Despite a surge in bullish sentiments since Nov. 2024 when US President Donald Trump won the presidential election, Bitcoin looks ready to slide further amid the current macro outlook.

Trump made a plethora of promises in his inaugural address, including including cryptocurrencies as part of the central reserve and establishing a regulatory body to provide more transparency to crypto trade.

But his effort to maintain the crypto on the top seems to remain on the back foot amid his other priorities, which revolve around his one and only aim: strengthening the US dollar by imposing reciprocal tariffs on many nations of the world.

I anticipate that the imposition of tariffs is widely seen as inflationary, complicating the probability of including cryptocurrencies in national reserves due to its uncertain moves.

Secondly, establishing new rules and regulations to regulate the trading of cryptocurrencies could be a long process for the Trump administration which is likely to extend the bearish pressure on cryptocurrencies.

On the other hand, growing concerns over the Fed’s reluctance to keep the interest rate future rate cuts for a long could result in the losing stance of cryptocurrencies to gold which is still considered a top safe heaven due to its less volatility compared to crytocurrencies.

Technical Levels to Watch

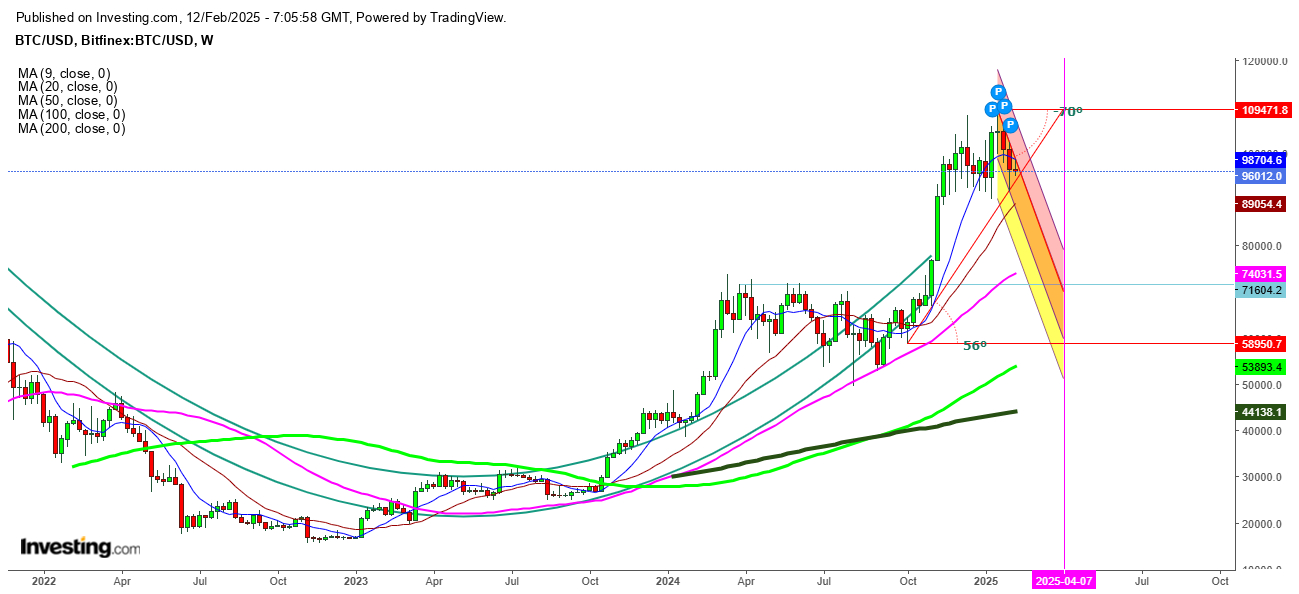

Technical indicators confirm a surge in bearishness in Bitcoin and the other crypto coins after the inaugural of US President Donald Trump when Bitcoin tested its lifetime high at $109,471.

Since then, surging bearishness looks evident enough in Bitcoin, despite some wobbly moves amid the surging strength of the US dollar and inflation.

After completing a cup-and-handle formation, Bitcoin faced selling pressure that could continue to push it below the significant resistance at 50 DMA at $98,770.

On the weekly chart, the formation of an ‘Evening Doji Star’ during the week of Trump’s inaugural seems to be the most bearish indicator that could keep the bearish pressure in Bitcoin for the long term.

Undoubtedly, the next two weekly candles were also bearish and could turn this week’s candle into the formation of three black crows as this week’s candle is showing the formation of a bearish hammer on Wednesday.

On the daily chart, after the formation of two bearish crossovers by 9 DMA which has already come below the 20 DMA and 50 DMA, looking to find a breakdown below the 100 DMA could generate a fresh selling spree in Bitcoin.

On the 4-Hr. Chart, the position of Bitcoin looks extremely bearish as it is trading below the 9 DMA at $96856, after the formation of a supper bearish crossover by a downward move by 100 DMA below the 200 DMA.

Takeaway for the Traders

I anticipate that Bitcoin could move upward due to its extremely volatile nature but could face stiff resistance at 200 DMA at $100,164, and any upward move will provide a good opportunity to go short till further updates on establishing a regulatory body for the cryptocurrencies.