A month ago, on Apr. 27, we said au revoir to our Bitcoin holdings. After hanging on to our coins for years (we were bullish on bitcoin since 2014 and recommended it to clients at $450), we sold our entire position. So why the change of heart?

We buy assets which are cheap and stay away from those that are either expensive or that we simply don’t understand. Risk/reward considerations are always prevalent in our framework. Bitcoin may well go on to hundreds of thousands of dollars, but we feel that the risks now associated with owning it are in our view worrisome.

What risks, you might ask? Chris laid out his long-term view on bitcoin and potential risks in a blog post a few months back. It’s just as relevant today. So we highly encourage you to read it, especially if you’re thinking about dipping your toes in the crypto market.

Looking back, it turned out to be the right call. A few weeks after we sent out our sell alert, bitcoin crashed from around $59,000 to $30,000.

Now, we’ll be the first to admit we were lucky with our call. If only it was this easy all the time.

It’s not hard to tell when an asset or a market is getting expensive and silly (as our friend Kuppy pointed out: “When you have porn stars shilling coins, you know the top is close“). But getting the timing right? Nah! As Chris likes to say, “I have two balls, and neither are crystal.” And as much as we’d love to be proven “right” immediately, it typically doesn’t work that way.

The reality is patience — and balls of steel — are required to hold onto the kind of investments we do here at Capitalist Exploits. They often take way, way longer to play out than you might think (or hope).

Achtung: Speculative Markets

It’s not just Bitcoin and the crypto market. Now is a time to be very careful of just “buying the market” or wildly following what is hot because there is so much speculation occurring. From experience, the dot-com bubble has nothing on what is currently going on.

It’s no surprise a handful of clients and Insider members recently asked us if we should be worried about being fully invested and putting every bit of spare cash into the “equity market”?

The answer is no. We are staying clear of any security which is the subject of optimism let alone euphoria. As we have discussed many times before, there is plenty of value out there in the markets and sectors that have been discarded by the “crowd of popular thinking”.

We came across the following quote from Seth Klarman and it rings so true:

“As the father of value investing, Benjamin Graham, advised in 1934, smart investors look to the market not as a guide for what to do, but as a creator of opportunity.”

Digging For Gold

While on the topic of buying cheap stuff (and selling what’s expensive), we came across this tweet from Crescat Capital’s Tavi Costa:

As an aside, Jamie Keech has been doing a stellar job digging up (pun intended) gold deals for Resource Insider members. Their gold holdings are up 98% on average.

How Asymmetry Works

The following was posted by our good friend George Gammon:

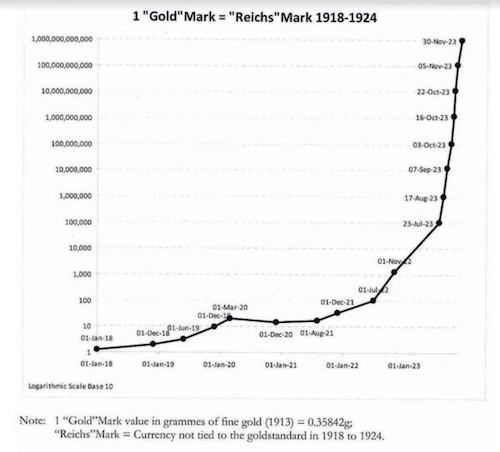

From 1920 to the end of 1921 the German mark (their currency) appreciated against gold. Two years later it was toilet paper.

We share this with you because we think this is so instructive of how markets that exhibit asymmetry can play out — gradually, and then suddenly, to paraphrase Hemingway.

Thank God For Fact Checkers

We live in a world where nobody does any fact checking anymore. Nope. Fact checkers are there to do that for you.