“It was the best of times, it was the worst of times….” the classic opening of Dicken’s A Tale of Two Cities is a perfect description for the biotech sector since August. Only backwards. The sector fell hard in August losing nearly 20%. It recovered somewhat slowly and then dove hard again in September, down 20% again.

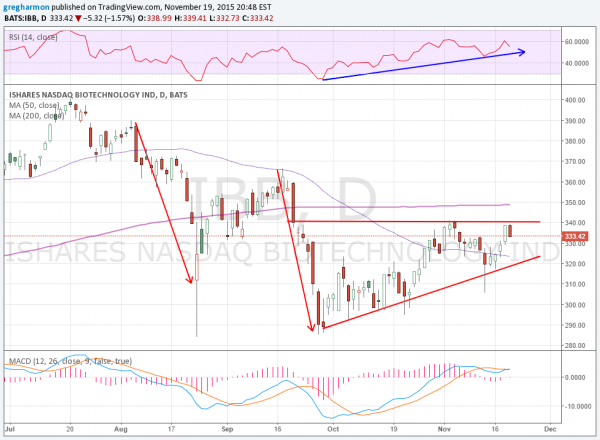

The double bottom that formed in the biotech ETF iShares Nasdaq Biotechnology (O:IBB) with that September low became the catalyst to launch it higher. A move up to resistance at 340 met with selling but a higher low on the pullback has now reversed and it is back at 340 again. The price action building an ascending triangle against the resistance.

So what will be the future? A punch through by the masses, overthrowing resistance to make new highs? Or will the ruling overlords beat it back down and start another run lower. I am just watching the story, I cannot foresee the future. But from reviewing the past there are signs that suggest it will rise up. It has momentum behind it.

The RSI is rising and on the edge of the bullish zone. The MACD has taken a break recently but is ready to cross up again. Should it succeed in breaking through the barrier it would establish a target of 390. A rise back to its greatness from July. But a breakdown under 320 could be a fatal blow in the intermediate term. Watch and follow.

The information in this blog post represents my own opinions and does not contain a recommendation for any particular security or investment. I or my affiliates may hold positions or other interests in securities mentioned in the Blog, please see my Disclaimer page for my full disclaimer.