the support at $9,400, which opened the door for further decline. After diving below $9K, buyers immediately supported the coin, pushing it back towards $9,200. Although this fact indicates the market support, still the situation remains very shaky, also due to the increasing pressure in the traditional market. Bitcoin may fall under the general wave of risk assets sales, and in this case, the support of retail investors is weaker than institutional pressure.

Over the week, Bitcoin showed a decline of 7%, while altcoins suffer even worse. Due to significantly lower market liquidity, alternative cryptocurrencies are more exposed to pressure in any direction and rarely demonstrate independent price dynamics. The TOP-10 altcoins for the week show a decline of 9-17%. The total capitalization of the digital currencies declined by almost $17 billion over the week.

Fears about the second wave of the epidemic, the collapse of the stock market and the protracted depression in almost all sectors of the economy will outweigh hopes for the growth of digital currencies due to extremely soft central bank policies and technical factors, including halving.

Although buyers supported Bitcoin on the decline below $9K, this does not mean that bears won’t try to push the coin again anytime soon. If the perfect storm is formed in the traditional market, we can see the collapse of the crypto in the same style as in March. At the end of last week analytical resources reported on the movement of Bitcoins worth $1.24 billion by an unknown whale. Such events may precede the strengthening of price dynamics on either side and in this case, there are signs of downward pressure.

At this stage, the sentiment of the participants is so fragile that Nassim Taleb’s post about the closure of his Coinbase account was enough to provoke a withdrawal of the 22K BTC (more than $200 million) from an exchange. A crypto card-castle is usually much more fragile than its “senior colleagues”. However, as always, the larger the decrease, the more opportunities to enter. No matter how the investment environment changes, the most advantageous moment for buying is still when “the markets are bleeding”.

The FxPro Analyst Team

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Caves Under Pressure Of Institutional Investors

Published 06/15/2020, 09:36 AM

Updated 03/21/2024, 07:45 AM

Bitcoin Caves Under Pressure Of Institutional Investors

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.