Bitcoin prices plunged as February 2018 began, even breaking below the $6,000 benchmark at one point earlier this week. Many investors watched with horror and wondered if the bubble in cryptos, and Bitcoin in particular—which had a spectacular 2017, gaining more than 900% during the course of the year, hitting an all-time high of $19,783 in mid-December before losing more than 60 % of its value at current prices—was finally over.

But nosebleed highs and breathtaking lows appear to be a key part of this extremely volatile cryptocurrency's history. Since the first Bitcoins were issued in 2009 the currency has experienced a number of corrections as well as two significant crashes—one in 2011, when it lost 94% of its value over a 5-month period, and in a more prolonged downturn from November 2013 through mid-January 2015 when it fell hard, dropping 85% in total.

Note that many analysts define a 60%-plus plunge as a bursting bubble. By that measure, Bitcoin has weathered two severe burst bubbles during it's brief history, yet each time it's come back stronger.

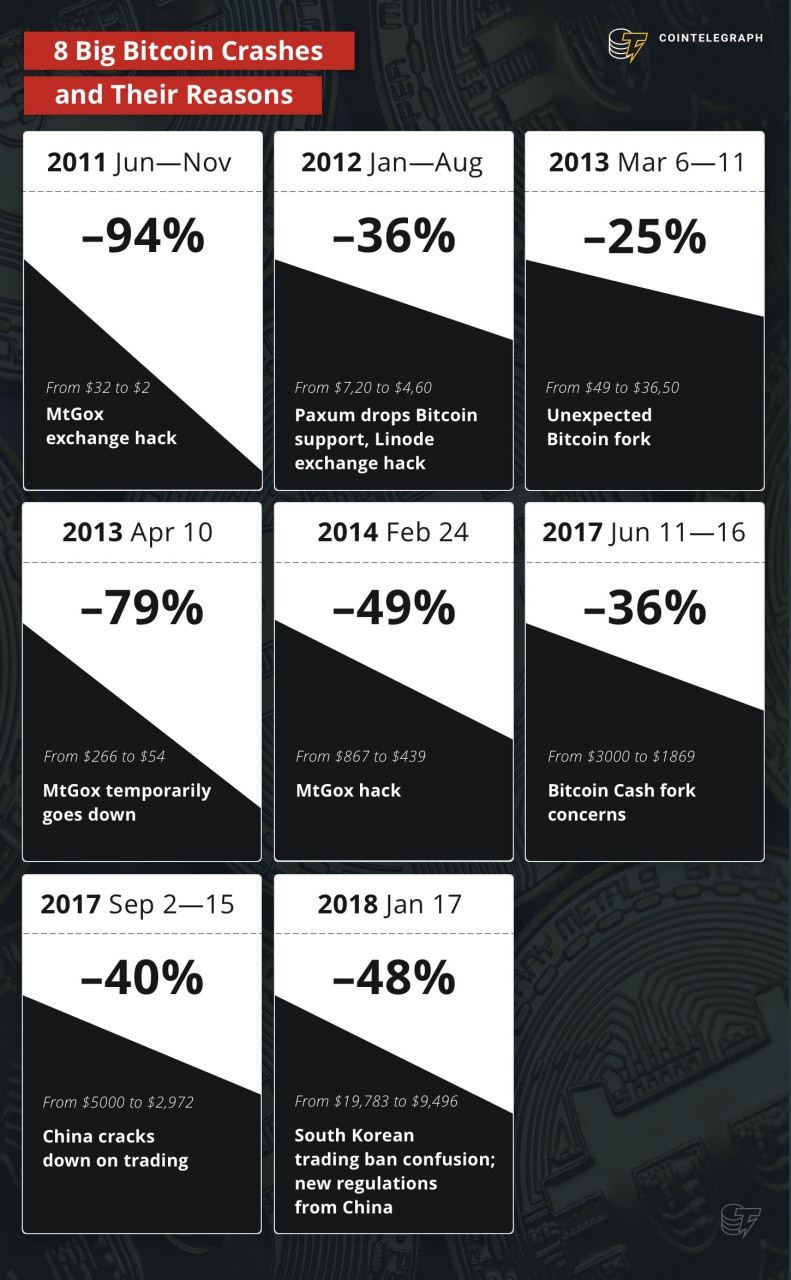

Source: CoinTelegraph

The chart above highlights previous triggers that caused the earlier crashes. What are the drivers of this current crash?

A number of factors appear to be in play. Asian governments have been making more noise about regulating ICOs and cryptocurrency trading for a while now.

Recent announcements from banks and credit card issuers noting they will no longer transact crypto purchases via credit cards have added to concerns pushing the alt-currency down further. JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC) and Citigroup (NYSE:C) have all said they’re halting purchases of Bitcoin and other cryptocurrencies on their credit cards.

More recently Lloyds Banking Group (NYSE:LYG) and Virgin Money (LON:VM) who have also banned card purchases. As the ban expanded, Bitcoin prices contracted.

Feeling #REKT?

Lately, scores of Bitcoin investors have been tweeting #REKT, slang for wrecked, which concisely describes how utterly destroyed or ruined they likely feel. Yet despite the numerous recent setbacks for the largest digital currency by market cap, there are still plenty of reasons for Bitcoin traders to remain steadfast. HODL has been a good strategy during previous crashes, especially since each time, Bitcoin has come back stronger than it had previously been.

Historical Context

To understand the full HODL case for Bitcoin going forward, perspective on the reasons for previous crashes and what triggered them is key. As well, it's important to note how long it took Bitcoin to recover from each event.

There have been two memorable Bitcoin crashes. One in 2011 when it dropped from $32 to $2, and again from 2013-early 2015 when it fell from a high of $1166 to $170 before staring to recover. Both events were triggered, at least at first, by circumstances surrounding trading at the now-defunct Mt. Gox exchange—the first time because of a hack to the exchange, the second time because the exchange's site crashed, halting trading.

Yet each time Bitcoin crashed, the comeback brought additional value for investors. Analyst Charlie Bilello tweeted the following chart on February 5:

Cybersecurity expert turned cryptocurrency expert John McAfee expressed the frustration most longtime investors feel toward the panic of newbie and/or short term investors at the first sign of significant losses, when he tweeted:

Noel Chandler, co-founder and CEO of Clinicoin, an open source wellness platform that rewards users with cryptocurrency for engaging in healthy activities, focuses on the broader history of this particular asset and the promise it provides for future value growth:

“Of course, the point would be not just to chronicle the falls, but also to describe what happened next in each case (the currency came back even stronger each time), and to speculate or even forecast if possible about what how low it might continue to go and what—based on history and technical analysis—might be the next step once the bubble phase is over this time. If what we're experiencing right now is another BTC bubble bursting, this is vastly different from the others, simply by the volume of innovations and ideas coming out of it. If we're following the Boom, Bubble, Bust, Rebirth pattern, I believe the rebirth is going to be quick and more exciting than anything we've ever seen before in business.”

Maksim Izmaylov, CEO and co-Founder of Winding Tree , a blockchain-based decentralized open-source travel distribution platform, focuses less on the price action and more on the underlying technology, which he believes is the real source of Bitcoin's value:

The crypto market is fueled by irrationality. The recent price increases have been driven by tons of new users who think that crypto is going to make them rich overnight. This is easily seen by the new users Coinbase and Kraken onboard every day. Price drops don't matter, it might change the perception of crypto among the public but it doesn't stop the development on the underlying technology, and that's what ultimately matters. Price is nothing else than speculation at the moment.”

Staying bullish on crypto

Despite the drop in price, Ted O'Neill, founder of Narrative LTD, a content and social networking platform, is still very bullish on cryptocurrency in general, particularly for the long term. Though the volatility may scare investors, keeping them away from the asset class, he points out that awareness of the coin's trading history and a deeper understanding of what drives an alt-coin's value is paramount:

“Unfortunately, the incredible price gains associated with cryptocurrency are going to be countered by scary downturns, as well. It’s best to think long-term if you hold cryptocurrency and of course to hold crypto that you understand and that has value to you.”

For Chris Tse, founding director of New York City-based blockchain developer Cardstack, it's really all about the technology:

“If nobody is actually using blockchain, then its intrinsic value is the trading value. To put it another way, if we don’t have real activity, with real substance — people building communities on blockchain, using decentralized software in their everyday lives; if we can’t get beyond the current single use case of trading — then volatility will persist because the price only reflects sentiment, and no real underlying value.”

Bitcoin has been experiencing wild volatility for as long as we have credible trading data explains Rob Viglione, co-founder of ZenCash. As he sees it, what we’re experiencing now, a 65% drop in Bitcoin's price from the mid-December peak just below $20,000, is nothing new.

“The worst drawdowns have ranged from about 80% to 95%, so this current crash is well within the historical bounds. The worst drawdown started in June 2011 and finally ran its course with a 93% drop that turned around in mid-November that year. Every crash has been preceded by a massive run up. In 2011 we saw prices skyrocket about 10,000% from the start of the year before they took a nosedive.”

Viglione believes it's important to gain some perspective from the 2013-2015 crash in particular. It started in April with Mt. Gox and saw a total drop of 82% by August of 2015, with plenty of false upturns that ended up fizzling out. He says:

“The 2013 crisis started after a 53,000% increase from the previous low in November 2011. Bear markets in Bitcoin tend to last anywhere from 6-24 months, at least from the sparse trading history we have thus far. The current marketplace is certainly much more mature than it was in both 2011 and 2013, so it is reasonable to think the downturn might be less severe.”

If you're new to cryptocurrency trading and Bitcoin in particular, be warned: it's a high risk and volatile investment.

But if history is any guide, as the chart above of BTC/USD from 2012-2016 so clearly illustrates, for investors who manage to keep calm and HODL, there can also be high reward.