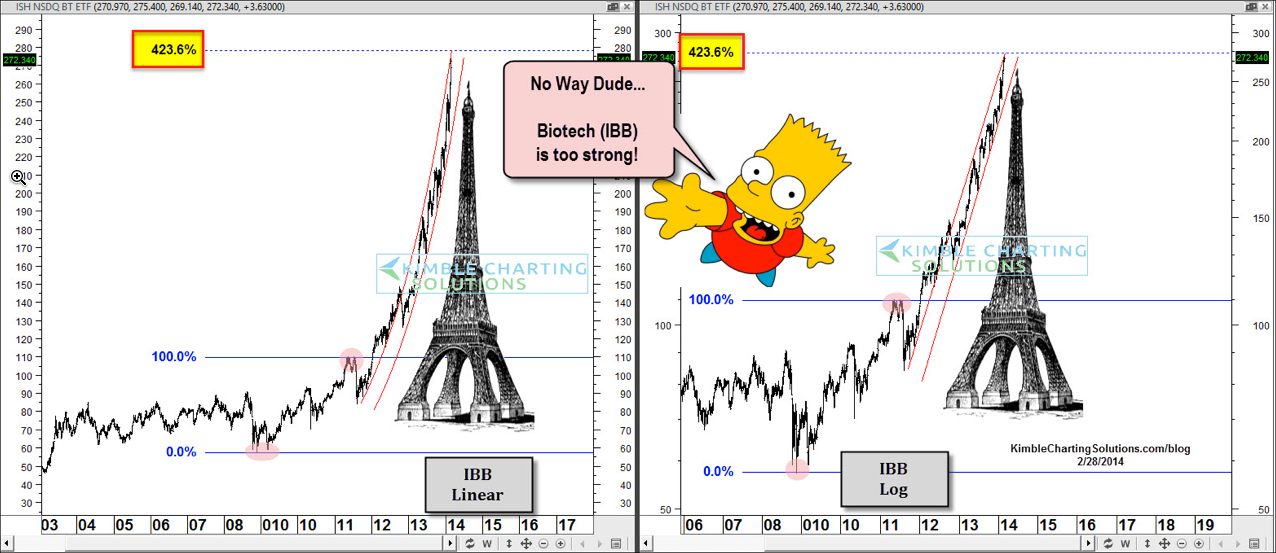

Ten weeks ago this morning (2/28), the Power of the Pattern reflected in the chart below that the white hot Bio-Tech sector looked to be hitting Fibonacci & Channel resistance and could be peaking and forming an "Eiffel Tower" pattern. It also looked to be creating a bearish reversal wick. To learn more on Eiffel Tower patterns and their impacts, see Trader Planet Article on the "Madness of Crowds and the Eiffel Tower Patterns" see (Here).

Due to this set up, premium members established short positions by purchasing the 2x inverse Bio Tech ETF (NASDAQ:BIS). Since 2/28, iShares Nasdaq Biotech (NASDAQ:IBB) is down 15%, not a huge decline.

The top chart reflects that Bio Tech ETF SPDR S&P Biotech (NYSE:XBI), was hitting resistance on 2/28 and is now hitting rising channel support.

Joe Friday, just the facts....If XBI breaks support in the top chart at (1) above, the real downside action could start here and now, as more of the herd heads for the exits.