Bitcoin shot up by over $400 in as little as 20 minutes today in a move some crypto experts attributed to a short squeeze during BitMEX’s scheduled maintenance. Unfortunately, BitMEX’s trading halt can explain the surge only in hindsight, which means even crypto experts did not expect it. For example, Don Le, CEO of ChainRock asked on Twitter: “Is it a coincidence Bitmex is down for maintenance and we get a pump?”

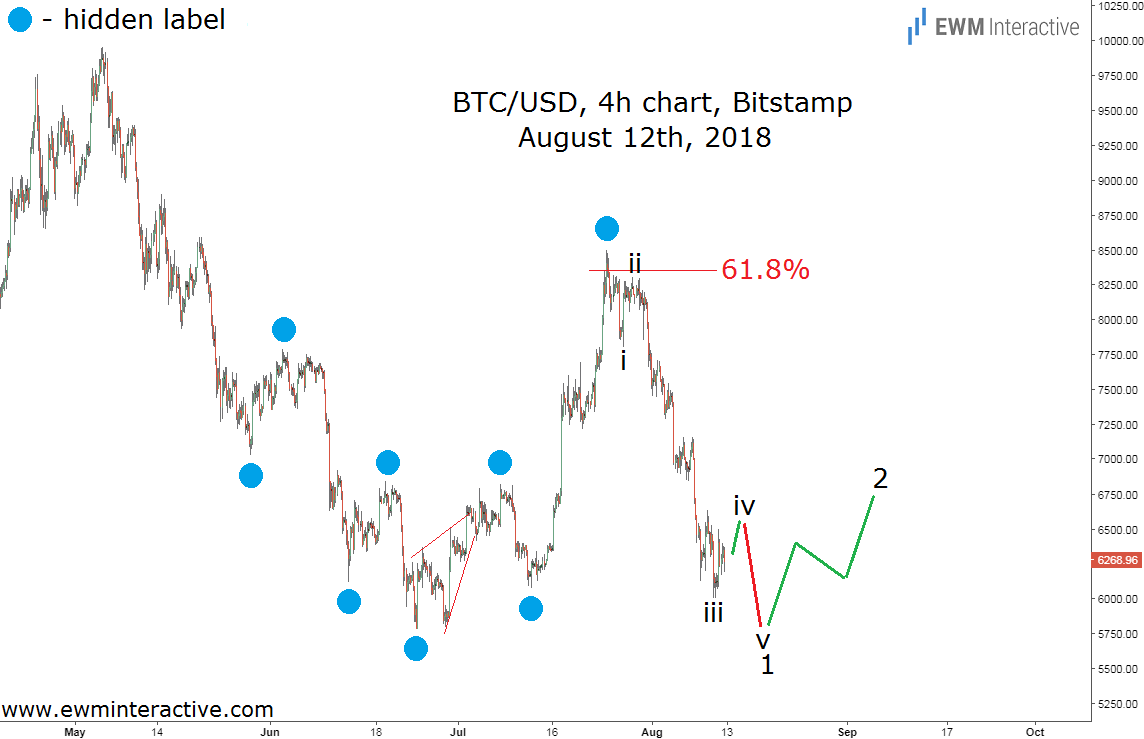

Whether it is a coincidence or not is not a question Elliott Wave analysts have to scratch their heads over, because today’s rally fits perfectly into the wave count we sent to subscribers ten days ago, on August 12th. Take a look. (some marks have been hidden for this article)

Actually, today’s surge was not the only move this chart prepared us for. Ten days ago we thought the decline from the 61.8% Fibonacci level was supposed to evolve into a complete five-wave impulse in the position of wave 1. Wave “iv” had to lift BTCUSD a little higher, before wave “v” drags it to a new swing low. On the other hand, the theory states that every impulse is followed by a correction of three waves in the opposite direction.

So, once wave 1 down was over somewhere below the $6000 mark, the bulls were expected to return in wave 2 and push the price of Bitcoin up to the vicinity of $7000 again. Furthermore, since Elliott Wave patterns form as a result of changes is market psychology, there was no reason for traders to search for particular catalysts to trigger the anticipated price moves. The market was probably going to find them anyway. Ten days later, here is an updated chart of Bitcoin against the U.S dollar.

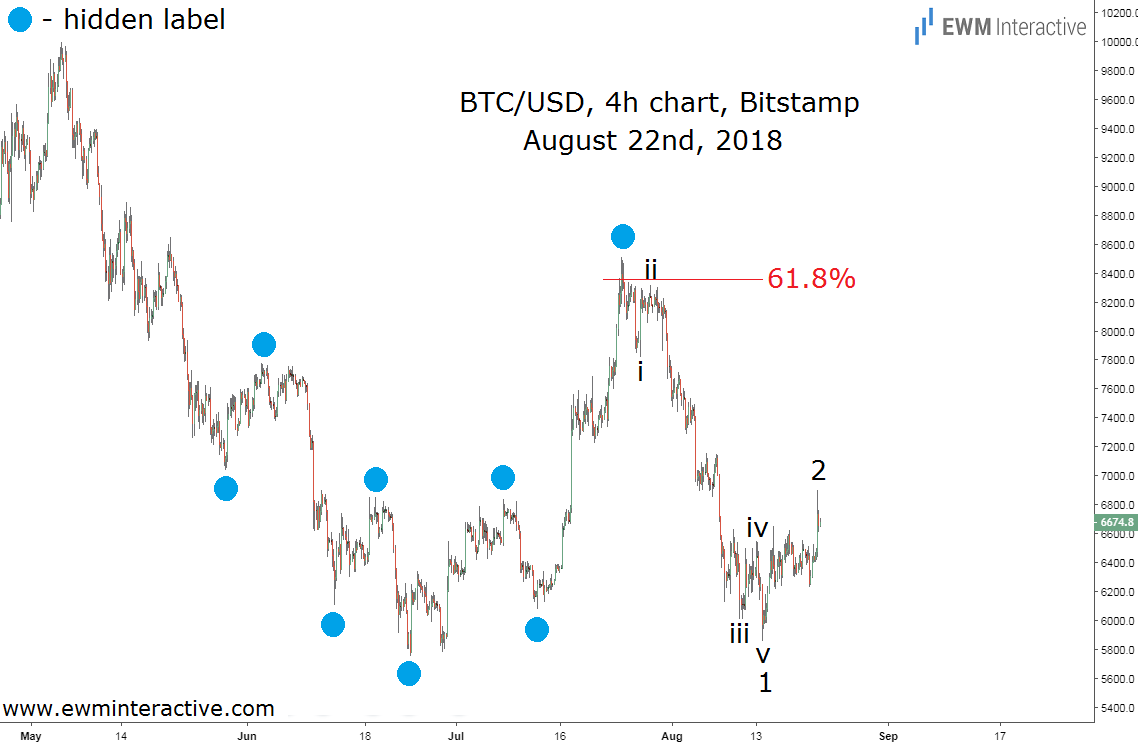

$6544 was where wave “iv” up ended and wave “v” down began on August 13th. On August 14th, BTCUSD plunged to $5880 to complete the entire impulsive selloff from $8497. It was time for a corrective recovery and the bulls did not disappoint – bitcoin climbed to almost $6907 earlier today. The market found the catalyst it needed in BitMEX’s scheduled trading halt, but the stage for today’s jump was set over a week ago, when the five-wave decline in wave 1 came to an end on August 14th.