The top two cryptocurrencies tumbled early Friday as the broader market suffered a correction.

Several leading assets suffered double-digit losses as Bitcoin and Ethereum fell.

Bitcoin and Ethereum Correct

The cryptocurrency market’s recent rally appears to have halted.

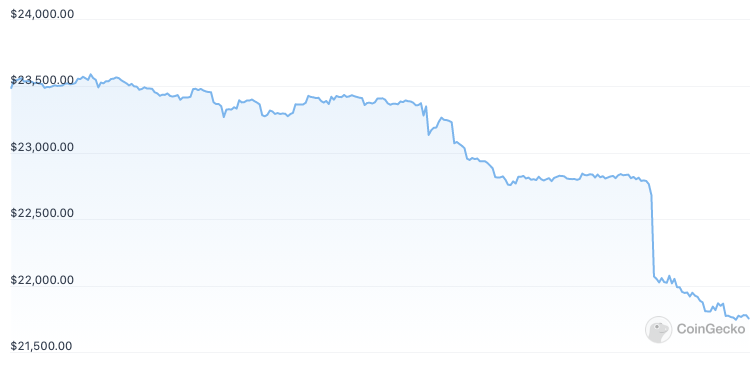

Bitcoin and Ethereum trended down early Friday in a broader selloff that’s hit several of the market’s top cryptocurrencies. Per CoinGecko data, Bitcoin is down 7.3% in the past 24 hours, dipping from around $23,500 to $21,750 at press time. Ethereum has lost 6.2%, trading at $1,730. The leading cryptocurrencies have rallied over the past few weeks, helped by renewed confidence in the market and widespread anticipation for Ethereum’s upcoming “Merge” to Proof-of-Stake. However, both assets have slumped over the past week as momentum wanes.

Many other major crypto assets were also hit in the downturn. When Bitcoin and Ethereum bleed, other cryptocurrencies with lower market capitalizations tend to drop in market value at a faster rate as panicked market participants rush to exit their positions. Dogecoin, Polygon, NEAR, Solana, and Avalanche have all posted double-digit losses over the past 24 hours.

One exception to the correction has been Gnosis, which is up 5.2% despite the market taking a hit. Gnosis Safe announced that it would be airdropping a new token called SAFE to early users Thursday, which likely explains why Gnosis is holding up against the volatility.

After the cryptocurrency market bounced from its June lows throughout July and early August, many market participants had placed their hopes on the bullish rally to continue into the fourth quarter. Without a doubt the strongest catalyst for a potential surge ahead is Ethereum’s Merge event, scheduled to ship around September 15. However, with growing concerns over Ethereum’s censorship resistance in the wake of the Treasury’s move to sanction Tornado Cash, the previously buzzy Merge narrative has started to lose steam over the past week.

The latest retrace saw the global cryptocurrency market capitalization lose around 6.8%. The space is now valued at $1.08 trillion, about 64% down from its November 2021 peak.