Key Takeaways

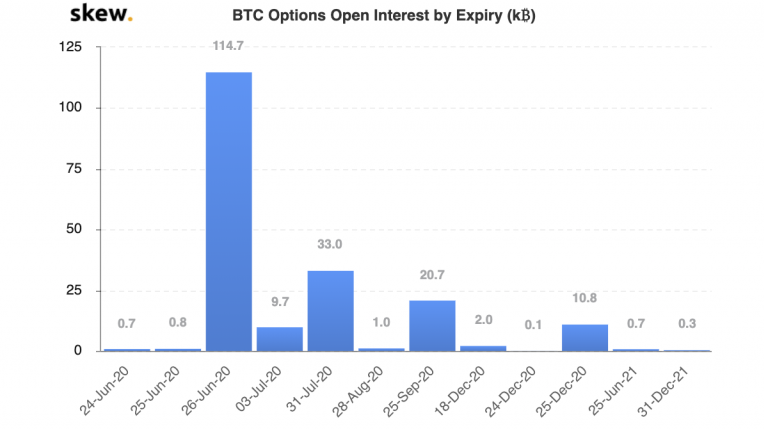

- The expiry of 114,700 Bitcoin options could end BTC's four-month volatility drought.

- Put-call ratio implies options traders have turned bullish in the last week.

- The effect of options in traditional markets cannot be compared to the Bitcoin market, as the dynamics vary.

A record-breaking $1.06 billion, or 114,700 Bitcoin, options are set to expire at 8:00 AM UTC today. Traders are debating whether this will lead to volatility, and if so, in which direction.

Bitcoin Options Market Dynamics

Today marks the largest expiry of BTC options ever. There wasn’t even $1.06 billion of open interest in options until two months ago.

While growth in options trading is exciting and signals institutional interest, market participants are focused on deciphering how this will impact the underlying market.

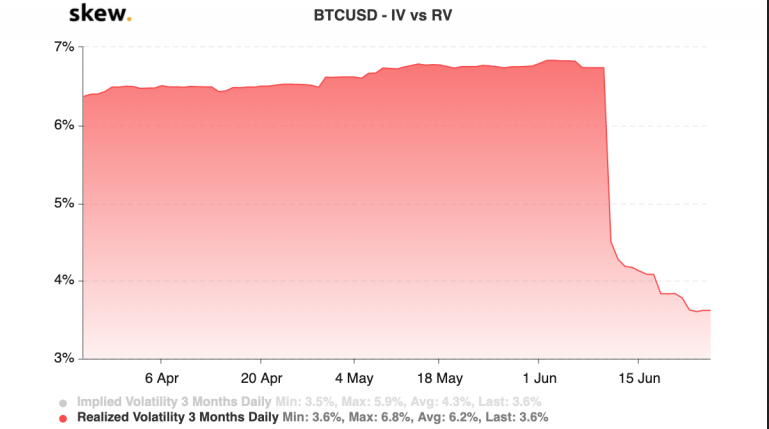

Volatility has been sinking for months now, ever since Black Thursday.

Historically, BTC volatility cannot be suppressed for long. The expiry of 114,700 Bitcoin worth of options contract could catalyze volatility.

In terms of the largest strikes, $7,000 and $8,000 puts, as well as $10,000 and $11,000 calls, have the most open interest, with a total value of 16,700 BTC, or $154 million.

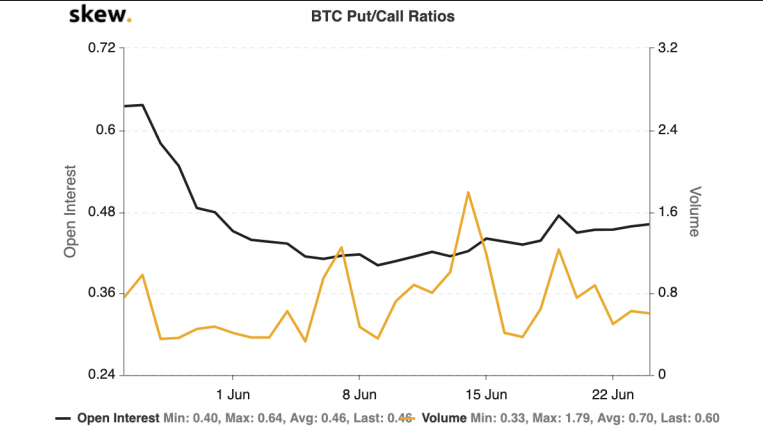

The put-call ratio measures the number of puts traders are purchasing versus the number of calls.

Since put options gain value when the price of the underlying asset falls, a rising put-call ratio is a bearish indicator. This ratio has been trending down after a spike last week, however, implying there is positive sentiment in the options market.

Several other factors set Bitcoin options dynamics apart from those of traditional markets.

For example, legacy options contracts are almost entirely physically delivered (you receive/pay the underlying asset upon expiry). But in crypto, nearly all Bitcoin options are cash-settled.

Physical delivery creates movement in the spot markets on the date of settlement, which is responsible for the volatility.

This same dynamic doesn’t carry over to cash-settled derivatives. However, it does influence the flow of funds, and it does free locked-up capital for institutional investors.

The bottom line is that volatility could still show up, but it isn’t a certainty, given the cash-settled nature of BTC derivatives. This could change in the future, as more venues start to offer physically delivered Bitcoin options.