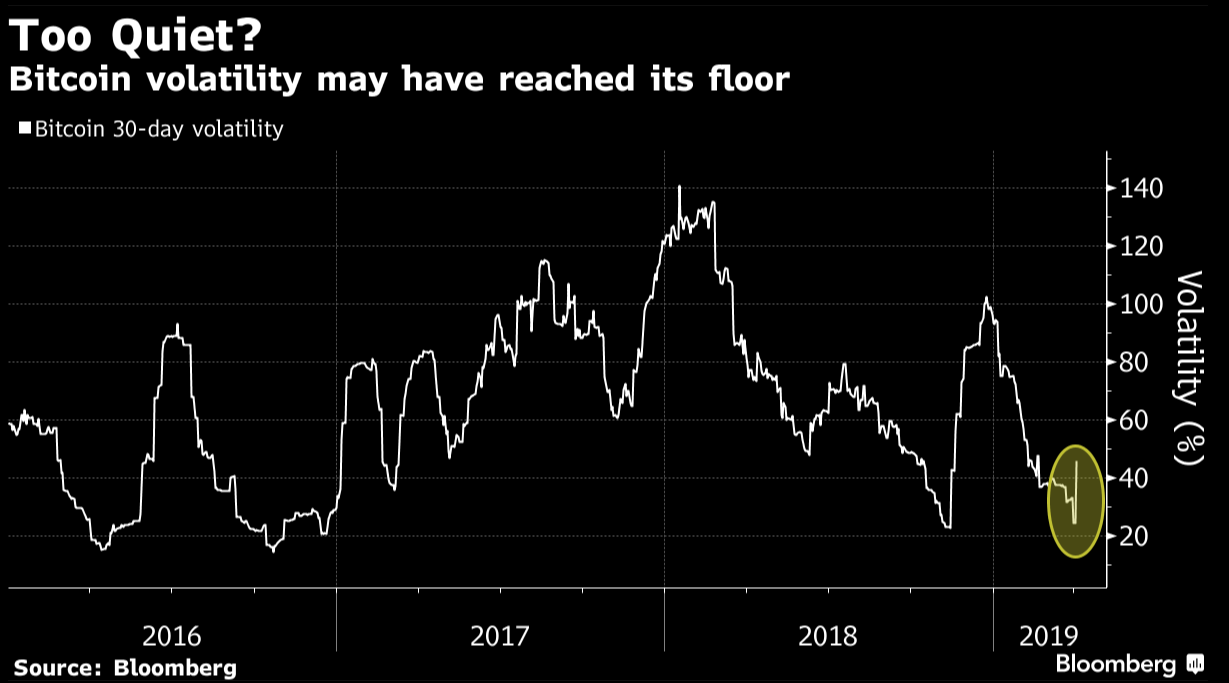

It was like the good old days in the crypto market on Tuesday, as traders in Europe and the U.S. woke up to a more than 20% rally in bitcoin. Safe to say, it had become the forgotten instrument for a while as the very volatility it was known for slipped away and price consolidated around $4,000.

Bitcoin Daily Chart

In the absence of any real catalyst though, many are left to question whether there’s anything of substance behind the bounce or if it’s just a short squeeze. Bitcoin has found some resistance around $5,100 – previous support – but the real test will come around $6,000 which was a significant support zone throughout 2018, a break of which in November sparked the move back to almost $3,000.

Naturally people are looking for reasons for the rally on Tuesday, something that will support and sustain the breakout but as yet, it would appear there’s not much there. There have been various attempts to explain it and the most plausible may be a large order at a time when we’ve seen a prolonged squeeze and price was near long-term resistance.