Tesla (NASDAQ:TSLA) CEO Elon Musk announced the company would stop accepting Bitcoin as payment due to environmental concerns. The EV-maker’s Bitcoin stunt lasted for just three months, apparently the time it took for its CEO to realize how inefficient and energy-consuming BTC mining is, something we wrote about in March.

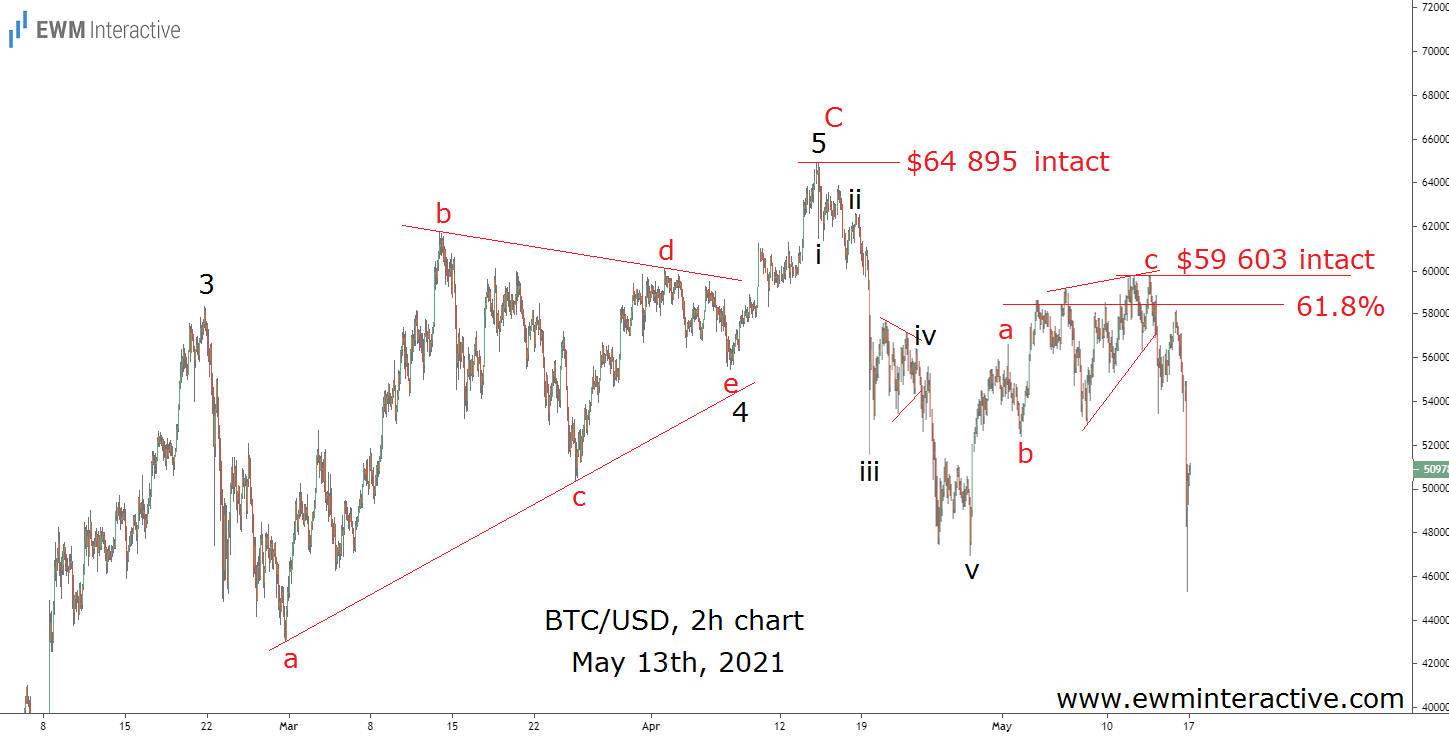

The price of Bitcoin, of course, plunged sharply to as low as $45,700 earlier today, down 21% from yesterday’s high. But in our opinion, the stage was set for a decline long before Tesla officially abandoned Bitcoin. In other words, the announcement came just in time to trigger the bearish Elliott Wave setup shown below.

The chart above was sent to our clients as a short-term update early Wednesday, May 12. It revealed that the decline from $64,895 was a five-wave impulse labeled i-ii-iii-iv-v. The following recovery looked like a simple a-b-c zigzag correction, where wave ‘c’ was an ending diagonal. Also note that the price tried to breach the 61.8% Fibonacci resistance level, but failed every time.

Bitcoin Drops 21% as Bearish Elliott Wave Setup Bears Fruit

Taken together, the impulsive decline and corrective recovery formed a complete 5-3 Elliott Wave cycle. According to the theory, the price was supposed to head in the direction of the impulsive sequence. Since wave ‘c’ appeared to have ended, we thought “holding a short position above $59,603 is not worth the risk.” Then, Mr. Musk spoke.

Several hours after our subscribers received their premium updates, Tesla decided to no longer accept Bitcoin as payment, sending the price sharply lower. BTC/USD breached the low of wave ‘v’ of the previous impulse, thus reaching its initial bearish target. $59,603 was never threatened.

While no-one knows what would have happened otherwise, we think BTC/USD was supposed to fall anyway. The Elliott Wave structure was pointing south. The bears only needed a catalyst and it could have come from anywhere. In September 2018, it came from Goldman Sachs (NYSE:GS). Now, it came from Tesla. We have no idea where the next catalyst is going to come from. We do plan, however, to keep relying on the Elliott Wave structure to put us ahead of it.