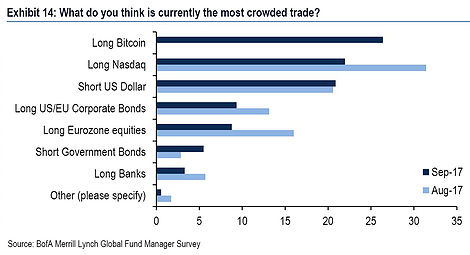

In this edition of ChartCritic we look at a chart from the latest BofA Merrill Lynch Global Fund Manager Survey. The chart shows the survey respondents' perceptions about what is currently the most crowded trade. At the top of the list is the controversial, loved by some, hated by others, ignored by many: Bitcoin.

It is an interesting result and chart for two reasons: first it is likely that the overwhelming majority, if not all, of the survey respondents are either not invested or not able to invest their funds in cryptocurrencies like Bitcoin (most traditional pension fund trustees/investment committees would balk). Second, it is quite a subjective question... more their perception of what they think is the most crowded trade.

Still, it provides interesting food for thought on BTC, and it shows Bitcoin out ahead of some other popular crowded trades - and most of those other assets have long and well established data on positioning and flows, which makes it easier and more objective to define a crowded trade.

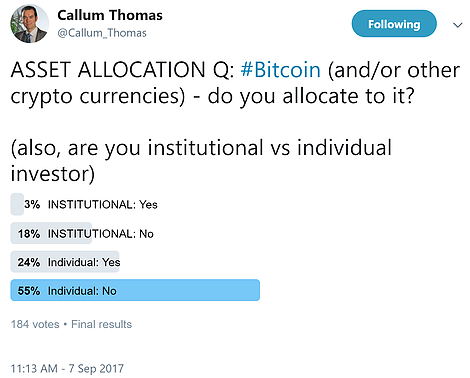

Anyway, here comes the part where we add our own charts and thoughts into the mix. First is a small survey I took which asks folks on Twitter whether they have any allocation to cryptocurrency/Bitcoin and whether they are institutional or individual investors. The results show, of the respondents: 14% of institutional investors had an allocation to cryptocurrencies or Bitcoin, and 30% of individuals did. Oddly enough the results suggest at least 1/10 institutional investors have invested in Bitcoin (not sure if that is accurate or representative!), and about 1/3 individual investors are on the Bitcoin bandwagon.

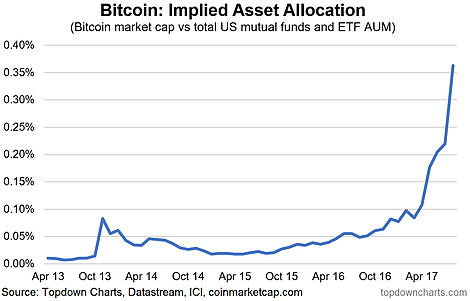

The final chart compares the market cap of Bitcoin to the total assets in US mutual funds and ETFs, which comes up with an implied asset allocation of around 35bps (0.35%). While still small in the scheme of things, it's actually not that far off from reaching half-of-1% implied asset allocation. This still trails behind cash allocations which are about 16% (based on the AAII survey and implied allocations from ICI stats).

So is Bitcoin a crowded trade? Hard to say: measuring or defining this, and having any reliable idea about its future or fundamentals makes this a difficult question to answer. On the face of it it looks like a speculative mania or a bubble, but widespread adoption and the economics of it could mean it goes higher in years to come (equally, it could fizzle out and become a side-note in history!). While there may be some crowding in this trade, it's certainly not mainstream, and relative to other assets it remains small. So is it a crowded trade? What do you think?

A small Twitter poll showed of the respondents, about 1 in 10 institutional investors had an allocation to Bitcoin and/or other crypto currencies, and about 1 in 3 individuals.

Comparing Bitcoin market capitalization to total assets under management in US mutual funds and ETFs reveals an implied allocation of about 0.35% (compares to cash allocations around 16%).