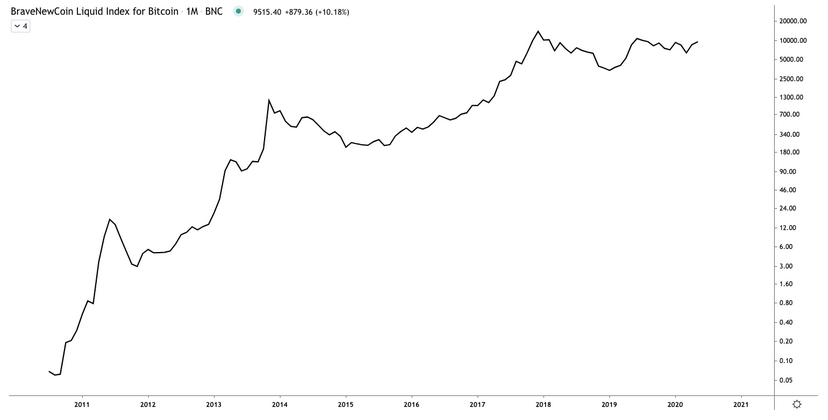

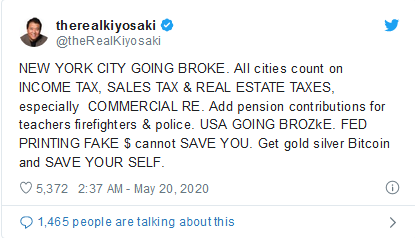

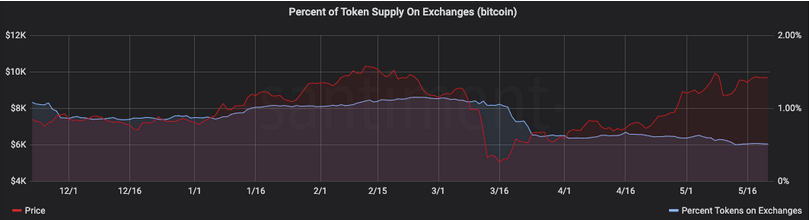

Electric Capital recently released a report outlining the most prominent features of a true store of value. Alongside the U.S. dollar and gold, Bitcoin is building a strong case. In an investor update, Electric Capital laid out a framework for determining if an asset is a store of value. Bitcoin meets all the criteria laid out and could become the foremost store of value as the global economy falls into a rut, according to the firm. Bitcoin is primarily used as a hedge against expansive money printing. As a result, believers have deemed it to be a store of value, and BTC’s long-term price movement strengthens this thesis. Due to its limited history and price volatility, however, Bitcoin has yet to prove this thesis in black and white terms. Three vital factors stand between an asset and its conquest to become a globally accepted store of value, according to Electric Capital. They include utility, trust, and adoption. Bitcoin is on its way to checking off these three criteria. A fundamental use case that provides benefit to a group of people is what gives an asset utility. Bitcoin’s utility lies in its ability to facilitate censorship-resistant payments. Trust refers to a belief that the store of value will continue to provide utility in the future. In this regard, trust means that most market participants believe that Bitcoin will be an essential part of the future. Finally, adoption is self-explanatory, and it represents the most critical objective for Bitcoin. Adoption will bring Bitcoin to a large number of people and will help it evolve from an experiment to serious economic innovation. Together, these three criteria make or break whether an asset is a store of value. Currently, the most dominant stores of value are the dollar and gold. While residents of the United States may disagree about the dollar preserving purchasing power, the rest of the world – whose currencies steadily depreciate against the dollar – begs to differ. Gold, too, has been an excellent store of value over the last century. But these two assets and their place as leading stores of value are under threat as the perfect storm brews for Bitcoin. A collapse of trust in governments and increased awareness of how cryptographic systems eliminate the need for trust could be the primary catalyst for Bitcoin gaining global recognition. The digital asset’s utility lies in its ability to facilitate the exchange of goods and services without trusting a central authority. No entity can be stopped from using Bitcoin or prevent anybody else from using it. Bitcoin has established utility, evident from its prominence in regions run by authoritarian governments. Governments and corporations alike have registered excessive amounts of debt. At this point, a global debt crisis seems to be a question of “when” rather than “if.” As a result, there is trust in Bitcoin’s longevity, and its propensity to serve as an economic hedge. The final frontier for Bitcoin is to establish adoption. In recent months, there has been an uptick in capital inflows to Bitcoin. Notable personalities in the legion of finance, including Paul Tudor Jones and Robert Kiyosaki, have advocated for portfolio allocations to BTC. But not every major investor publicly announces their investment like Jones or Kiyosaki. One can imagine several high net-worth investors finally see a clear reason to invest in BTC. Bitcoin already has demonstrable utility, while public trust and adoption are growing by the day. The case for BTC to become a store of value was strong before the COVID-19 pandemic, but current economic conditions are amplifying its value proposition.Key Takeaways

What Determines a Store of Value?

How Bitcoin Becomes a Global Store of Value

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Bitcoin Building A Strong Case As Gold-Like Store Of Value

Published 05/21/2020, 07:00 AM

Bitcoin Building A Strong Case As Gold-Like Store Of Value

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.