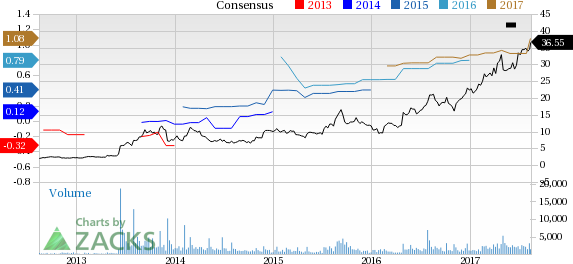

Shares of Pennsylvania-based BioTelemetry Inc. (NASDAQ:BEAT) rallied to a new 52-week high of $37.50 on Aug 15, closing a tad lower at $36.55. This represents a strong year-to-date return of approximately 63.5%, better than the S&P 500’s 10.3% over the same time frame.

BioTelemetry provides cardiac monitoring services and cardiac monitoring device manufacturing. The stock sports a Zacks Rank #1 (Strong Buy).

For the majority of the last three months, the company’s share price has considerably outperformed the broader industry. The stock has rallied 30.5% over the last three months, outshining the industry’s return of just 3.6% over the same time frame.

Notably, BioTelemetry has a market cap of $1.2 billion. Taking the stable performance of the stock into consideration, we expect BioTelemetry to scale higher in the coming quarters. The company’s long-term growth of 28.4% also holds promise in this regard.

Growth Catalysts

Q2 Results Solid: BioTelemetry exited second quarter on a strong note with earnings exceeding the Zacks Consensus Estimate and revenues meeting the same. Revenues increased 10.3% year over year to $58.1 million, primarily driven by a $1-million increase in Healthcare revenues owing to rising MCOT patients. Notably, this marked the 20th consecutive quarter of year-over-year revenue growth. The company also registered growth across all segments. We are encouraged to note that the company is putting efforts in product innovation through research and development. However, a decline in gross margin is a matter of concern.

LifeWatch Acquisition: In July, BioTelemetry announced the acquisition of LifeWatch AG in a deal valued at about $280 million. With this buyout, BioTelemetry enhanced its position in the wireless medicine space, expanding its product profile and customer base in the cardiac monitoring and diagnostic services space.

Management expects the acquisition to yield significant synergies over the next 12–18 months. Both the companies make products which are utilized for remotely monitoring cardiac care patients.

Guidance Strong: The raised full-year 2017 revenue guidance is encouraging. Post the acquisition of LifeWatch, BioTelemetry currently expects full-year 2017 revenue in the range of $285 million to $290 million. The Zacks Consensus Estimate for full-year 2017 revenues is pegged at $286.05 million.

The company expects $82 million to $84 million of revenues in the third quarter and $89 million to $92 million in the fourth quarter. The company also expects one-time expense related to the acquisition of approximately $15 million which is further expected to be reflected in third-quarter results.

Estimate Revision Trend: The estimate revision trend for BioTelemetry is favorable at the moment. For the full year, two analysts moved north compared to no movement in the opposite direction over the last two months. As a result, full-year estimates jumped 22.7% to $1.08 over the same time frame.

For the current quarter, one analyst moved north, compared to no movement in the opposite direction in the last two months. The Zacks Consensus Estimate for the current quarter rose 8% to 27 cents over the same time frame.

Key Picks

Other top-ranked stocks in the broader medical sector are Edwards Lifesciences Corporation (NYSE:EW) , Masimo Corporation (NASDAQ:MASI) and IDEXX Laboratories, Inc. (NASDAQ:IDXX) .

Notably, Edwards Lifesciences sports a Zacks Rank #1, while IDEXX Laboratories and Masimo Corporation have a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Edwards Lifesciences has a long-term expected earnings growth rate of 15.2%. Notably, the stock has returned 2.7% over the last three months.

Masimo yielded a strong return of 26.6% year to date. The stock has a long-term expected earnings growth rate of 11.1%.

IDEXX Laboratories has a long-term expected earnings growth rate of 19.8%. Additionally, the stock represents an impressive one-year return of 39.6%.

The Hottest Tech Mega-Trend of All

Last year, it generated $8 billion in global revenues. By 2020, it's predicted to blast through the roof to $47 billion. Famed investor Mark Cuban says it will produce "the world's first trillionaires," but that should still leave plenty of money for regular investors who make the right trades early.

See Zacks' 3 Best Stocks to Play This Trend >>

Masimo Corporation (MASI): Free Stock Analysis Report

IDEXX Laboratories, Inc. (IDXX): Free Stock Analysis Report

Edwards Lifesciences Corporation (EW): Free Stock Analysis Report

BioTelemetry, Inc. (BEAT): Free Stock Analysis Report

Original post

Zacks Investment Research