This article was written exclusively for Investing.com.

- Bitcoin breaks above short-term technical resistance

- Ethereum heads for a challenge of the $4000 level

- Volatility is the norm

- The factors supporting new highs

- The reasons for caution

Trading cryptocurrencies is like riding a psychotic horse through a burning barn. Just when it looks like they are ready to fall into a bearish abyss that confirms the warnings of the asset class’s high-profile opponents, they explode higher. Warren Buffett and his cohort Charlie Munger have called cryptos “financial rat poison squared” and “disgusting and contrary to the interests of civilization.”

Like all markets, cryptos look great on the way up and awful on the way down. As they rally, they validate the growing number of supporters adopting the asset class’s libertarian ideology that removes control of the money supply from central banks and governments and returns it to individuals.

The incredible volatility only exacerbates the emotional responses. In May and June, Bitcoin and Ethereum looked ugly. In August and September, they recovered and consolidated. They are back on the bullish trail in early October, with prices looking like a challenge of the all-time highs is in the cards before the end of 2021.

Bitcoin breaks above short-term technical resistance

It’s been a wild ride in Bitcoin in 2021. After reaching a high of $65,520 per token on Apr. 14, the day of the Coinbase Global (NASDAQ:COIN) flotation, the price nosedived to a low of $28,800 on June 21.

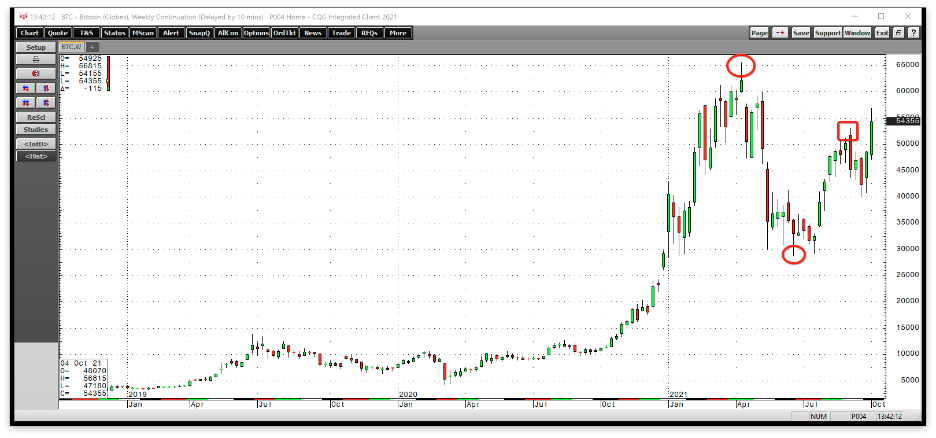

Source: CQG

The weekly chart shows the recovery that took the leading cryptocurrency to $53,125 in early September when it put in a bearish key reversal trading pattern. However, Bitcoin made a higher low at $40,085 in late September and rose above the $53,125 resistance level, reaching $56,815 last week. The technical break puts the $65,520 record high in play for the end of 2021.

Ethereum heads for a challenge of the $4000 level

Ethereum, the second-leading crypto, has been just as volatile. After reaching a high of $4,406.50 during the week of May 10, the bottom fell out of the Ethereum futures market.

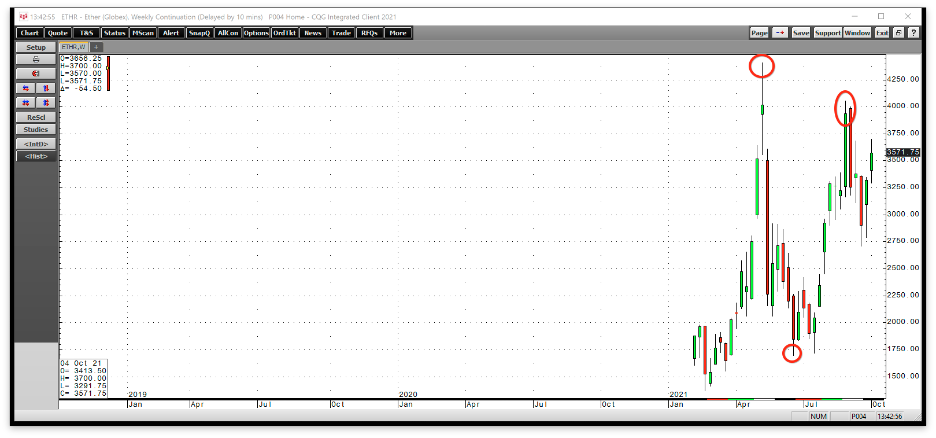

Source: CQG

The chart shows the plunge to a low of $1,697.75 in late June and a recovery that took it back over $4,000 in early September. At the $3,570 level at the end of last week, Ethereum was trending higher, and a new high by the end of the year is not out of the question.

Volatility is the norm

Historical volatility is a statistical measure of the past price variance of an asset. The cryptocurrency asset class exhibits extraordinary volatility levels compared to other markets.

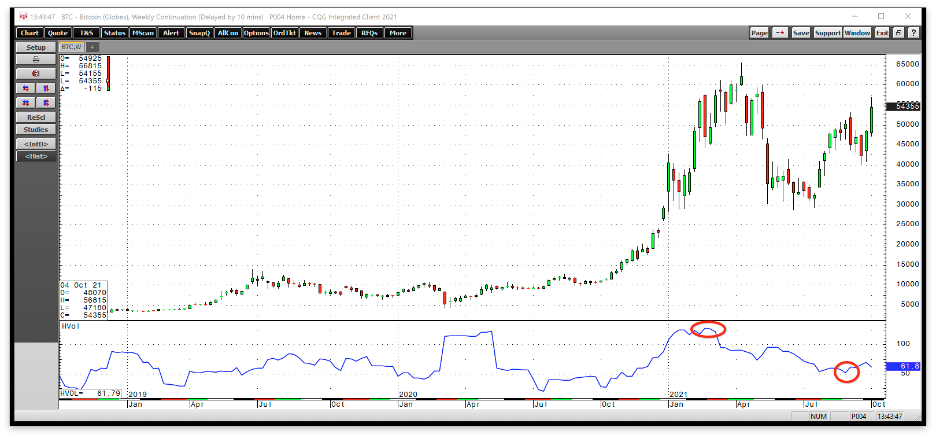

Source: CQG

The chart highlights that weekly historical volatility in Bitcoin futures has traded as low as 52.20% and as high as 128.50% in 2021.

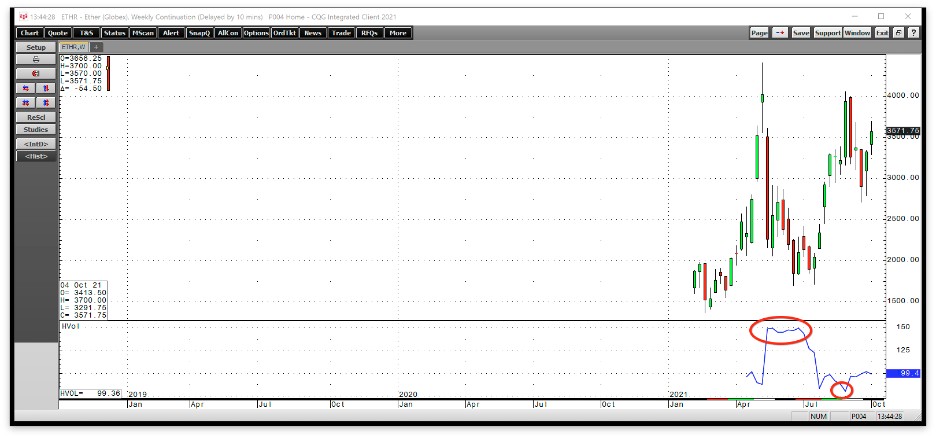

Source: CQG

The range in Ethereum volatility has been even higher at 79.82% to 149.95% since the end of 2020.

While the past is not always a guarantee of futures results, high levels of price volatility in the leading cryptocurrencies are a good bet for the coming months.

The factors supporting new highs

Many markets take the stairs higher and an elevator to the downside during corrections. Cryptocurrencies seem to be an express elevator in both directions.

The libertarian means of exchange that returns control from governments, monetary authorities, and central banks to individuals are likely to receive support from the following factors:

- More businesses are accepting cryptos as acceptable currencies.

- Financial institutions are allowing investors to put a percentage of assets into cryptocurrencies.

- The faith in governments is eroding as debt levels swell and political divergence has increased.

- El Salvador adopted Bitcoin as its national currency, and other countries could follow.

- Inflation is eroding the value of fiat money, increasing the attractiveness of alternative means of exchange.

- Gains in the cryptocurrency arena have a magnetic impact on speculators as they are willing to take high risks for the potential of substantial profits.

- The trend is bullish, and the trend is always your best friend in markets across all asset classes.

The reasons for caution

I also caution that capital invested in any cryptocurrency is at total risk. Risk is a function of potential rewards. You should never part with any money you are not willing to lose when approaching cryptocurrencies. The reasons for high caution in the asset class are:

- Regulatory oversight could weigh on cryptos as they seek to, in the words of the SEC, “protect the public.”

- Custody issues remain an issue as storing cryptos in computer wallets is a leap of faith for many investors and traders.

- Security is a concern as computer hacks can cause a total loss of tokens.

- Elon Musk pointed out that the carbon footprint from crypto mining is significant and could deter many market participants from entering the asset class.

- Most significantly, the government’s desire to control the money supply is a critical risk. China recently banned all crypto transactions. Ray Dalio, the prominent US hedge fund manager, recently said that if the asset class gets too big, the government has the power to “kill” it.

Be careful out there in crypto land! New highs in Bitcoin, Ethereum, and many of the over 12,570 cryptocurrencies by the end of 2021 are a real possibility. However, like all assets, the risk of substantial pullbacks and elevator shaft rides lower increases with the prices.