Those that view the message of the market on daily basis are likely confused by trading noise. While trading noise contributes to the long-term trends, it does not define them. Human behavior tries to explain trading noise as a meaningful trend. This confuses the majority which, in turn, contributes to their role as bagholders of trend transitions.

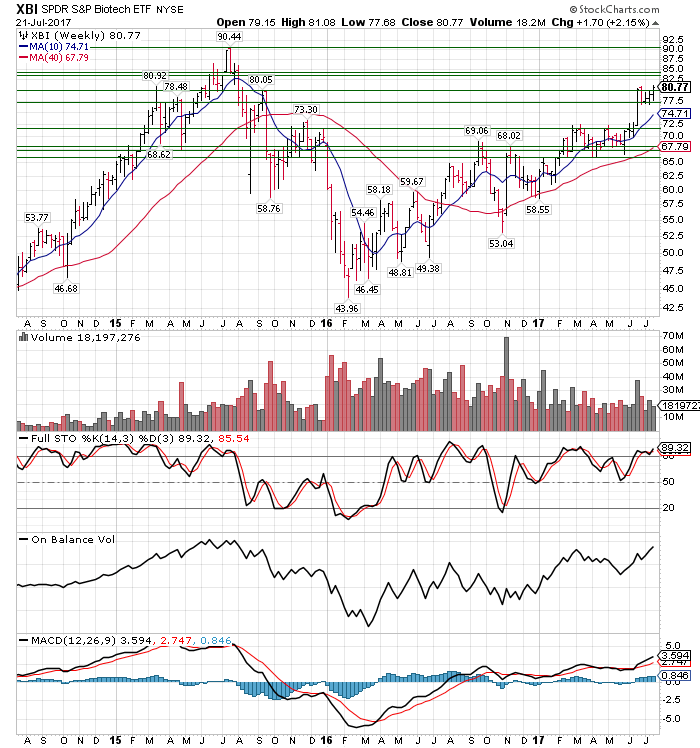

Biotech's primary trend has been aligned up since 5/1. Amateur investors, generally preoccupied with the FANG stocks or Bitcoins, have generally ignored the 90% annualized return over 13 weeks. Numerous Facebook (NASDAQ:FB) groups can be provided to those looking to experience the cheer leading first hand.

Biotech bulls don't care about approval from the majority. As we discussed in early spring, the majority will turn bullish only after price (XBI (NYSE:XBI) and IBB (NASDAQ:IBB)) trades at much higher levels. Professional investors, a small group that properly enters and exits the flow of trends, will be selling their positions to them. They are necessary for exiting the flow.

How long does the current aligned up impulse last?

Trading Notes defines the average and max cycle duration since 2006. Estimates of TIME can be adjusted from the Nasdaq Biotech Index, a similar biotech proxy that trades as far back as 2001.